As doubts about the 2023 market rally begin to emerge, Tom Lee from Fundstrat has returned with an optimistic prediction.

The ex-analyst from JPMorgan Chase provided clients with a suggestion to take advantage of a “strategic buying opportunity”. In a research note, the analyst argued that the recent decrease in prices presents a good opportunity to enter the market before the release of the consumer-price index for June on Wednesday. If the index turns out to be as low as Lee predicts, it could potentially lead to a 100 point increase, or approximately a 2.3% rise, in the S&P 500.

In recent weeks, statements from Federal Reserve officials and the minutes from their June meeting have reiterated the expectations of senior policymakers for ongoing increases in interest rates. The futures market for Fed funds sees a rate hike in July as highly likely, and the Fed’s projected trajectory for rates suggests there may be two more hikes in 2023. However, Lee believes that investors have too quickly embraced the idea of rates staying higher for a longer period of time. Lee also suggests that a weak inflation report could alleviate the pressure on the Fed to continue raising rates. Lee predicts that core inflation for June may be around 0.2%, which is lower than the 0.3% anticipated by economists surveyed by The Wall Street Journal for both core and headline inflation. Looking at a one-year basis, economists anticipate core inflation to be at 5% and headline inflation to slow to 3.1%.

In case Lee’s prediction is accurate, it would indicate that inflation has decreased to its lowest point since August 2021.

During an interview on CNBC Monday morning, he stated that if this were to happen, it would demonstrate that the Federal Reserve is consistently achieving the inflation rates they aim for on a monthly basis. He believes that a 0.2 increase would equate to a 2.5% annualized inflation rate.

Chairman Jerome Powell has emphasized that the central bank should witness a consistent and lasting return of inflation to the 2% yearly target before considering any interest rate reductions.

After establishing Fundstrat in 2014, Lee has gained a well-known image as an everlasting optimist in the market. He remained positive and encouraged investors to purchase stocks throughout the rally following the financial crisis of 2008. In addition, he advised his clients to invest in stocks during the decline caused by the COVID-19 pandemic.

Fundstrat started the year 2023 with a prediction that the S&P 500 would reach 4,750 at the end of the year. This made them one of the most optimistic analysts on Wall Street, and one of the select few who expected the market to recover quickly.

Look at this: He accurately predicted the rise of the stock market in 2023. Now let’s see what the most optimistic Wall Street expert predicts for the latter half of the year.

Lee, an early advocate of cryptocurrency on Wall Street, had faith in bitcoin and predicted it could reach a value of $100,000 by the conclusion of 2021. Surpassing this estimate, the currency peaked at $69,000 on November 10, 2021, based on FactSet data. In a more recent prediction, Lee suggests that bitcoin could potentially reach $200,000 per coin within the next five years.

According to data from FactSet, as of Monday, the value of one bitcoin (BTCUSD) was $30,344.

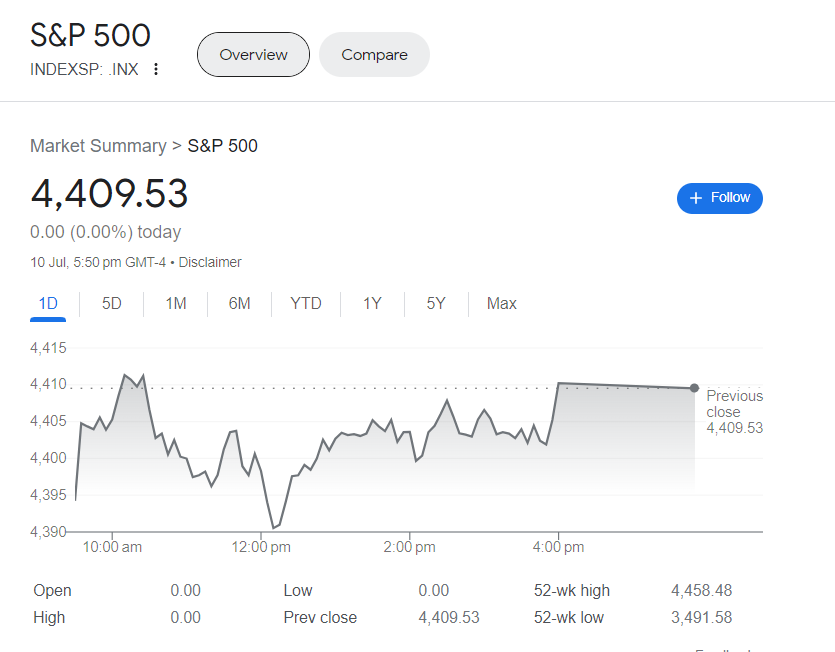

On Monday, there was a mix of performance among U.S. stocks. The S&P 500 increased by 4 points or 0.1% to reach 4,403. In contrast, the Nasdaq Composite decreased by 6 points or 0.1% to reach 13,653. However, the Dow Jones Industrial Average experienced gains of 158 points or 0.5%, reaching 33,895. It is worth noting that all three indexes saw declines last week, with the Dow experiencing its largest drop since March.

Why would Lee alter their usual approach in making long-term calls now?

During his appearance on CNBC, he stated that the primary purpose of the call was to provide reassurance to Fundstrat’s clients. The aim was to alleviate any concerns they had about the market, particularly in light of the bears’ expectation that increasing Treasury yields could hinder the ongoing rally.