Next time you’re faced with armed conflict, here’s the savvy approach:

In our world, where conflicts and tensions wield significant influence over markets, there’s no shortage of experts offering advice to investors. But heed this: most of them thrive on sensationalism, which may captivate headlines but often spells trouble for investment portfolios. In my book on geopolitics for investors, available for free on the CFA Institute website, I outline a pragmatic guide to navigating such crises.

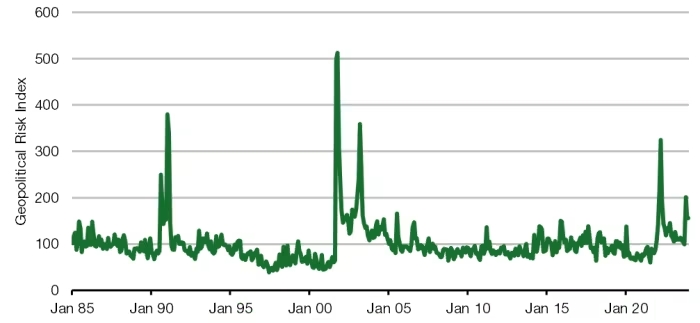

This guide, drawn from extensive empirical research, focuses solely on stock markets‘ response to geopolitical events. Evidence-based investors should view it as a compass amidst the chaos, helping to discern the signal from the noise.

Rule number one: Don’t panic. Over one-month-plus horizons, the majority of geopolitical events have negligible impact on equity markets.

So, resist the urge to hastily sell stocks. Typically, the correct move during a crisis is to buy risky assets as they dip.

Investors often overreact to crises, envisioning worst-case scenarios like World War III. However, history shows that such escalations are rare. While conflicts arise frequently, they seldom spiral out of control due to human preference for peace. It takes monumental miscalculations from multiple parties to escalate a conflict beyond containment.

Now, let’s tackle this step by step:

Step 1: Assess the damage to infrastructure in your investment country. If infrastructure remains intact, move to the next step. If not, brace for economic slowdown, favoring defensive sectors like healthcare and consumer staples.

Step 2: Evaluate if there’s a prolonged impact on inflation and inflation expectations. If so, invest in sectors benefiting from higher inflation, like oil & gas or defense contractors, while steering clear of inflation-sensitive sectors with low profit margins.

Step 3: Consider if there’s a lasting effect on real rates. A permanent increase in borrowing costs could trigger a bear market. Be defensive, avoiding companies with high financial leverage.

Step 4: If all previous questions yield negative responses, it’s time to buy risky assets! Geopolitical shocks often elevate risk aversion temporarily, presenting buying opportunities.

Remember, the initial market reaction post-crisis may be fleeting. Only if there’s a sustained impact on inflation, earnings, or real rates should you consider selling stocks. Patience is key, as markets ultimately weigh the evidence over the long term.

In the words of Ben Graham, “In the short run, the market is a voting machine, but in the long run, it is a weighing machine.” So, when others panic, weigh the evidence and act wisely.