Leuthold Group’s Chief Investment Officer (CIO), Doug Ramsey, points out a concerning trend in market analysis: an increasing number of analysts are omitting valuations from their assessments. Ramsey notes that this trend is not limited to bullish perspectives; even those who are cautious about the market are overlooking the issue of persistently high equity valuations.

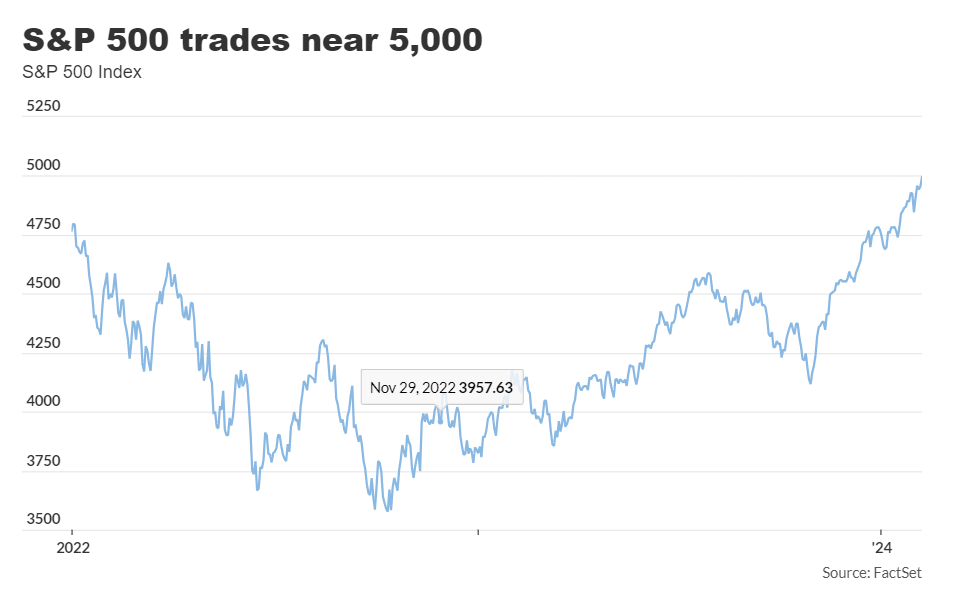

Ramsey’s observations come at a time when the U.S. stock market is reaching notable milestones, with the S&P 500 index edging closer to the 5,000 mark. Despite this, Ramsey warns of the market’s susceptibility to accidents due to its elevated valuations.

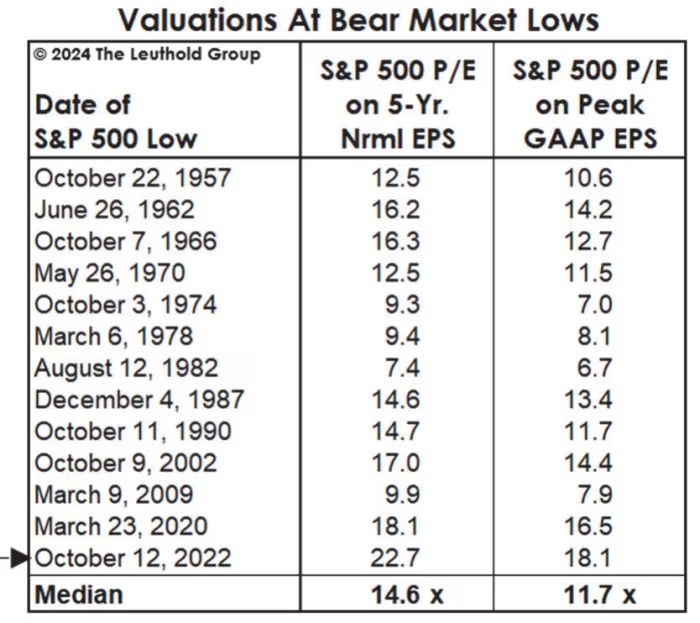

The current bull market, which began after the record high in January 2022, has seen the S&P 500 climb steadily. However, according to Leuthold’s analysis, the market bottom in October 2022 marked a historically expensive low point, setting the stage for the current scenario of high valuations.

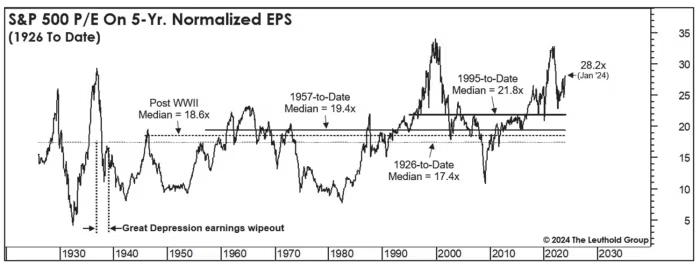

Ramsey highlights key metrics to illustrate the extent of overvaluation, including the five-year normalized price-to-earnings ratio, which has risen significantly. Similarly, Bob Doll, CEO and CIO of Crossmark Global Investments, echoes concerns about stretched valuations, particularly in relation to forward earnings estimates.

Despite widespread optimism about a smooth economic trajectory, concerns linger regarding the Federal Reserve’s ability to balance inflation and interest rates. Doll argues that achieving both double-digit earnings growth and significant rate cuts is unrealistic, suggesting that the market may be overly optimistic about the Fed’s monetary policy.

Traders’ expectations of multiple rate cuts contrast with Doll’s view that such aggressive easing would require a significant economic slowdown, which seems unlikely given the current robustness of the U.S. labor market.

Looking ahead, Ramsey emphasizes the importance of considering the potential for market downturns, especially in light of past instances where significant declines occurred despite limited periods of recession.

The market’s performance this year has been buoyed by gains in prominent technology stocks, particularly those involved in artificial intelligence (AI). However, Doll warns against excessive optimism in the AI sector, advocating for a cautious approach and highlighting the importance of considering valuations.

In summary, while the market continues its upward trajectory, concerns about high valuations and the sustainability of current growth patterns persist among analysts like Ramsey and Doll, underscoring the need for careful evaluation and risk management.