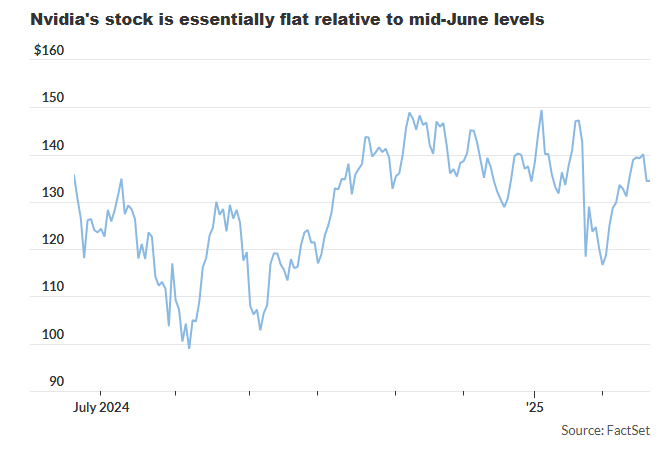

Nvidia Corp. is set to report earnings on Wednesday, and the market is watching closely. With the stock trading sideways since June despite some volatility, the big question is: Will earnings be the catalyst for a breakout, or should investors temper their expectations?

A Bullish Case: Sideline Money Ready to Jump In

Mizuho desk-based analyst Jordan Klein sees potential for an upside move. In a note to clients, he highlighted the significant capital on the sidelines that could fuel a rally. He expects Nvidia’s stock (NVDA -3.09%) to go “higher before lower” following its recent stagnation.

Klein is particularly optimistic about Nvidia’s Blackwell lineup, noting that demand is far outpacing supply. With production ramping up in the second half of the year, he sees strong momentum ahead.

Lingering Concerns: DeepSeek and Microsoft Jitters

Despite this optimism, some analysts remain cautious. The debate over Chinese AI firm DeepSeek looms large, with questions about whether future AI development will require less hardware.

Additionally, a recent report from TD Cowen suggests that Microsoft (MSFT -1.03%) may have canceled some data-center leases, sparking concerns about cloud infrastructure spending. However, Mizuho’s Vikram Malhotra, who covers real-estate investment trusts, downplayed the fears. He suggested the move was likely just a routine “course correction” rather than a major shift in strategy.

Caution from Stifel and the Bigger AI Picture

Stifel analyst Ruben Roy is less convinced that earnings will deliver a strong upside catalyst. Given post-DeepSeek market jitters, he believes investors may remain hesitant in the near term.

On the other hand, Melius Research’s Ben Reitzes is focused on the bigger picture. He argues that AI-chip demand is already being validated, with tech giants racing to secure their positions. Nvidia, he says, is in prime position to benefit from this spending surge.

Reitzes likens Nvidia’s hardware to Ferraris—high-performance tools that AI leaders like Elon Musk’s xAI can’t get enough of. Despite the “noise” surrounding the stock, he believes Nvidia will continue to dominate as AI demand intensifies.

Bottom Line: A Defining Moment for Nvidia?

With Nvidia’s earnings on deck, investors are split—some see a breakout opportunity, while others remain wary of near-term volatility. One thing is certain: the AI race is heating up, and Nvidia remains at the center of it.