Truist’s Lerner: Sharp V-Shaped Market Rebounds Often Signal More Upside

It may be “Jobs Thursday” instead of Friday this week — thanks to the July 4th holiday — but the shortened trading session hasn’t slowed this bull market’s momentum.

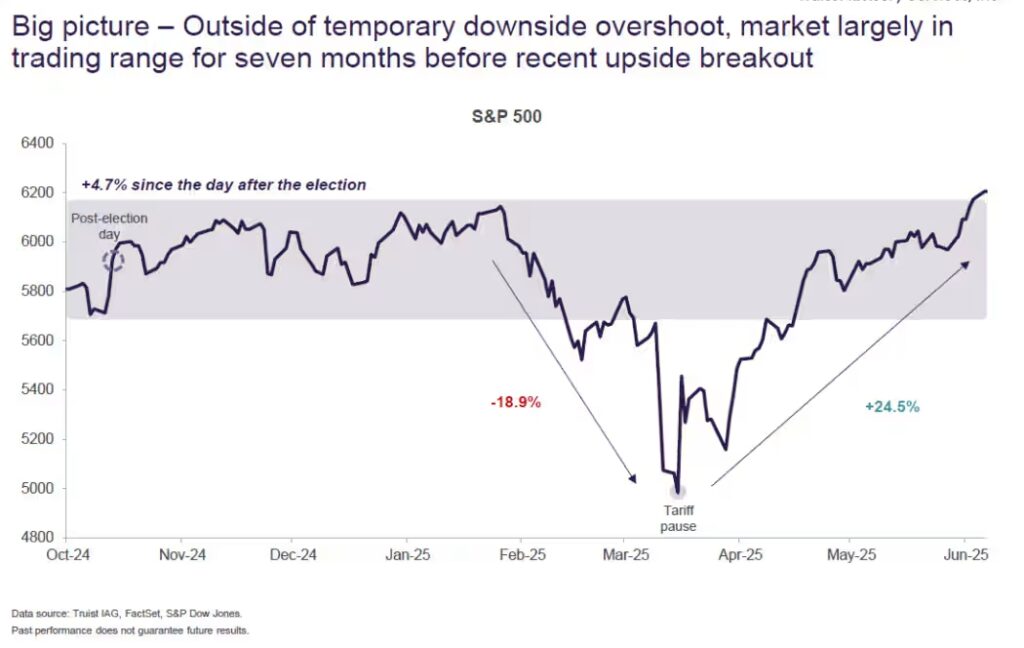

The S&P 500 closed Wednesday at a fresh record high, now up 25% from its April low. And according to Keith Lerner, chief market strategist at Truist, this swift V-shaped rebound is a bullish signal in itself.

“Despite a carousel of concerns — tariffs, geopolitical tensions, policy uncertainty — the market has powered through, reclaiming all-time highs in one of the fastest recoveries on record,” Lerner wrote in a Wednesday note.

Lerner believes the rally has legs, though he cautions the path forward may be less smooth. “The bar for positive surprises is higher now, and the second half brings its own set of challenges,” he adds.

Reasons for Cautious Optimism

Lerner sees a number of factors supporting the market:

- U.S. Growth: While the economy faces headwinds, Lerner expects GDP growth around 1.3% this year — slow but steady.

- Labor Market: Cooling, not collapsing — a healthy sign.

- Consumer Activity: Volatile, but resilient.

- Policy Outlook: Lerner expects two Fed rate cuts this year and sees potential clarity from the GOP’s tax bill, even if it doesn’t meaningfully boost growth.

- Trade: De-escalation of tariffs has helped, but long-term uncertainty remains a risk.

Valuations and Technicals: Mixed Signals

The S&P 500 is trading at 22 times forward earnings — a cycle high — which could limit upside. However, the equal-weighted S&P 500 is priced more in line with historical norms, and earnings estimates have recently improved.

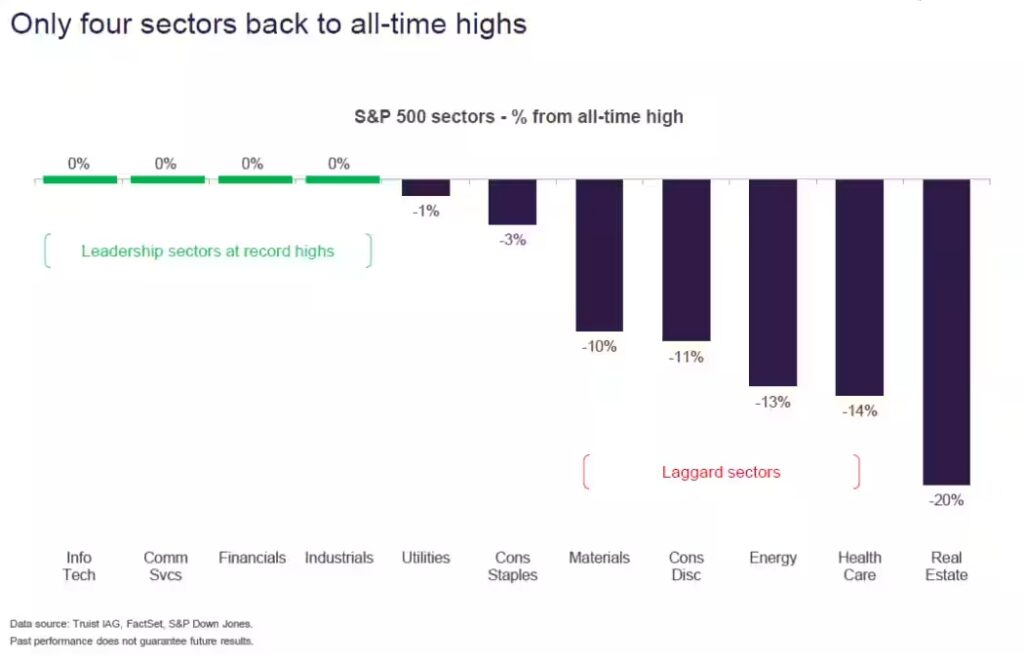

Market breadth remains a concern. Only four sectors — tech, communication services, industrials, and financials — are at all-time highs. Small- and mid-cap stocks, along with the equal-weighted S&P 500, are still lagging.

Improving breadth may hinge on a broader economic pickup and stronger earnings. Until then, Lerner maintains a preference for large-cap growth stocks.

Other Portfolio Views

Truist also sees value in developed international markets, especially Europe, which continues to play catch-up. On the fixed-income side, they favor high-quality and municipal bonds, while gold remains a recommended hedge and diversifier.

Momentum Still Matters

One trend working in the market’s favor: the speed of its rebound. “When the S&P 500 has rallied more than 20% in two months or less — as it just did — it’s been higher a year later in all 10 previous cases, with an average gain of 24%,” Lerner notes.

In short, history suggests that strong recoveries tend to lead to continued gains — even if the journey gets bumpier from here.