Analysts caution that the recent uptick in the Vix alongside increased interest in bearish options suggests potential weakness ahead for stocks. After enjoying five months of stability, the stock market‘s upward trajectory faced a hiccup last week as the Vix, dubbed the “fear gauge,” surged, prompting concerns among some experts about a more significant downturn.

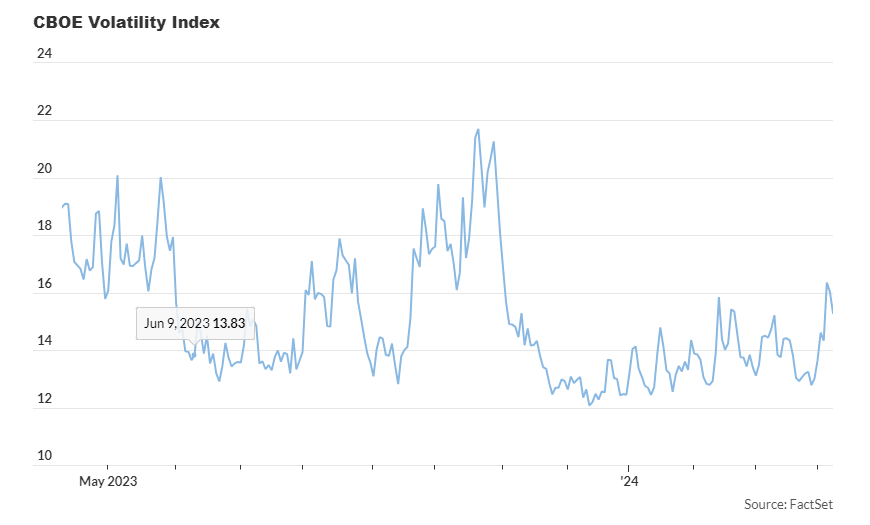

The Cboe Volatility Index, known as the Vix, has sparked worries that stocks might be on the verge of a correction, defined as a decline of 10% or more from recent highs. Its notable 23% increase last week, the most substantial weekly surge since September, pushed the index above 16 for the first time since November 1, as per FactSet data.

This spike comes after a prolonged period of subdued Vix readings, attributed to various factors such as the rise in popularity of short-term option contracts and derivative-income exchange-traded funds. Analysts caution that this increase in volatility could gain momentum as traders unwind derivative positions that profit from market stability.

The Vix gauges implied volatility based on options market activity, with volatility typically rising faster during market downturns. The combination of a rising Vix and heightened demand for bearish put options suggests to Tyler Richey, co-editor of Sevens Report Research, that the market may be at a “tipping point,” indicating potential softening in the weeks ahead. Richey suggests a scenario similar to the selloff experienced between late July and late October of the previous year.

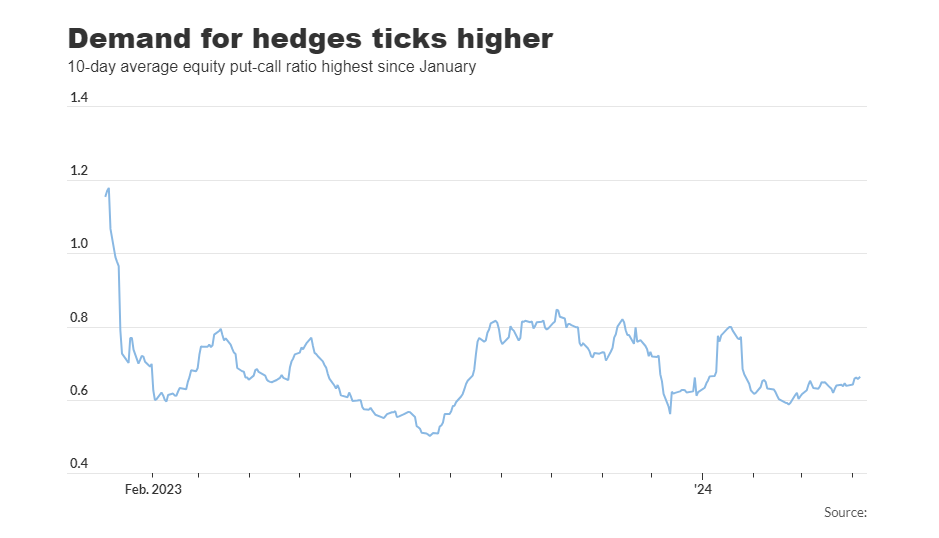

Last week’s surge in demand for bearish put options pushed the 10-day rolling average of the Cboe equity put-call ratio to its highest level since January 26, signaling increased interest in options tied to individual stocks.

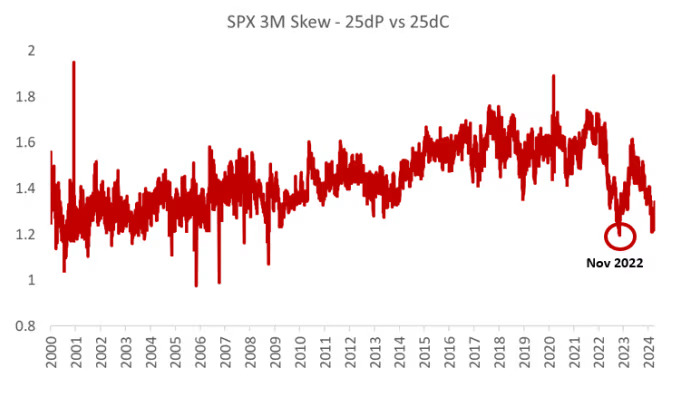

Additionally, the rise in demand for out-of-the-money puts compared to calls has attracted attention. This surge, according to Charlie McElligott, a derivatives strategist at Nomura, has led to a notable increase in the options-market skew, indicating a shift in investors’ sentiment. Such rapid increases in skew from historically low levels have historically coincided with weak excess returns for stocks.

These indicators suggest potential near-term challenges for markets, especially with upcoming economic data releases and Treasury auctions that could impact bond yields. Slow-moving catalysts such as a strengthening economy and changing expectations regarding Federal Reserve policies also contribute to market uncertainty.

While some analysts caution against overinterpreting last week’s volatility, they acknowledge the vulnerability of the market’s recent rally. Despite mixed performance on Monday, with the S&P 500 and Dow Jones slightly down while the Nasdaq edged up, low trading volume indicated investor distraction, possibly due to external events like the total solar eclipse.

The Vix, however, finished lower on Monday, showing a decline of 5.1%, reflecting the ongoing market uncertainty despite the recent surge in volatility. The remarkable rally in stocks since late October, without significant pullbacks, underscores the unusual resilience of the market in recent months.