Trump’s Tariff Pause Hints at Market Floor—but Investors Should Remain Cautious

President Donald Trump’s decision to partially pause tariffs may have revealed an informal threshold for how far equity market can fall before prompting a policy shift. But investors would be wise not to take this as a guarantee of support.

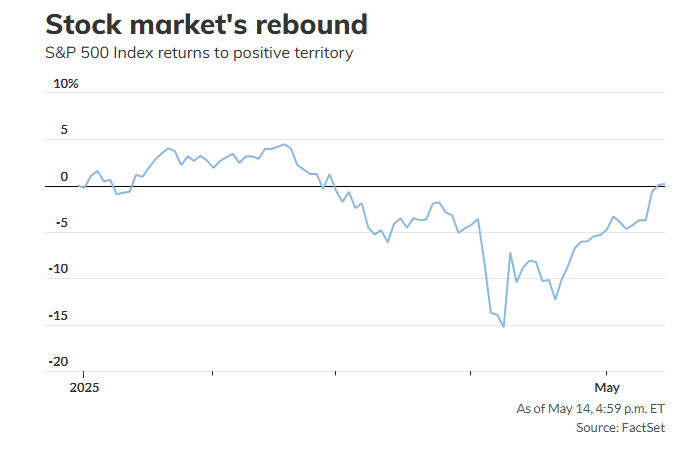

After a steep tariff-driven selloff, the stock market staged a rapid rebound, suggesting a new baseline for when Trump might intervene to stabilize markets. The S&P 500 returned to positive territory for 2025 on Tuesday, following tariff pauses between the U.S. and China. The index recovered from its April 8 low of 4,982.77, implying a potential “Trump put” — an informal market floor — around an 18.5% decline.

Trump’s re-election in November initially sparked euphoria on Wall Street. U.S. equity benchmarks surged to record highs through February. Jeremy Siegel, a finance professor at the Wharton School, called Trump the most “pro-stock-market president” in history, as reported by MarketWatch’s Joseph Adinolfi.

That optimism gave way in January as trade tensions with China escalated. By spring, concerns over a full-blown trade rupture and a potential U.S. recession gripped investors. Markets found relief when Trump paused reciprocal tariffs for most countries on April 9, and again after an additional pause in U.S.-China tariffs on May 12.

“The Trump put is alive and well,” said Tom Lee, head of research at Fundstrat, in a recent podcast. “The White House doesn’t want the stock market to go down.”

Still, Trump downplayed the market downturns this spring, raising doubts about how quickly he would act to stabilize equities. Federal Reserve Chair Jerome Powell dismissed speculation that the Fed would intervene on Trump’s behalf during the April slump.

“Markets panicked in early April partly because they feared the Trump put wouldn’t come into play until the S&P 500 had fallen deep into the 4,000s,” said Tom Essaye, president of Sevens Report Research. Now, he believes that policy sensitivity has shifted to the mid-to-low 5,000s on the S&P 500.

Despite recent gains, the S&P 500 remains 4.2% below its record close of 6,144.15 from February 19, according to Dow Jones Market Data. Stocks extended their recovery on Wednesday, moving closer to retesting those highs.

Steven Blitz, chief U.S. economist at GlobalData TS Lombard, wasn’t surprised by Trump’s 90-day pause on China tariffs, given the scale of recent selloffs. However, he remains cautious about the durability of Trump’s dovish stance, especially as Republicans aim to finalize a new budget bill by Memorial Day.

“I’m skeptical about how Trump’s trade rhetoric will shift once the budget is signed,” Blitz told MarketWatch. He noted it’s unclear whether political pressure or financial market volatility had more influence on Trump’s tariff pause. “He needs those congressional votes to get the budget passed.”

As of Wednesday, the S&P 500 was up 0.2% for the year. The Dow Jones Industrial Average was down 1%, while the Nasdaq Composite slipped 0.9%, according to FactSet.