A large number of investors are looking for indications that the stock market decline may soon be over, even though the S&P 500 has only dropped by 5.5% from its peak in late July.

Taking this into consideration, Victor Cossel from Seaport Research Partners has shared some technical charts that may provide insight into when a potential turnaround might occur. However, the main point is that, for now, it is expected that there will be more difficulties in the future unless the continuous increase in Treasury yields and the U.S. dollar comes to an end.

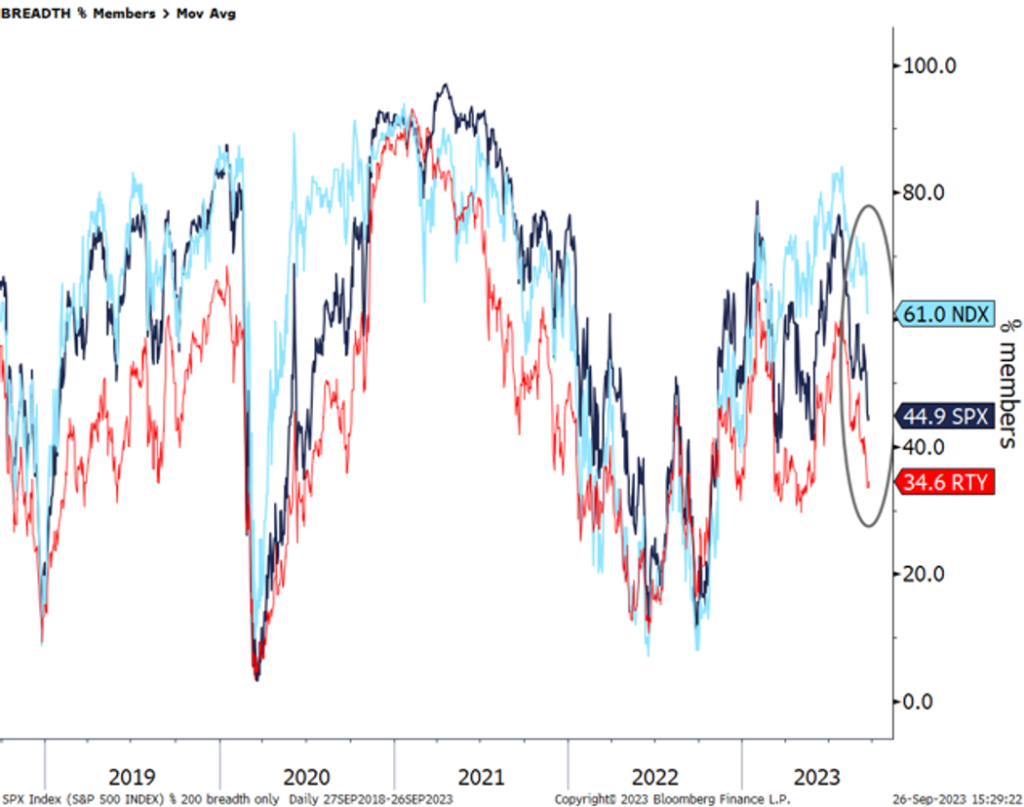

Initially, it is necessary for the percentage of Nasdaq 100 components that are currently trading below their 200-day average to align with the amount of S&P 500 and Russell 2000 members that are also trading below their 200 DMAs.

Analysts use moving averages to assess the momentum and directionality of a particular security. By examining these patterns within index components, analysts can determine the extent to which an index’s performance relies on a select group of stocks, which has been a prominent trend in the U.S. equity markets throughout the year, notably due to the emergence of the “Magnificent Seven.”

The “Magnificent Seven” refers to a collection of large technology stocks that have experienced significant growth due to the popularity of artificial intelligence. This group includes companies such as Nvidia Corp., Microsoft Corp., Apple Inc., Meta Platforms Inc., Tesla Inc., Amazon.com Inc., and Alphabet Inc.’s Class A and Class C shares.

As per the most recent data provided by Cossell, which was up to date until the end of trading on Monday, 61% of Nasdaq 100 NDX members remained higher than their 200-day moving averages. In comparison, the figures were 45% for the S&P 500 SPX and 35% for the Russell 2000 IWM. However, these percentages might have slightly changed after Tuesday’s significant decline in U.S. stock prices.

If the pressure to sell increases, traders will closely observe whether the S&P 500 can maintain its position at 4,200, a level that has been a strong foundation for the large-cap index over an extended period.

If the stock market drops below 4,200, it could be a negative sign for future developments. Traders would interpret this decline as an indication that the downward momentum is gaining strength.

Nevertheless, the market’s frothiness, which may have influenced the Federal Reserve to provide guidance of sustained higher interest rates, is gradually diminishing.

An illustration of this is when the S&P 500’s information-technology sector reached correction territory on Tuesday by closing at 2,869.6 after a 1.8% decrease in its value. This decrease caused the index to drop by 10.5% from its highest point in the past 52 weeks, which was 3,207.29. When a stock or index falls by 10% or more from its recent peak, it is considered to be in correction territory.

The recent movements in Treasury yields and the dollar have been widely attributed to the interest rate plans revealed by the central bank after its September policy meeting.

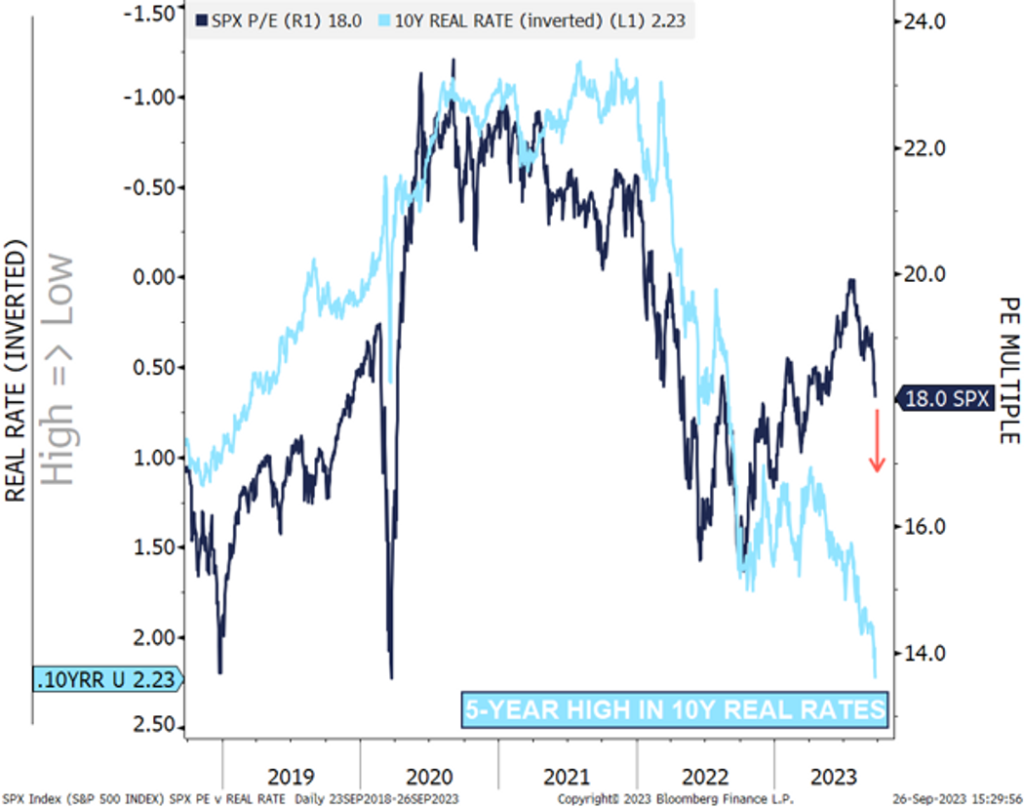

It is possible that increasing real rates, which are bond yields adjusted for inflation, may cause problems for the stock market. Cossel recently demonstrated this in a chart, showing that the S&P 500’s valuation based on future price-to-earnings ratio is noticeably high compared to where 10-year real rates are currently trading.

The real rate Cossel utilized in this context is the 10-year nominal Treasury yield BX:TMUBMUSD10Y, which has been modified by taking into account the 10-year breakeven spread.

Cossel mentioned in the note that if rates do not decrease, there is a possibility of the S&P 500 experiencing some vulnerability at its current levels.

On Tuesday, the U.S. stock market experienced significant declines, as the Dow Jones Industrial Average had its largest one-day decrease since March. This was accompanied by an increase in Treasury yields and the ICE U.S. Dollar Index reaching its highest level in 10 months, indicating a stronger value of the U.S. dollar. Specifically, the mentioned gauge, the ICE U.S. Dollar Index, rose by 0.2% to 106.18.

The Dow Jones Industrial Average dropped by 338 points, representing a 1.1% decline to its current level of 33,618.88. Correspondingly, the S&P 500 index experienced a decrease of 63.91 points, or 1.5%, reaching 4,273.53. Similarly, the Nasdaq Composite index saw a decline of 207.71 points, equivalent to a 1.6% decrease, bringing it to 13,063.61.