Despite Tech’s Surge, Goldman Sachs Warns of Underlying Market Risks

While markets remain largely quiet ahead of key consumer price data, the Nasdaq-100 continues to ride high in a melt-up, led by heavyweight tech stocks. The index is up 13% for the quarter, outpacing the S&P 500’s 7.6% gain. Formerly written off earlier in the year, giants like Nvidia, Meta, and even the often-controversial Tesla have posted double-digit gains this quarter.

However, in Goldman Sachs’ “call of the day,” Peter Callahan, the firm’s technology, media, and telecom sector specialist, sounds a note of caution. Despite the strong momentum — the Nasdaq-100 has risen in six of the past seven sessions — Callahan sees signs of stress beneath the surface.

He attributes the market’s recent strength to a combination of positive developments: encouraging signals from the recently concluded U.S.-China trade talks in London, upbeat economic data including improving small-business sentiment, and solid corporate earnings such as May revenue from Taiwan Semiconductor.

These forces have helped push Goldman’s U.S. Financial Conditions Index near its year-to-date lows, signaling looser financial conditions — essentially, a friendlier environment for corporate borrowing and risk-taking.

Yet beneath the surface, Callahan notes early signs of market “choppiness.” The Cboe Volatility Index (VIX), often called the market’s fear gauge, continues to decline, potentially masking deeper risks.

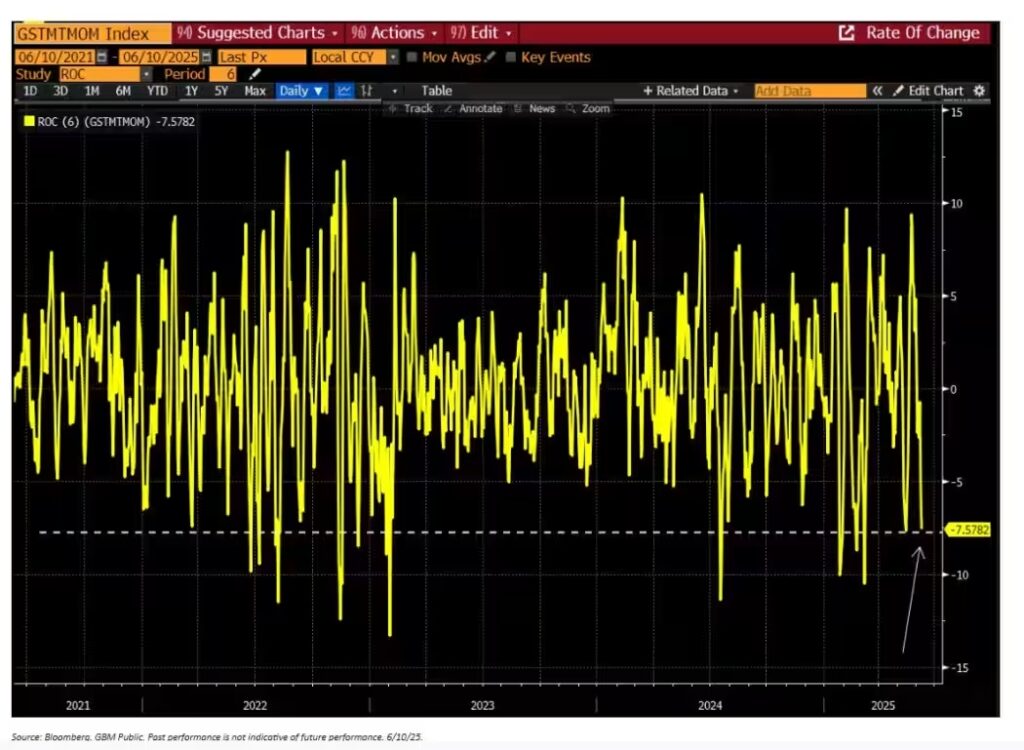

Of particular concern is Goldman’s TMT (tech, media, telecom) momentum pair trade — a strategy that goes long on recent tech winners and short on laggards. That trade has stumbled, falling roughly 7.5% over the past six days and underperforming the Nasdaq-100 by about 850 basis points. Callahan includes a chart illustrating this divergence.

He also highlights a softening in several recent market leaders, including Netflix, Duolingo, Sea, Verisk Analytics, Spotify, Broadcom, MercadoLibre, and Carvana — all of which have declined for three consecutive sessions.

Meanwhile, some traditional “quality” stocks — companies with stable financials and strong balance sheets like Costco and GE — have begun to lag on both weekly and monthly bases.

Other notable shifts Callahan sees: small-cap stocks are starting to outperform large caps, cyclicals are edging ahead of defensives, and unprofitable tech names are gaining ground over high-quality peers. These developments come as the market braces for a potential lull in news flow heading into the end of the quarter, following this week’s busy calendar of CPI data, TMT updates, and U.S.-China trade headlines.