Goldman Sachs See 11% Stock Gain Ahead Despite Trade Uncertainty

Despite renewed uncertainty surrounding U.S. trade policy, Goldman Sachs remains upbeat on the market’s prospects. Strategists led by David Kostin now forecast an 11% gain for the S&P 500 over the next 12 months, raising their year-ahead target to 6,900, up from 6,500.

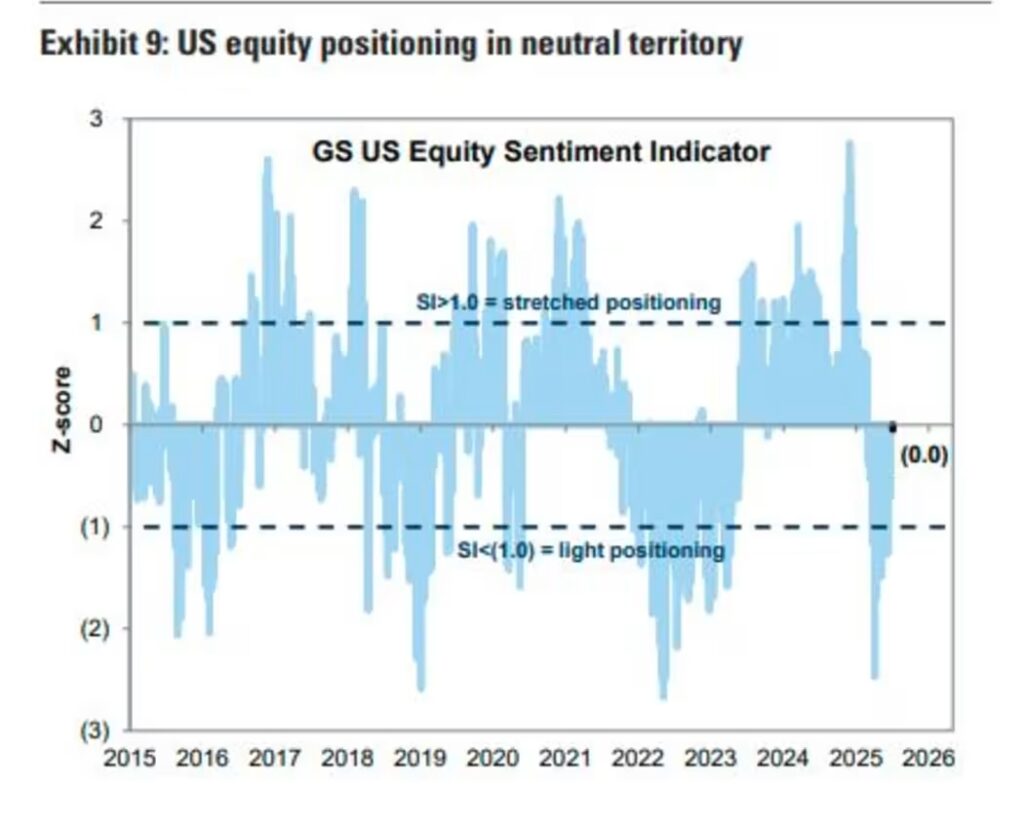

They also see short-term gains: a 3% rise to 6,400 over the next three months and a 6% gain to 6,600 in six months. Their optimism is fueled by expectations of strong 2026 earnings growth, Fed rate cuts, and neutral investor positioning that could pave the way for broader participation in the rally.

But not everyone is convinced.

Swissquote Bank’s Ipek Ozkardeskaya warns the market is acting “suspiciously optimistic,” dismissing the potential fallout of new tariffs on supply chains, earnings, inflation, and growth. “Assuming everything will be magically resolved in the next three weeks is like seeing unicorns in the sky,” she cautioned.

Goldman, however, anticipates “earlier and deeper Fed easing,” falling bond yields, and continued strength from large-cap stocks. They’ve also raised their S&P 500 forward P/E multiple forecast to 22x from 20.4x, reflecting investors’ willingness to look through any short-term earnings soft spots.

While they project 7% EPS growth in both 2025 and 2026, they acknowledge risks. The shifting tariff landscape is a wildcard—Goldman expects the adjustment process to be gradual, with large caps cushioned by inventories ahead of any rate hikes.

Still, narrow market breadth remains a concern. The median S&P 500 stock is over 10% below its 52-week high, suggesting limited participation in the current rally. Yet Goldman sees that as an opportunity, predicting a “catch-up” rather than a “catch-down” as laggards potentially join the rally.

Investment Recommendations:

Goldman Sachs offers three key strategies for stock allocation in the second half of the year:

- Build a balanced portfolio with exposure to growth areas like software, media, and entertainment; cyclical laggards like materials; and defensives such as utilities and real estate.

- Invest in alternative asset managers, which have underperformed despite improving capital markets.

- Look for firms with high floating rate debt, which may benefit from falling bond yields.

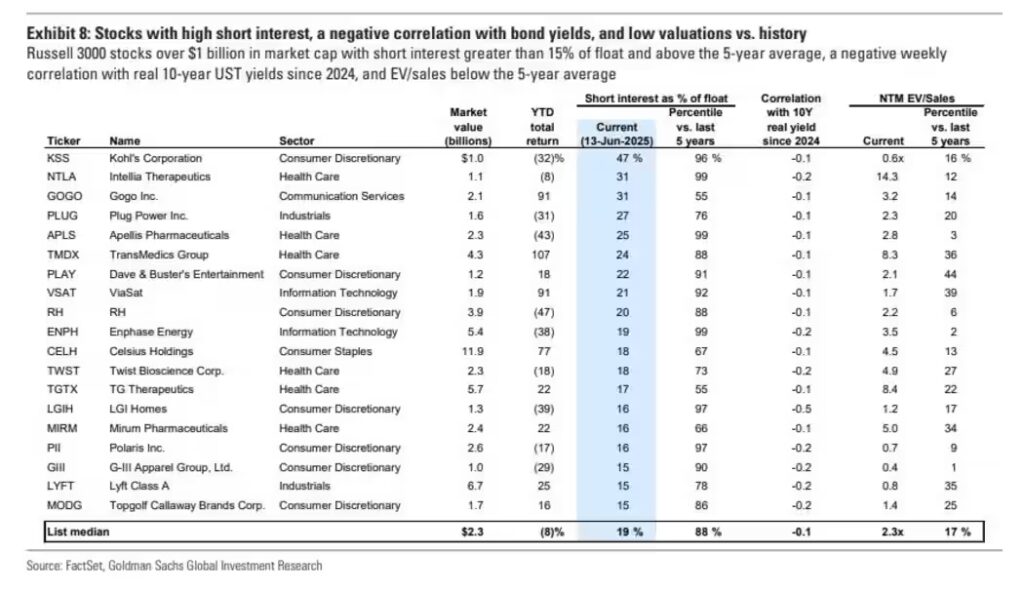

Finally, Goldman screens Russell 3000 stocks for high short interest, low valuations, and inverse correlation to bond yields—potential rebound candidates include Kohl’s (KSS), Intellia Therapeutics (NTLA), Gogo (GOGO), Plug Power (PLUG), and Apellis Pharmaceuticals (APLS).