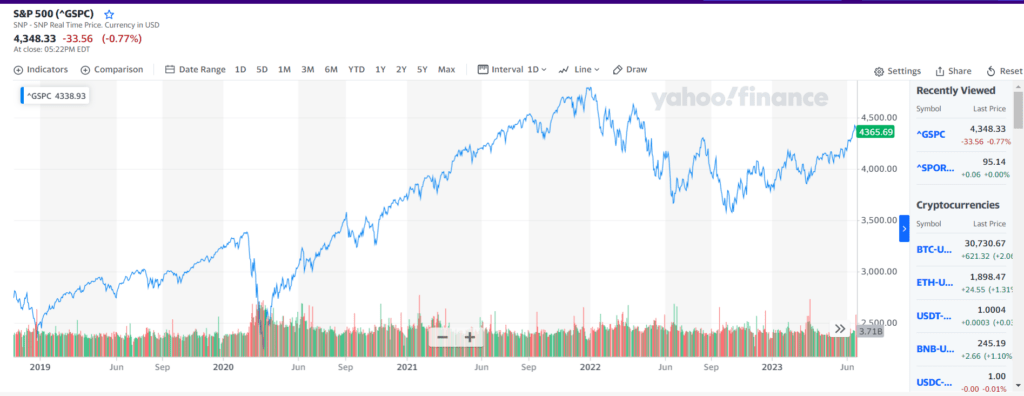

The S&P 500 experienced a drop during the week after the Federal Reserve Chair, Jerome Powell, addressed Congress and stated that the members of the Federal Open Market Committee unanimously agreed on raising interest rates by the end of the year.

June experienced the biggest decline in the index, ending the weeks of high performance in the general market gauge. Similarly, other indexes had a rough week, with the Dow Jones and Nasdaq Composite experiencing a weekly drop of 2% and over 2.6%, respectively, by the deadline.

In the last five trading days until June 21st, the technology industry experienced a withdrawal of 2 billion dollars, which is the biggest decrease in the previous 10 weeks.

Investors across different sectors were filled with optimism after the Federal Open Market Committee decided to halt interest rate hikes for the first time in March 2022, despite Powell’s words being received with disappointment.

Central banks worldwide are anticipated to increase interest rates again owing to the persistence of inflation in several economies.

The presence of India’s leader Narendra Modi in Washington, D.C. was a significant event, with the Biden administration welcoming him with great attention. President Biden emphasized that the connection between the United States and India will be crucial for this century, as India continues on its path to becoming one of the world’s most dominant financial and military forces.

When FedEx Corp. had its earnings call, people had different reactions because the company announced that its revenue for the fourth quarter decreased by 10.2% (worth $21.9 billion), which was lower than the expected revenue of $22.7 billion given by analysts. However, the company exceeded the projected earnings per share of $4.89 by earning $4.94 per share.

Remember Bitcoin?

The digital currency experienced a significant surge, increasing approximately 20% each week up until Friday. It crossed the significant $30,000 threshold and hit $31,200 following the disclosure of fresh cryptocurrency projects by multiple financial institutions.

What’s next

The upcoming New Home Sales report will provide insight into the real estate market in May, while the Personal Consumption Expenditures index on Thursday will offer a glimpse into the inflation measure favored by the Fed.

The pharmacy company Walgreens will reveal its earnings on Tuesday, and the producer of semiconductor chips, Micron Technologies, will release their financial results on Wednesday, along with General Mills, a major player in the food industry. On Thursday, Nike, a leader in sports apparel, will announce their earnings, while on Friday, Constellation Brands, a top beverage company, will report its financial status.