From Wall Street to Main Street: Understanding Investor Behavior Through Movie Lenses

Do movies centered around money offer genuine investing insights or are they merely Hollywood fantasies? Every so often, Tinseltown casts finance as its leading role, depicting the highs and lows of stock markets, Wall Street shenanigans, and the often colorful characters that inhabit them. Works like “The Wolf of Wall Street,” “Dumb Money,” and “The […]

Why This Isn’t Your Typical Bull Market: Unveiling the ‘Duck’ Market Dynamics

The current trajectory of major U.S. equity indexes suggests a consistent upward movement, but this trend isn’t mirrored by individual stocks within these indexes. Observations from strategists at Charles Schwab & Co. shed light on this contrast between the relatively steady performance of overall equity indexes and the more erratic behavior of their constituent stocks. […]

Nvidia’s Stock on a Record Streak: Is the Momentum Sustainable?

A Mizuho analyst has raised concerns about the strong momentum observed in chip stocks despite the absence of fresh developments. The continued surge in Nvidia Corp. shares, now on a sixth consecutive day of gains and poised to hit a sixth consecutive record high, is particularly unsettling for the analyst. Jordan Klein, a desk-based analyst […]

Are We Approaching a Stock-Market Bubble? The Missing Ingredient

The absence of a significant element seen at nearly every previous peak bubble suggests that U.S. stocks are not currently in a bubble, according to analysts at TS Lombard. Unlike past bubbles, the current market lacks substantial leverage. Despite appearing overvalued, with technology stocks notably high compared to historical averages, margin debt has scarcely increased […]

Behind the Numbers: Exploring the Ripple Effect of Dow Transports’ Lag on the Economy

The broader U.S. market tends to thrive even when the transportation sector is struggling. While major U.S. stock-market indices reach new peaks, the Dow Jones Transportation Average (DJT) faces challenges, remaining over 6% below its November 2021 peak. Over the past year, it has trailed behind the broader Dow Jones Industrial Average (DJIA) by over […]

Nasdaq’s Record Streak: Time for a Market Shakeout?

Jonathan Krinsky, BTIG’s chief market technician, notes that the Nasdaq-100, dominated by tech, hasn’t experienced a 2.5% or greater pullback in 303 trading sessions, marking it as the third-longest streak since 1990. While this streak doesn’t necessarily signal an imminent downturn in the AI-driven U.S. stock surge, Krinsky suggests that the market is due for […]

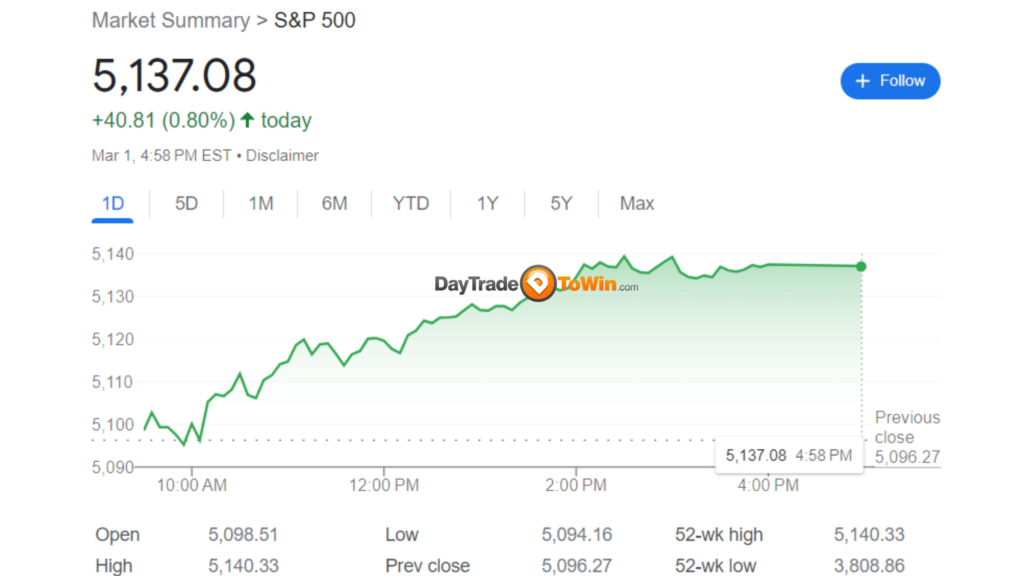

Analyzing Bank of America’s Calculations: S&P 500 Target Upgraded to 5,400

Futures indicate a cautious start for Wall Street, despite major stock indices holding at record levels. The Nasdaq Composite has surged 13.8% and the S&P 500 has gained 11.8% in the last three months, prompting concerns about market bubbles. Bank of America’s team, led by Savita Subramanian, remains bullish, raising their end-of-year S&P 500 target […]

Tracking Trends: U.S. Stock Market Behavior in March After February’s Surge

Bespoke notes that March typically brings a middling performance for U.S. stocks, with gains that don’t stand out compared to other months. While February saw U.S. stocks securing a winning streak, there’s now speculation about whether investors might opt to cash in on those gains at the start of March. Looking back, history reveals a […]

Ray Dalio’s Insight: Why the Stock Market Isn’t Bubble-Prone

When examining the U.S. stock market through these lenses, it doesn’t appear overly bubbly, according to Ray Dalio, the founder of Bridgewater Associates, even amidst notable rallies and media attention on certain segments. Stocks have surged significantly since their October lows, marking four consecutive months of gains and propelling both the S&P 500 and Dow […]

The Hidden Gem: Traders’ Quest to Uncover the Significance of this Obscure Financial Element

According to a strategist, investors are keenly aware of the potential for changes in the background that have been unfolding over the past 1.5 to 2 years, which could lead to adjustments that might prove to be messy. Instead of focusing on potential actions by Federal Reserve officials on interest rates in the coming months, […]