Once again, the monthly stock-market options for August are about to come to an end on Friday, which could result in increased instability in the stock market following a difficult three weeks.

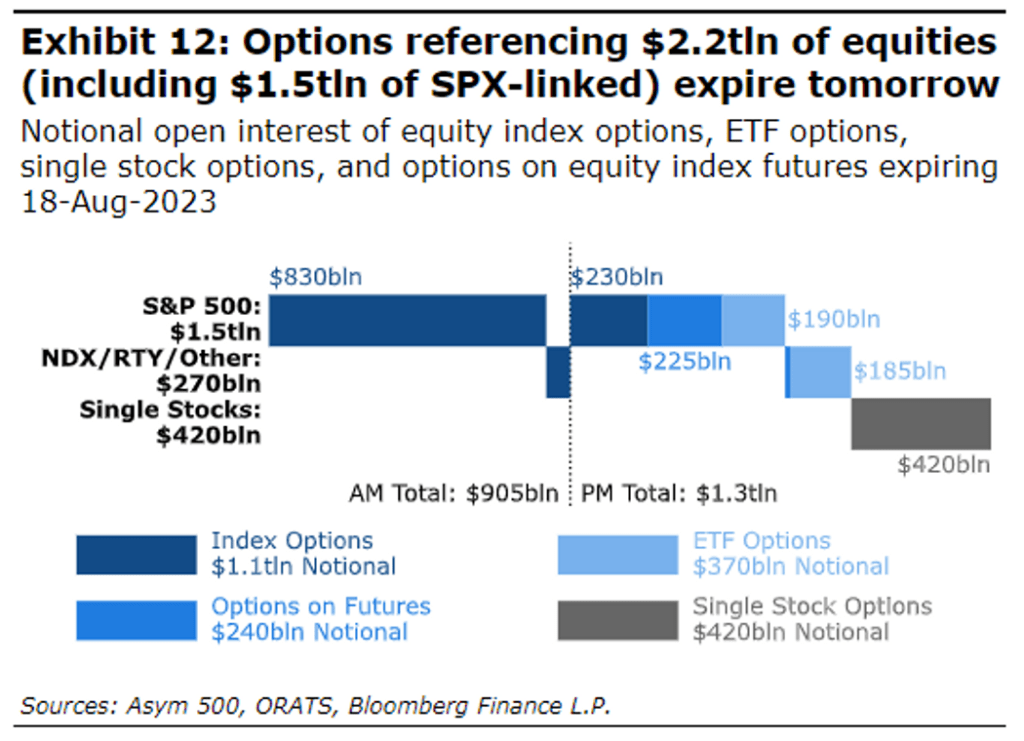

According to Rocky Fishman, the founder of strategy firm Asym 500 and former head of index derivatives strategy at Goldman Sachs Group, there are U.S. stock option contracts worth $2.2 trillion that are about to reach their expiration. The notional value of these contracts represents the market value of the stocks, indexes, and exchange-traded funds that the options control. However, it is important to note that the actual premiums paid by the option holders are significantly lower in value.

Fishman observed that the quantity of open options contracts set to expire on Friday is within the normal range for an off-month expiration.

Every month, options expire. However, once every three months, specifically in March, June, September, and December, a phenomenon called “Triple Witching” occurs. During this event, the notional value of expiring options increases significantly as quarterly and sometimes yearly options expire, in addition to the monthly and weekly ones.

Analysts in the options market cautioned that Friday could experience increased volatility, similar to sessions when monthly options expire.

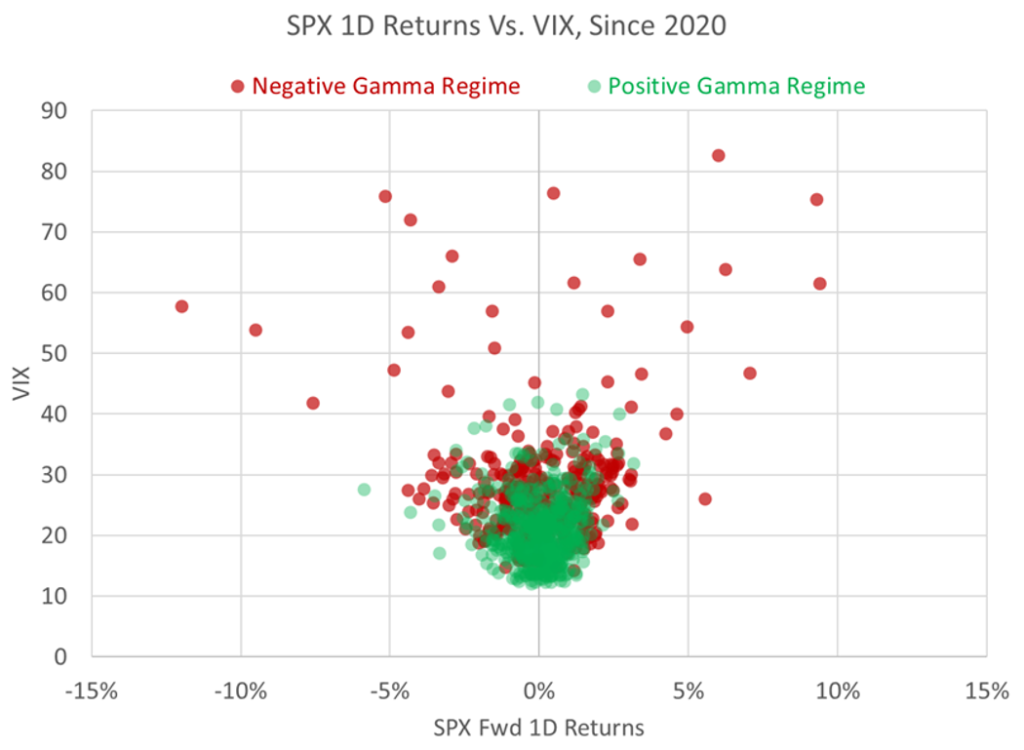

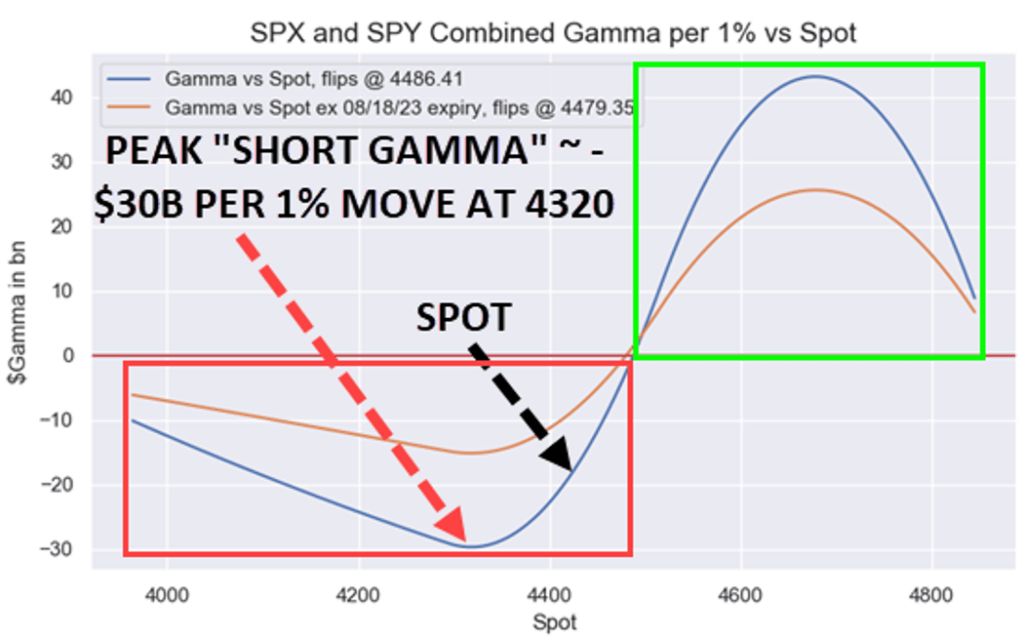

Charlie McElligott, a strategist who specializes in derivatives and shares his research with Nomura’s trading desk, has alerted his clients about the risks associated with option dealers being “short gamma” as Friday’s expiration approaches. This could potentially lead to option dealers amplifying market volatility. McElligott supported this idea with a chart displaying the pattern.

Fishman observed that the amount of open interest in the option market expiring on Friday is typical for a non-busy month’s expiration.

Each month, there is an expiration for monthly options. However, there is a special event called “Triple Witching” that occurs every quarter, specifically in March, June, September, and December. During this event, the value of expiring options increases significantly as both quarterly and sometimes yearly options expire along with the monthly and weekly options.

Analysts in the options market cautioned that on Friday, there could be increased volatility similar to what is typically observed during sessions when monthly options expire.

Charlie McElligott, a derivatives strategist who provides research for Nomura’s trading desk, cautioned clients that option dealers are at a disadvantage with regards to the value of gamma and this could worsen market volatility. McElligott visually demonstrated this tenancy through a chart.

Options analysts use gamma to describe the rate at which an option’s delta changes. Delta indicates how responsive the option’s price is to changes in the underlying asset. As an option nears its expiration, delta tends to increase significantly because even small movements towards being profitable or unprofitable can greatly affect the option’s price.

In research shared with clients, SpotGamma’s founder, Brent Kochuba, mentioned the potential dangers associated with dealers’ short-gamma position. SpotGamma provides clients with information and analysis pertaining to the option market.

The speaker stated that they have been observing a decline in market gamma, which has now gone into negative gamma territory for the entire month. They noted that once this occurred, the price movement became more volatile, as anticipated under such circumstances. These comments were shared through written commentary with both MarketWatch and SpotGamma clients.

Option contracts provide traders with the freedom to purchase or sell various assets or currencies, without any obligation to do so. Typically, options linked to stock-market indexes such as the S&P 500 are resolved through futures or cash. Conversely, options connected to exchange-traded funds like the SPDR S&P 500 ETF Trust (SPY), which mirrors the S&P 500 index, are settled in the form of ETF shares.

A put option gives the purchaser the choice to sell shares at a prearranged price called the “strike price,” but it is not mandatory. On the other hand, a call option grants the holder the right to purchase shares. When the value of the underlying stock or index declines, put options typically increase in value, while the opposite holds true for call options.

On Thursday, U.S. stocks ended the day with a decrease, causing the S&P 500 and Nasdaq Composite to potentially go through a third consecutive week of decline. This would be the longest period of decline for the S&P 500 since February.

On Thursday, the S&P 500 experienced a decrease of 0.8%, and the Nasdaq Composite fell by 1.2%, reaching 13,316.93. Similarly, the Dow Jones Industrial Average dropped 290.91 points, equivalent to a 0.8% decrease, settling at 34,474.83.

Besides the monthly options that expire on Friday, there are also weekly options referred to as “zero days until expiration” or “0DTE” options, which could make the market’s response more complex. A seasoned strategist from Goldman Sachs Group raised concerns earlier this week, stating that 0DTE traders have been restraining stock price increases and exerting additional pressure when the market declines.