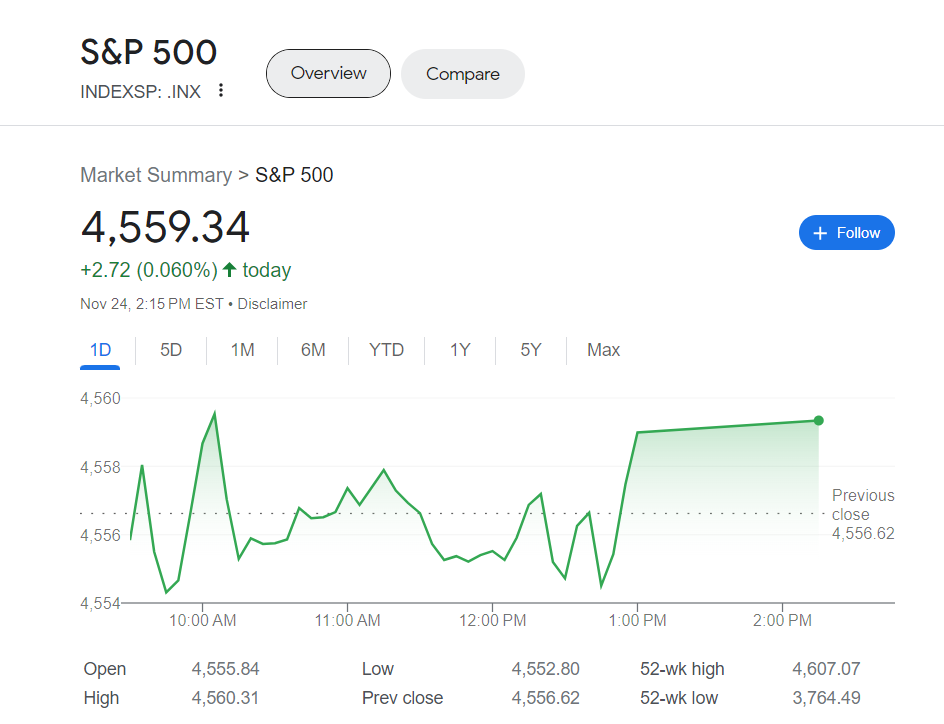

The S&P 500 Index has made a decisive breakthrough, surging beyond 4400 and maintaining momentum. Despite indications of an overbought market, no confirmed sell signals have emerged. Overcoming two minor resistance levels, the next hurdle lies at the 2023 highs near 4610, with potential for reaching all-time highs at 4800.

While a gap down to 4420 remains on the SPX chart, filling it would still preserve the bullish scenario. As long as SPX stays above 4400, the chart maintains its bullish stance.

The recent McMillan Volatility Band (MVB) buy signal achieved its target at the +4σ “modified Bollinger Band” (mBB), closing successfully. With SPX above the +4σ Band, a new MVB sell signal may be forming, triggered by a “classic” mBB sell signal if SPX closes below the +3σ Band, currently at 4488.

Equity-only put-call ratios signal buying opportunities as both decline, despite distortion from equity put arbitrage. Market breadth, though recovering from a recent sell signal, remains modestly overbought. New Highs and New Lows on the NYSE stay neutral.

While VIX has edged lower, hovering near 13.0, maintaining the “spike peak” and trend of VIX buy signals, the “spike peak” signal will expire after 22 trading days on Nov. 24. The trend would only end if VIX closes above its 200-day moving average.

Volatility derivatives signal a bullish outlook for stocks, with upward-sloping term structures and substantial premiums of VIX futures over VIX.

Maintaining a “core” bullish position as long as SPX remains above 4400, other signals will be traded around this core position. The overall market outlook remains positive, with attention to potential signals that could influence trading decisions.