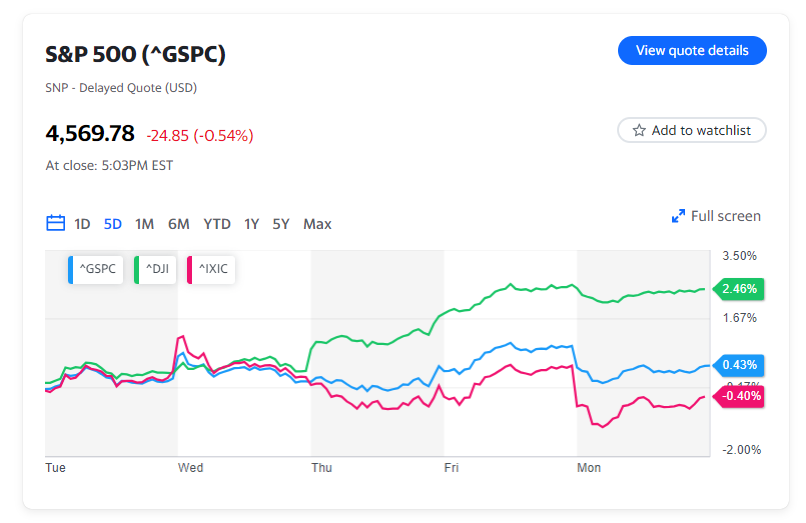

After a robust November rally, stocks experienced a pullback on Monday, setting the stage for a cautious market ahead of the crucial monthly jobs report. The S&P 500 (^GSPC) retreated by 0.5%, and the Dow Jones Industrial Average (^DJI) dipped by 0.1%, approximately 40 points. Leading the downturn, the Nasdaq Composite (^IXIC) recorded a 0.8% decline.

November had witnessed an impressive stock surge, securing five consecutive weekly wins as investors clung to the belief that the Federal Reserve would initiate rate cuts early next year. However, these expectations, persisting despite Fed Chair Jerome Powell’s dismissal of rate hike cessation talks, have recently pressured Treasury yields.

Both stocks and bonds are now experiencing a retreat on Wall Street, as an increasing number of analysts caution that the rally may be excessive. The 10-year Treasury yield (^TNX) climbed by 6 basis points, reaching around 4.28%.

As the market braces for the November jobs report scheduled for release on Friday, there’s anticipation that the data could influence the rally’s trajectory. Whether the data supports or contradicts the notion that the Fed has concluded its rate hikes will be pivotal, especially considering the significance of labor market conditions in policymakers’ decision-making.

In other market developments, the optimism surrounding a potential Fed pivot propelled bitcoin (BTC-USD) prices to surpass $41,000, reaching levels not seen since the 2022 crypto downturn. Expectations that the SEC will approve US spot bitcoin ETFs in January also contributed to gains in various digital currencies.

Meanwhile, individual stock movements were notable, with Hawaiian (HA) shares soaring by approximately 190% following Alaska Air’s (ALK) announcement of its intent to acquire the troubled fellow airline at nearly four times Friday’s closing price. Conversely, Alaska shares declined by about 15%.