The broader U.S. market tends to thrive even when the transportation sector is struggling. While major U.S. stock-market indices reach new peaks, the Dow Jones Transportation Average (DJT) faces challenges, remaining over 6% below its November 2021 peak.

Over the past year, it has trailed behind the broader Dow Jones Industrial Average (DJIA) by over 12 percentage points, sparking concerns among investors who see transportation as a key indicator of U.S. economic health.

However, contrary to popular belief, historical data suggests that the overall market performs well despite weaknesses in the transportation sector.

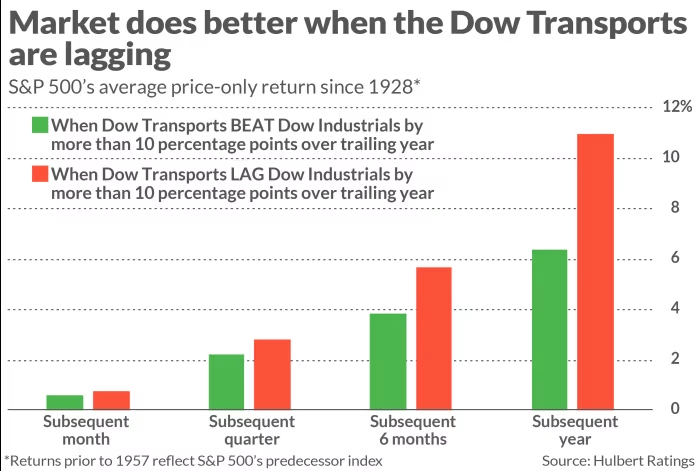

Analyzing the U.S. stock market‘s performance since 1928 reveals that the S&P 500 tends to fare better following periods of significant underperformance by the Dow Transports compared to the Dow Industrials, as is currently observed.

Moreover, even when the Dow Transports experience absolute declines rather than just relative weakness compared to the DJIA, there’s no significant cause for alarm. On average, the S&P 500 has shown stronger performance following 12-month periods of decline in the Dow Transports compared to periods of gains.

In essence, while concerns like overvaluation and excessive optimism abound, fretting over the weakness in the Dow Transports may not be warranted.