BCA Research Warns Bitcoin May Have Peaked as Profitability Reaches Historic Levels

Bitcoin’s meteoric rise may be nearing its peak, according to BCA Research, as the percentage of bitcoin in profit has reached levels historically associated with market tops.

While a 10% drop from its record high—set when former President Donald Trump was inaugurated on Jan. 20—might be considered a routine correction for such a volatile asset, BCA Research, which has been bullish for the past two years, is now signaling caution.

Led by Juan Correa, BCA’s global asset allocation strategist, the firm points to several classic signs of a market top. Among them is Trump’s involvement in launching two memecoins with low public floats—moves they interpret as prioritizing personal gain over broadening crypto adoption.

Though institutional investors largely avoid memecoins, these speculative assets still make up nearly 2% of the crypto market. More importantly, BCA strategists view the memecoin frenzy as symptomatic of extreme bullish sentiment in crypto. Bitcoin ETFs have become the most successful exchange-traded fund launches in history, with BlackRock CEO Larry Fink even suggesting institutional investors may allocate up to 5% of their portfolios to bitcoin. Fink has speculated that bitcoin’s price could soar to $700,000.

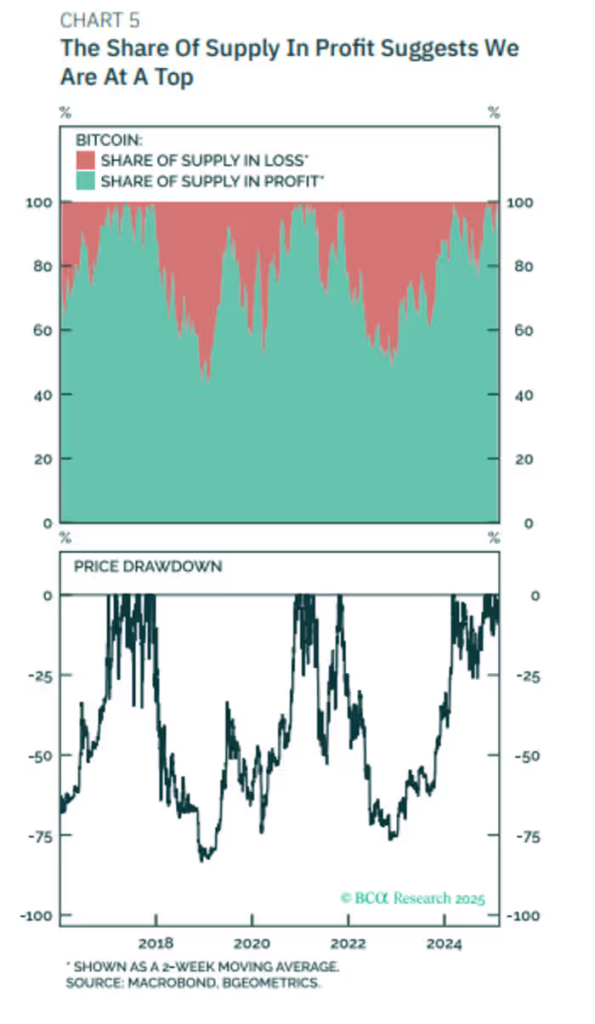

“We are concerned that this raging optimism signals we are near a top,” BCA analysts caution. They highlight that over 90% of bitcoin supply is currently in profit—historically a threshold where market peaks have occurred. Additionally, eight of the top ten most downloaded financial apps are crypto trading platforms, another indicator of overheated sentiment.

Macroeconomic factors also pose risks to bitcoin’s continued surge. BCA warns that lower-than-expected deficit spending could dampen the asset’s explosive performance. “A U.S. economy that is both cooler and less fiscally reckless than expected is not conducive to bitcoin’s current trajectory,” they explain.

Despite their concerns, BCA Research maintains a long-term positive outlook on bitcoin. “We still believe bitcoin has a role in a diversified portfolio,” they note, but caution that sentiment-driven surges can lead to unsustainable valuations. They suggest a more favorable entry point would be around $75,000.

One potential wildcard is Trump’s proposed strategic bitcoin reserve, which would hold crypto assets seized by law enforcement. “While this could provide short-term support for prices, we believe it would ultimately mark the top of the cycle,” BCA states.

Amid the speculative frenzy, BCA has even launched its own satirical memecoin, Liquidity Trap. “This coin pays homage to our firm’s historic work on liquidity,” they quip. “It is also called Liquidity Trap because, quite literally, any money you put in will most certainly be lost forever.”