Stock futures on Wall Street remained mostly steady on Thursday, as investors closely monitored Federal Reserve policymakers for further insights into interest-rate strategies following a string of mixed signals.

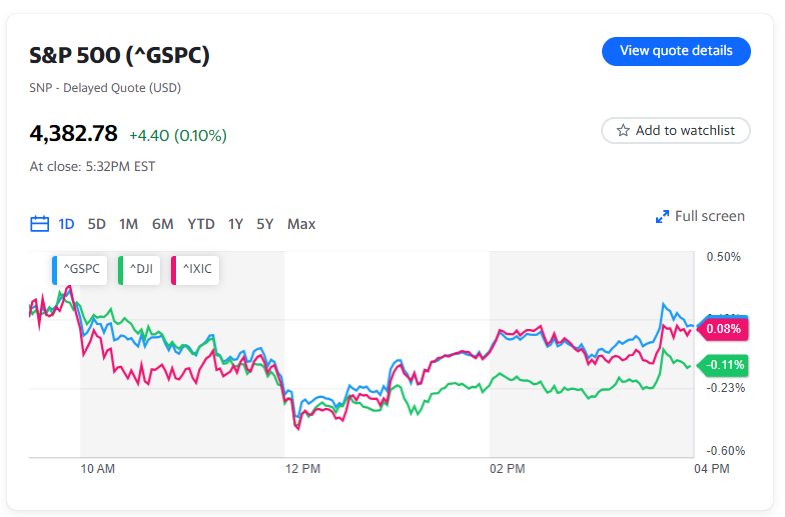

The S&P 500 futures hovered near the baseline after the benchmark narrowly achieved its eighth consecutive day of gains on Wednesday—marking the index’s lengthiest streak in two years. Dow Jones Industrial Average (^DJI) futures saw an increase of approximately 0.1%, while contracts associated with the tech-heavy Nasdaq 100 (^NDX) dropped by around 0.1%.

Investors eagerly await Jerome Powell’s potential hints on the possibility of a rate cut during his upcoming speech, especially after the Fed chair remained silent on monetary policy during his Wednesday appearance. Recent statements from central bankers have unveiled a spectrum of perspectives, fostering uncertainty among investors who were previously convinced the Fed was finished with hikes.

As the earnings season winds down, a fresh wave of corporate reports is expected. Disney (DIS) shares surged after exceeding quarterly earnings estimates in after-hours trading, likely boosted by a tentative agreement between Hollywood studios and striking actors.

Conversely, Arm (ARM) shares declined as investors processed its initial post-IPO results, coupled with the chip designer’s backer SoftBank reporting a quarterly loss of $6.2 billion.

In the realm of commodities, oil prices rebounded marginally after hitting a three-month low due to concerns about global consumption. West Texas Intermediate crude futures (CL=F) and Brent crude futures (BZ=F) saw an increase of about 0.5%, trading at approximately $76 and nearly $80 a barrel, respectively.