In the past year, the U.S. government has poured $6.2 trillion into various initiatives, catching the eye of investors. According to Bank of America’s strategists, spearheaded by Michael Hartnett, this fiscal splurge spells a trajectory of no end, spiraling into inflation and a long-term downturn in bond markets, hence fueling a fervent appetite for alternative investments.

The surge in government spending, bolstered by pandemic relief measures, energy incentives, financial sector rescues, and even student debt pardons, has reshaped the mindset of both Main Street and Wall Street. The populace questions the value of saving amidst such abundance, while investors are wary of betting against the seemingly unstoppable flow of government intervention and monetary stimulus.

This sentiment shift is reflected in the soaring values of the U.S. dollar and assets like gold and cryptocurrencies, which have seen remarkable highs. Bank of America attributes this to a declining trust in traditional institutions. However, they caution that the Federal Reserve’s recent stance on anticipating interest rate cuts might exacerbate asset inflation, making any policy adjustments challenging.

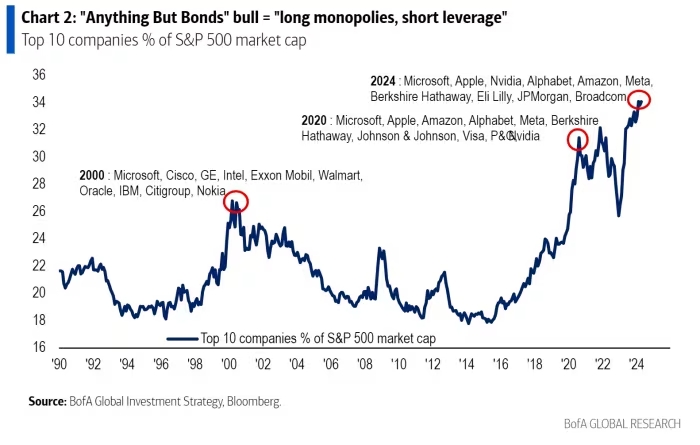

This skepticism towards bonds has fostered a preference for what Bank of America terms “long monopolies, short leverage,” with a handful of mega-corporations dominating market capitalization. This trend is evident not only in the S&P 500 but also on a global scale.

Bank of America predicts that this trend will persist until real yields reach a certain threshold, or until economic conditions provoke a shift.

They envision two scenarios emerging from this environment: a positive one driven by robust economic expansion, benefiting cyclical stocks, and a negative one marked by escalating inflation, leading to increased volatility and a flight to tangible assets like cash, gold, and commodities.