According to a strategist, investors are keenly aware of the potential for changes in the background that have been unfolding over the past 1.5 to 2 years, which could lead to adjustments that might prove to be messy.

Instead of focusing on potential actions by Federal Reserve officials on interest rates in the coming months, traders are turning their attention to the intricacies of funding markets, often overlooked, but crucial for maintaining confidence in the U.S. banking system.

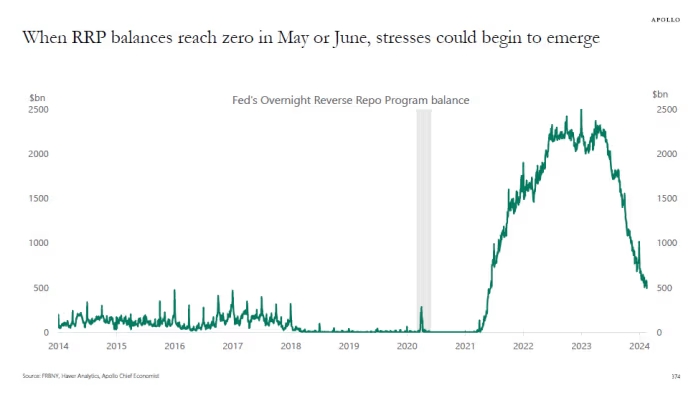

These markets, particularly the underpinnings such as the Federal Reserve’s reverse repurchase facility, play a vital role in managing the central bank’s main policy rate target and ensuring the smooth functioning of financial markets.

However, concerns are growing that certain scenarios could lead to disruptions similar to those experienced in September 2019 when volatility shook the overnight funding market due to a significant decline in bank reserves.

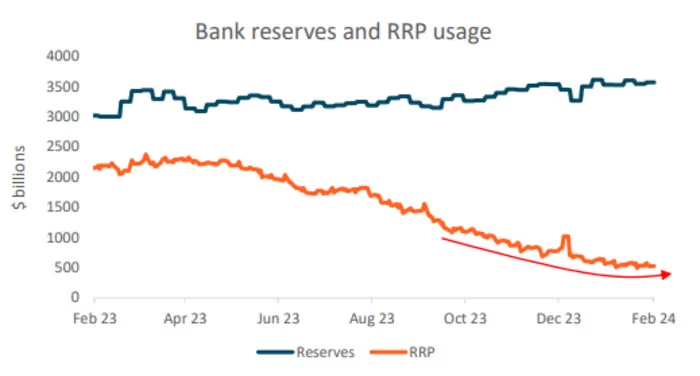

Economist Derek Tang highlights the challenges faced by Fed officials during such episodes, emphasizing the uncertainty surrounding the effectiveness of their actions in mitigating risks. Currently, the usage of the reverse-repo facility is declining, raising concerns that a complete drop-off could lead to a shortage of reserves in the banking sector, reminiscent of the events preceding the collapse of Silicon Valley Bank.

Despite this, funding markets have shown resilience this year, with no signs of strain comparable to those witnessed in late 2023. As long as bank reserves remain ample, the Fed has room to continue its quantitative tightening efforts, although concerns persist regarding potential disruptions once reverse repo usage hits zero.

The convergence of these issues at the Fed’s balance sheet is capturing market attention, with many fearing a period of calm preceding a storm. Tang suggests that while the Fed may not be moving on interest rates, the focus on these issues in 2024 aligns with expectations for a revisit of balance-sheet plans.

While some policymakers have earmarked March for discussions on adjusting the pace of quantitative tightening, analyst John Velis questions the urgency, pointing to the current stability in funding markets and policy uncertainty delaying rate cut expectations.

Nevertheless, developments in various market indicators, including Treasury prices and yields, underscore the evolving landscape that investors are monitoring closely.