U.S. stock index futures indicated a mixed start just below record levels on Wednesday, as bond markets stabilized and investors awaited further corporate earnings releases.

Here’s how the stock-index futures are trading:

- S&P 500 futures (ES00, -0.04%) edged up 1 point, or 0%, to 4976.

- Dow Jones Industrial Average futures (YM00, -0.15%) gained 3 points, or 0%, reaching 38616.

- Nasdaq 100 futures (NQ00, +0.02%) advanced 10 points, or 0.1%, to 17670.

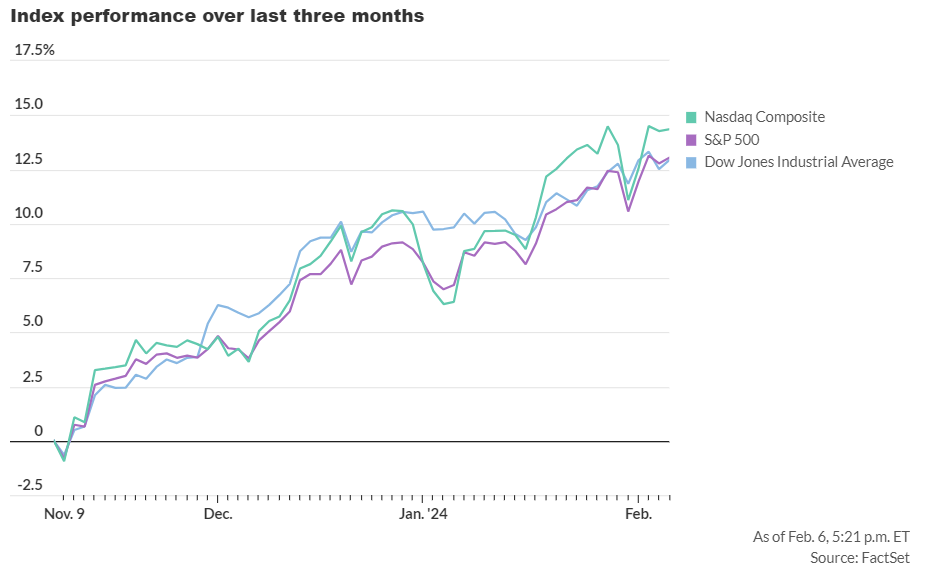

On Tuesday, major indices saw modest gains: the Dow Jones Industrial Average rose 141 points (0.37%) to 38521, the S&P 500 increased 11 points (0.23%) to 4954, and the Nasdaq Composite gained 11 points (0.07%) to 15609.

Market drivers:

Market drivers include the stabilization of 10-year Treasury yields around 4.1%, leading traders to reassess the timeline for potential Federal Reserve interest rate adjustments. Attention is shifting back to corporate performance amid a market hovering near all-time highs.

Snap Inc. (SNAP, +4.18%) shares plummeted 30% following a revenue miss and weak outlook, dampening sentiment. However, Ford Motor (F, +4.14%) and Chipotle Mexican Grill (CMG, +0.68%) enjoyed stock boosts of 6% and 3%, respectively, after positive earnings and forecasts.

Upcoming earnings reports include Uber Technologies (UBER, +2.15%) and CVS Health (CVS, +1.82%) before the market opens, followed by PayPal (PYPL, +3.53%), Walt Disney (DIS, +2.73%), and Arm (ARM, -0.40%) after the close.

Analysts highlight the resilience of the U.S. economy amid rising interest rates, supporting corporate earnings growth and investor sentiment. S&P 500 operating earnings growth of approximately 5% year-on-year fosters bullish sentiment, while higher rates seem manageable for consumers and corporations, allowing the Fed flexibility in managing inflation without disrupting market momentum.

Key economic updates scheduled for release include the December trade deficit at 8:30 a.m. Eastern and January consumer credit at 3 p.m. Additionally, several Federal Reserve officials will deliver speeches throughout the day, discussing policy, economic outlook, and support for small businesses.