Tuesday appears to signal a potential stabilization in the bond market, as more analysts pivot towards expecting the first U.S. rate cut to occur in the summer. However, the stock market is exhibiting volatility as investors grapple with this shifting perspective.

Recent robust job and growth data, coupled with a more cautious stance from Fed Chairman Jerome Powell over the weekend, have tempered the previously optimistic forecasts for rate cuts.

Deutsche Bank, previously among the first to predict a slowdown in April 2022 and a subsequent recession within two years, now suggests a different outlook. They no longer anticipate a mild recession in the first half of the year.

Revising their stance, Deutsche Bank now projects a solid 1.9% growth rate for 2024, with the first Fed rate cut expected in June, but with a total decrease of just 100 basis points. They attribute this shift to the economy performing better than anticipated in 2023, with a resilient job market and inflation below 2% in the latter half of the year.

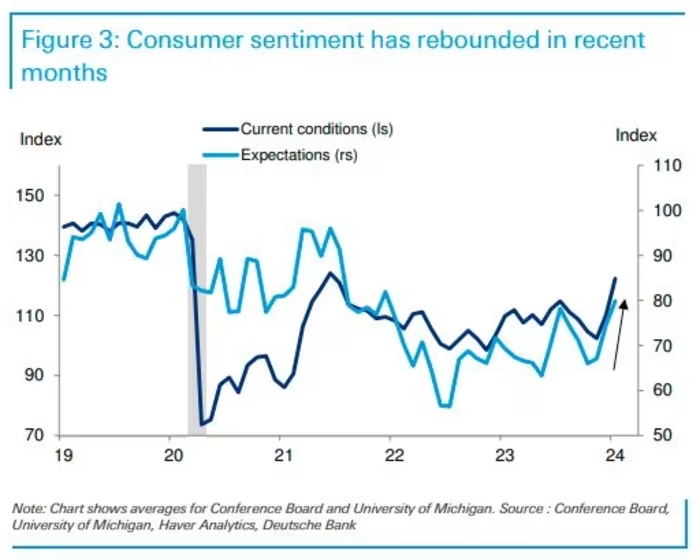

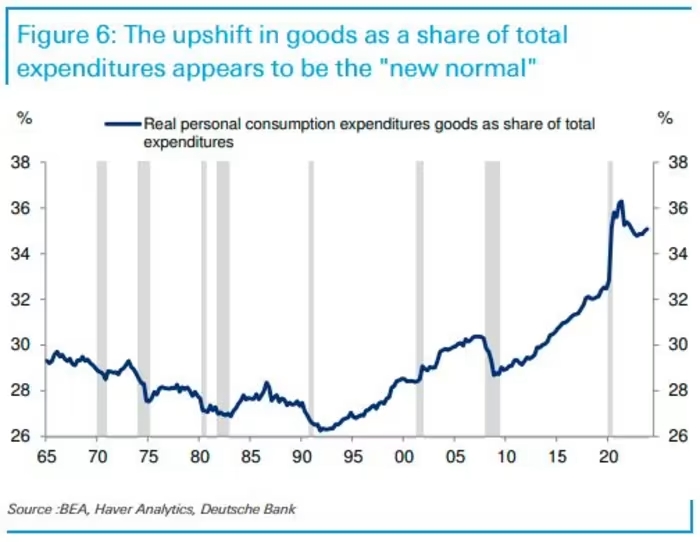

The bank’s economists highlight positive trends such as easing financial conditions and strong consumer spending, which has defied expectations by remaining robust.

However, potential risks to their revised forecast include the impact of previous Fed tightening measures and geopolitical uncertainties. Conversely, they acknowledge the possibility of continued upside surprises in growth, especially given the easing financial conditions and potential for enhanced productivity.

Despite their earlier prediction of a short recession and a year-end S&P 500 forecast of 5,100, among the highest on Wall Street, Deutsche Bank now faces the question of whether to adjust their outlook in light of these developments.