According to an analysis by Bespoke Investment Group, historical patterns suggest that the S&P 500 index may continue its upward trajectory in 2024, following robust returns in January.

The research team at Bespoke observed that when the S&P 500 is in positive territory for the month up to a certain point, it tends to climb further in the final four trading days of January.

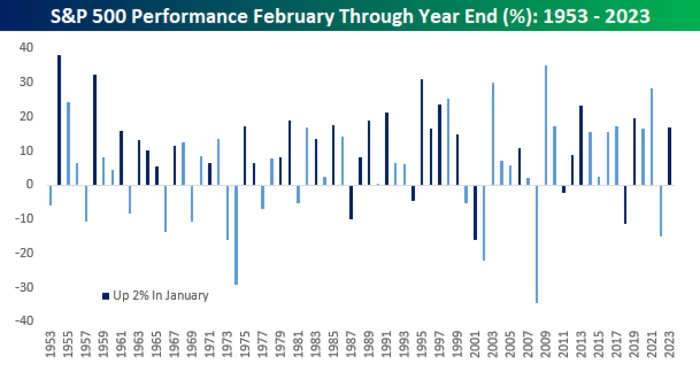

In instances where the index concludes January with a positive performance, the likelihood of continued advancement throughout the year significantly improves. Bespoke’s analysis, spanning from 1953 to 2023, revealed that when the S&P 500 was up 2% or more in January, the median performance for the rest of the year averaged a gain of 13.5%.

Moreover, the index recorded positive returns for the remainder of the year 84% of the time in such scenarios.

Conversely, when the S&P 500 finishes January with gains of less than 2% or in negative territory, its median performance for the rest of the year drops to 6.4%, with positive returns occurring in only 68% of cases. Currently, the S&P 500 has seen a 2.5% increase since the start of January, as per FactSet data.

Although the index is poised to finish lower on Friday, down 0.1% at 4,887 in the final 90 minutes of trading for the week, historical trends indicate a positive outlook for the rest of the year based on the January performance.