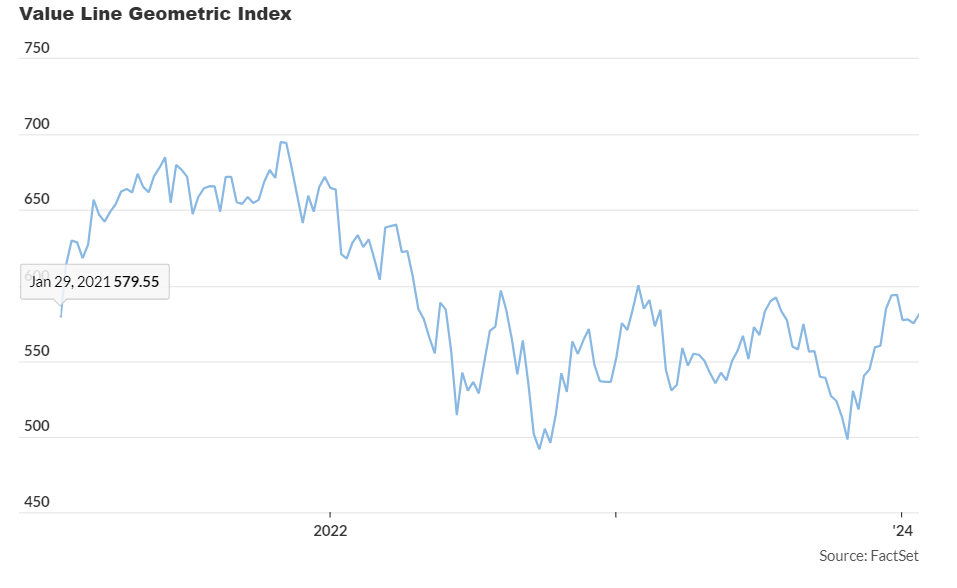

Thursday could mark the fifth consecutive record close for the S&P 500, showcasing its ongoing strength. However, alternative indicators of the U.S. stock market reveal a less optimistic picture. The Value Line Geometric Index VALUG, an equal-weighted measure tracking the median performance of approximately 1,700 major listed companies in North America, lags significantly behind its November 2021 record highs—around 17% below, according to FactSet data.

The disparity between the Value Line Geometric Index and the S&P 500, represented by the tickers VALUG and SPX, respectively, offers valuable insights. It highlights the impact of a few mega-cap technology stocks driving much of the S&P 500’s gains over the past year.

Steve Sosnick, Chief Market Strategist at Interactive Brokers, notes that the gap underscores the heightened concentration in large-cap stocks.

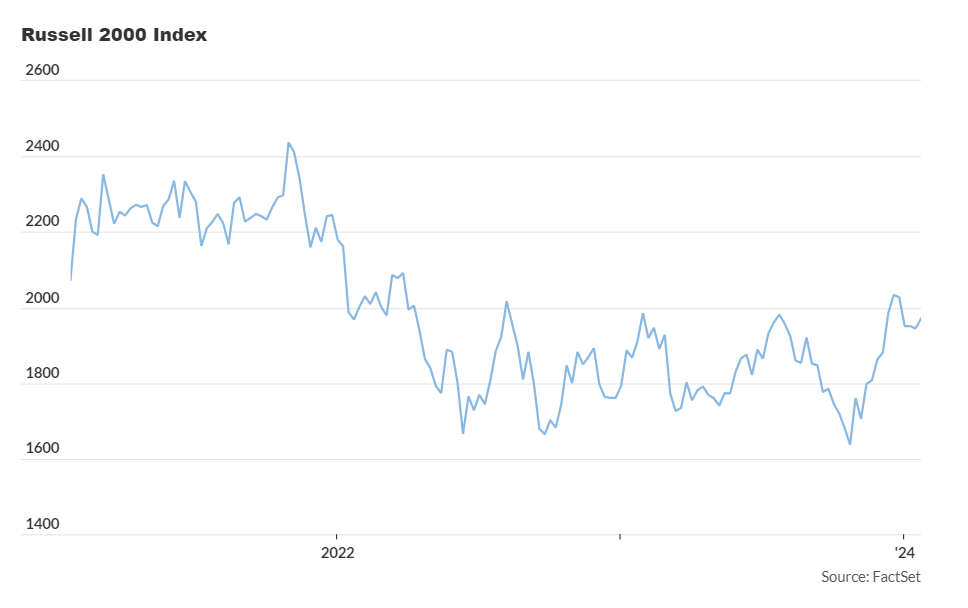

Examining the Russell 2000 index of small-cap stocks versus the broad Wilshire 5000, which includes approximately 3,500 actively traded U.S. stocks, provides further insights.

While the Wilshire 5000 is near its recent record high from January 3, 2022, the Russell 2000 lags by about 20% from its November 2021 record closing high. Sosnick emphasizes that this discrepancy underscores the prevailing dynamic of small caps versus large caps in the market.

Analyzing the S&P 500 growth index versus the S&P 500 value index reveals a recent catch-up by high-quality value stocks to the dominant tech sector. Over the past three months, the S&P 500 value index has risen approximately 14%, slightly trailing the 17% increase in the S&P 500 growth-factor index.

However, the performance gap widens over the past 52 weeks, with a 29% gain for the S&P 500 growth index compared to a 13% gain for large-cap value stocks.

As of Thursday afternoon, the S&P 500 was up 0.2%, set to close around 4,877 according to FactSet data.