Barry Bannister Challenges Optimistic Stock Market Predictions

Barry Bannister, Stifel’s chief equity strategist, holds a different perspective from the bullish forecasts of the stock market. According to him, the soaring S&P 500 index is unlikely to reach a record peak by the end of this year.

In a recent note, Bannister stated, “A new high by year-end 2023 is exceptionally unlikely.” While some equity strategists, whom he refers to as “uber-bulls,” anticipate the index hitting a record price of around 4,800 by year-end, Bannister believes that this level is “still out of reach.”

Despite a resilient economy and the Federal Reserve’s gradual interest rate hikes to combat inflation, Bannister points out that the S&P 500 would require “very favorable” earnings per share and financial conditions, which he deems improbable, to return to its previous all-time high.

Year-to-date, the S&P 500 has already surged by 17.1%, coming within 6.2% of its record close in early January 2022, according to Dow Jones Market Data.

On a recent trading day, major U.S. stock benchmarks closed lower as investors returned from the Labor Day weekend. The S&P 500 declined by 0.4%, ending at 4,496.83, while the Dow Jones Industrial Average dropped 0.6%, and the Nasdaq Composite shed 0.1%, as reported by FactSet.

Bannister’s year-end prediction for the S&P 500 stands at 4,400, which contrasts with a median year-end target of 4,350 based on a Bloomberg survey of U.S. sell-side equity strategists.

For the index to reach 4,800, Bannister suggests it would require a financial conditions index “near generational lows,” a scenario he doubts the Federal Reserve would want.

Since early 2022, the Fed has been tightening monetary policy to curb persistently high inflation, making achieving such low financial conditions unlikely.

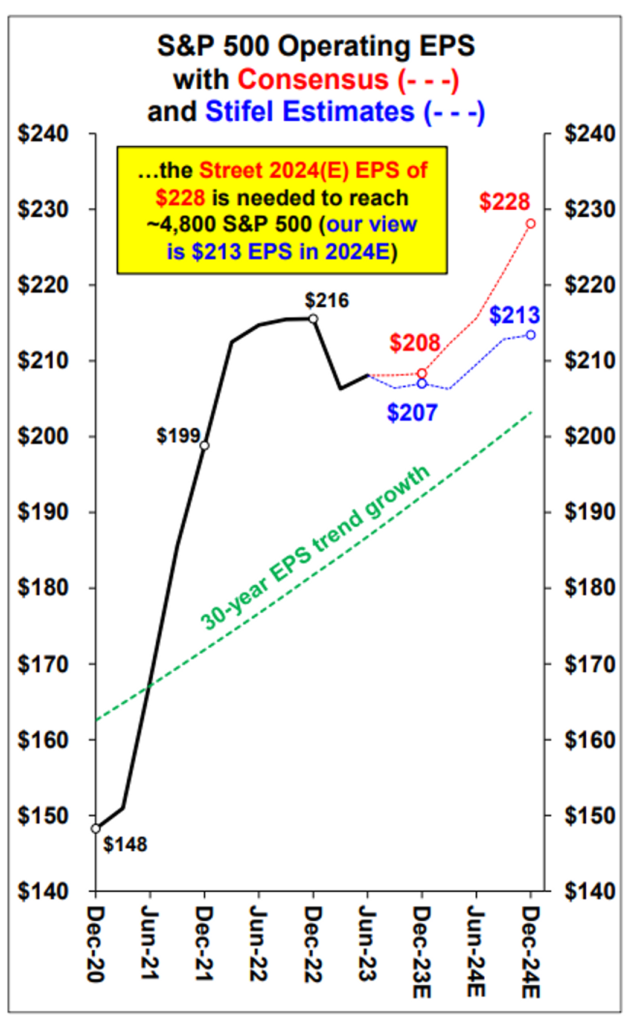

Another challenge identified by Bannister is the earnings per share (EPS) expectations on Wall Street. He believes they are overly optimistic, and the slowdown in cyclical economic data in 2023, following the Fed’s rate hikes, may restrain EPS growth for technology companies in 2024.

In conclusion, Bannister suggests that the stock market’s performance in late 2023 may not live up to the optimistic expectations, despite the recent influence of artificial intelligence and hopes for a soft landing of the economy. Additionally, he notes that the S&P 500’s equity risk premium, currently at 3%, signals a return to normality in a market that is fully priced.

In his words, “The first half S&P 500 relief rally is over,” and he anticipates that the “second half will just be flat.”