Discussing an unpredictable market—high-volatility and high-quality stocks have seen an upward trajectory this year. This isn’t ordinarily the case, but there’s a rationale behind it.

Typically, when investors opt for high-volatility stocks, pushing their value higher, they often divest from quality stocks. The intention here is to capitalize on increased profits as the economy recovers—a situation that predominantly benefits high-volatility stocks.

On the flip side, to safeguard their portfolios amid economic downturns, investors usually invest in higher-quality stocks, occasionally by divesting from economically vulnerable, volatile stocks. These quality shares often blend consistent earnings and robust cash reserves.

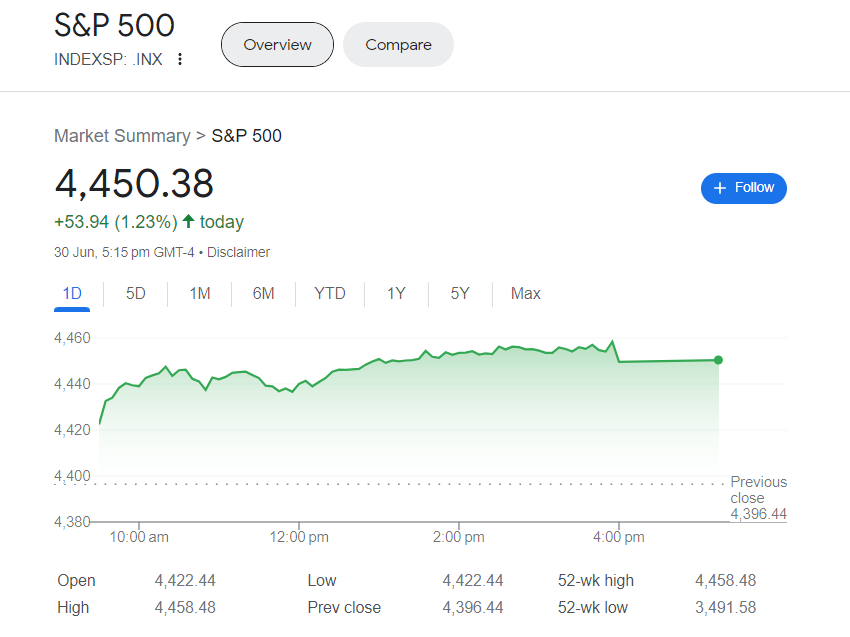

Contrarily, this year’s market movement hasn’t exactly followed this pattern. Consider the Invesco S&P 500 High Beta ETF (ticker: SPHB)—a fund selecting the 100 most volatile S&P 500 stocks—which has seen about a 20% rise this year. Astonishingly, the Invesco S&P 500 Quality ETF (SPHQ)—choosing firms based on various attributes, like high return on equity—is up by nearly 13%. Overlooking this unusual simultaneous growth of both funds is hard.

Understanding this anomaly starts with the high-volatility element. Shares sensitive to economic shifts are rising, instilled by the market’s belief in an imminent improvement in goods and services demand. The idea is that the Federal Reserve is approaching the end of its regime of interest-rate hikes, designed to curtail inflation by reducing demand.

Among these sensitive stocks, Generac (GNRC), Royal Caribbean Group (RCL), Norwegian Cruise Line (NCLH), and Caesars Entertainment (CZR) have all shown significant increases this year. Other stocks, including Big Tech contributions, contribute to these gains. The fund’s largest holding, Nvidia (NVDA), has almost tripled, suggesting investor willingness to pay a premium for future profits.

The surprising equal performance of quality stocks against high volatility can be simplified to Big Tech’s presence in the quality pool. Remaining a high-growth sector, Big Tech benefits from steady rates.

Seaport Global Securities’ Macro Strategist, Victor Cossel, says, “When you unwind recession, and you unwind inflation, that’s why you can have beta and quality working simultaneously.”

Big Tech names like Apple (AAPL), Microsoft (MSFT,) and Alphabet (GOOGL) have registered significant gains this year, with the combined contribution of these stocks encompassing almost 30% of the quality fund. If the fund were equal-weighted, the year’s gains would be under 9%, less than half of the high-volatility stocks’ gains, as per Dow Jones Market Data.

Tech stocks are high-quality because, despite their inherent volatility, they possess redeeming qualities. For example, Apple’s abundant cash reserves and Microsoft’s astounding return on equity in 2022 surpassed the S&P 500’s average substantially.

In sum, instances occur where high volatility and high-quality stocks simultaneously thrive, undermining traditional market theory.