Beating the market is a challenging task, with only a small group of individuals able to achieve it.

It is noteworthy that it is comparatively simpler to outperform the stock market during a downturn. In the year 2021, the stock market saw a growth of 29%, yet 85% of money managers performed worse than the benchmark. Conversely, in 2022, the S&P 500 experienced an 18% decline, and only 51% of money managers performed worse than the benchmark. However, even this success rate is not very promising as more than half of the managers still failed to perform better than the market.

If you’re still impressed, consider that the market is more likely to gain annually than it is to lose. This translates to the fact that, on the whole, the market is likely to perform better than any funds that are being actively managed.

If you can’t beat them, join them

Warren Buffett, who is one of the few successful investors, suggests that the majority of people should invest in an S&P 500 index fund. This type of fund has proven to be an effective means of generating wealth over time and is less nerve-racking than attempting to identify lucrative investments. Buffett even recommended that his wife invest all of her money in an S&P 500 index fund once he passes away.

Calculating your present-day money if you had invested $10,000 twenty years back is a straightforward task.

If you add up all the dividends, the total would be over $65,000, resulting in a profit of 555%. This calculation is not affected by fluctuations in the stock market or the need to transfer funds between different stocks.

Naturally, you can opt to make this type of investment alongside having an assortment of individual stocks in your portfolio, much like how Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) is managed by Buffett. Crafting a collection of around 25 carefully chosen stocks, diversified adequately and perhaps with an index fund investment, presents advantageous opportunities for building a robust stock portfolio that outperforms the market.

If your sole investment strategy were to put your money in an index fund, you would still be in good shape.

Don’t discount monthly contributions

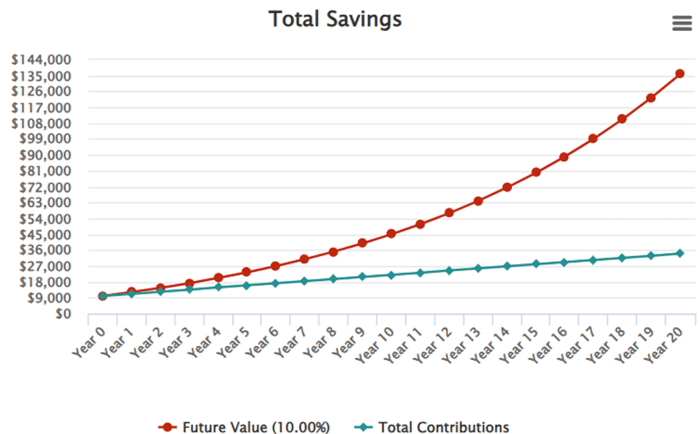

It gets even more advantageous now. If you had deposited every month during the same period, your gains would have been much higher. In the last two decades, the index has provided a yearly regular return of approximately 10%. If you started with a $10,000 investment and regularly added $100 monthly, you would now have $136,000 in your account.

If you calculated it, you would notice that $24,000 was put in over a period of 20 years. However, as the money was not invested for the entire duration, the benefits of compound interest have not been fully realized just yet.

There are good reasons to consider investing in the stock market. One reason is that it allows you to potentially earn higher returns on your money than other investment options like savings accounts or bonds. Additionally, investing in stocks can help you to diversify your portfolio and spread out your risk. Moreover, investing in the stock market gives you the opportunity to own a piece of well-known companies that have the potential to grow and increase in value over time. Overall, if you are looking to build wealth and secure your financial future, investing in the stock market could be a smart move.

Warren Buffett frequently expresses his faith in the United States to shareholders. Investing in the stock market is a way to display belief in the potential of American businesses.

The market is often impacted by unforeseen circumstances that can either benefit or harm it in the short run. These occurrences are difficult to anticipate, like the COVID-19 outbreak, which is a classic example of an unpredictable black swan event. Despite this unpredictability, investing in the market allows you to tap into America’s long-term growth potential, ultimately benefiting your financial situation.

Experiencing the current phase of substantial inflation could reinforce this idea. Although hyperinflation periods have occurred in the past and they are infrequent, it is possible that they may not occur during your lifetime. However, investing in an S&P 500 index fund can ensure stability despite environmental difficulties and can still yield remarkable long-term profits.