As the year nears its end, financial experts can enumerate various reasons for the upward trajectory of the U.S. stock market. However, a faction of Wall Street strategists contends that attributing the market gains solely to the possibility of a “soft landing” for the U.S. economy or potential Federal Reserve interest rate cuts oversimplifies the situation.

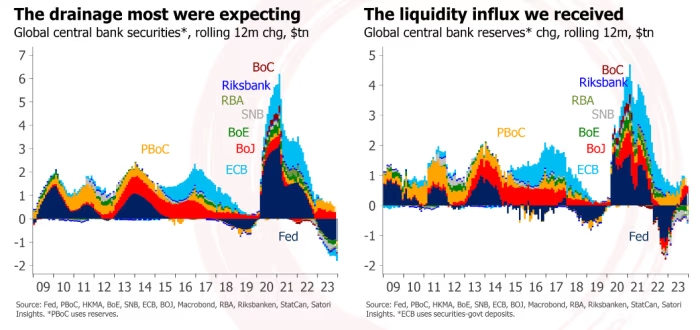

Instead, a closer examination of the balance sheets of major central banks, with a focus on the Federal Reserve, reveals a more nuanced explanation. Despite the Fed reducing the size of its balance sheet, central banks globally have increased market support by permitting the expansion of bank reserves. This surge in reserves enhances the available capital for deployment in both markets and the broader economy, historically leading to a rise in securities prices, even when economic strength or corporate earnings outlooks don’t fully justify such advances.

According to research by former Citigroup strategist Matt King, who now heads Satori Insights, changes in reserves correlate most strongly with market movements. King emphasizes that the correlation extends to equity changes and credit spread adjustments, with a noticeable lag that rules out a reverse causality.

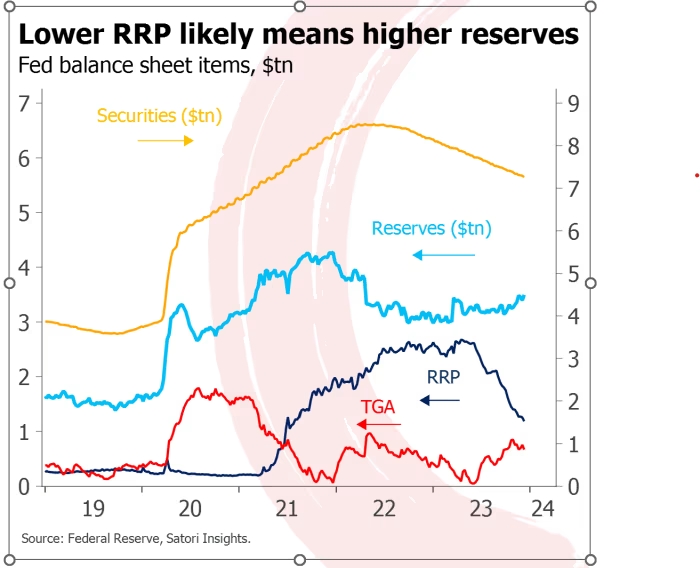

The apparent contradiction of injecting more liquidity while reducing the balance sheet size arises from a crucial distinction. Rather than focusing solely on the reduction of the Fed’s bondholdings to $7.8 trillion from its peak of $9 trillion last year, King underscores the importance of the $500 billion increase in reserves within the U.S. banking system since January.

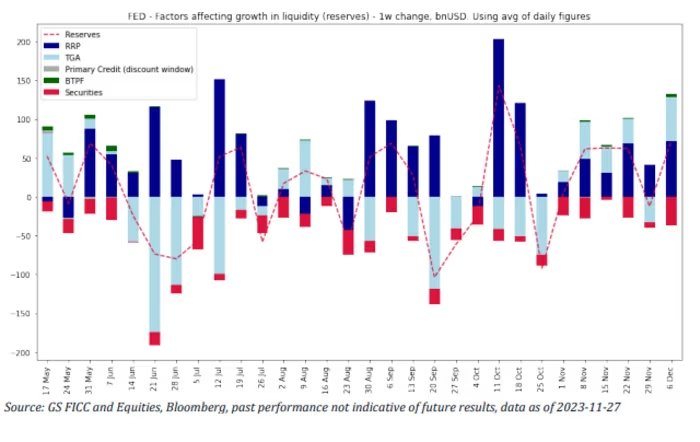

This liquidity boost isn’t exclusive to the Fed; major central banks, instead of withdrawing $1 trillion in liquidity as anticipated in the fight against inflation, injected a roughly equivalent amount, according to King’s findings. Factors contributing to rising bank reserves include the ongoing drainage of the Fed’s reverse-repo facility, which saw counterparties removing over $1 trillion since April.

The liquidity support for markets initiated late last year, initially driven by the Bank of Japan, People’s Bank of China, and European Central Bank. The Fed intensified its involvement in the spring to support the U.S. banking system after the collapse of Silicon Valley Bank, and the recent drain from the Fed’s reverse-repo facility has become a primary driver.

Prominent financial institutions, including Morgan Stanley and Goldman Sachs Group, have taken notice of this liquidity trend, with analysts discussing its impact on markets. Goldman Sachs’ cross-asset analysts note the expanding U.S. liquidity trend in December and anticipate continued support for risk assets and tight credit spreads into year-end.

King suggests that if the liquidity impulse weakens, stocks may face challenges. Regardless of future developments, King underscores the “QE-like” nature of the market rebound in 2023, drawing parallels to the Federal Reserve’s post-crisis and post-pandemic bond-buying programs. U.S. stock indexes have now fully recovered from the previous year’s losses, with the Dow Jones Industrial Average reaching a fresh record above 37,000.

The S&P 500 and Nasdaq Composite have also posted substantial gains. King emphasizes the potency of quantitative easing (QE), noting its ability to create new money in the form of reserves, withdraw bonds and bills from the market, and influence the balance between private investors’ funds and available securities—an interplay that impacts market prices.