The Dow Jones Industrial Average has recently marked its ninth straight day of increases, achieving its most extensive sequence of consecutive wins since 2017.

Interestingly, the most recent progress happened in a session which also witnessed the Nasdaq Composite COMP, -2.05% register a 2% decline, marking its largest fall in four months.

Does the expansion of market activity indicate a prolonged upswing in the bull market? Or does the downfall of tech stocks suggest a significant decline for the S&P 500, which currently records an 18.1% increase this year? Notably, even the constantly optimistic Tom Lee, the Head of Research at Fundstrat, recommends taking some profits, terming it as “healthy”. The recent instability, characterized by the poor performance of prominent tech stocks and the increase in defensive securities like healthcare, utilities and staples, coupled with negative feedback from technical gauges, is causing a rise in the calls for a substantial market pullback, asserts Lee in a recent note. He, hence, prompts one to watch out for a potential 5% correction which may lead to a 200-225 points drop for the S&P 500, a scenario he suggests would be stressful for investors.

However, considering this is Tom Lee, one should note the caveat attached – any decline is expected to be minor. The following is the reason behind this.

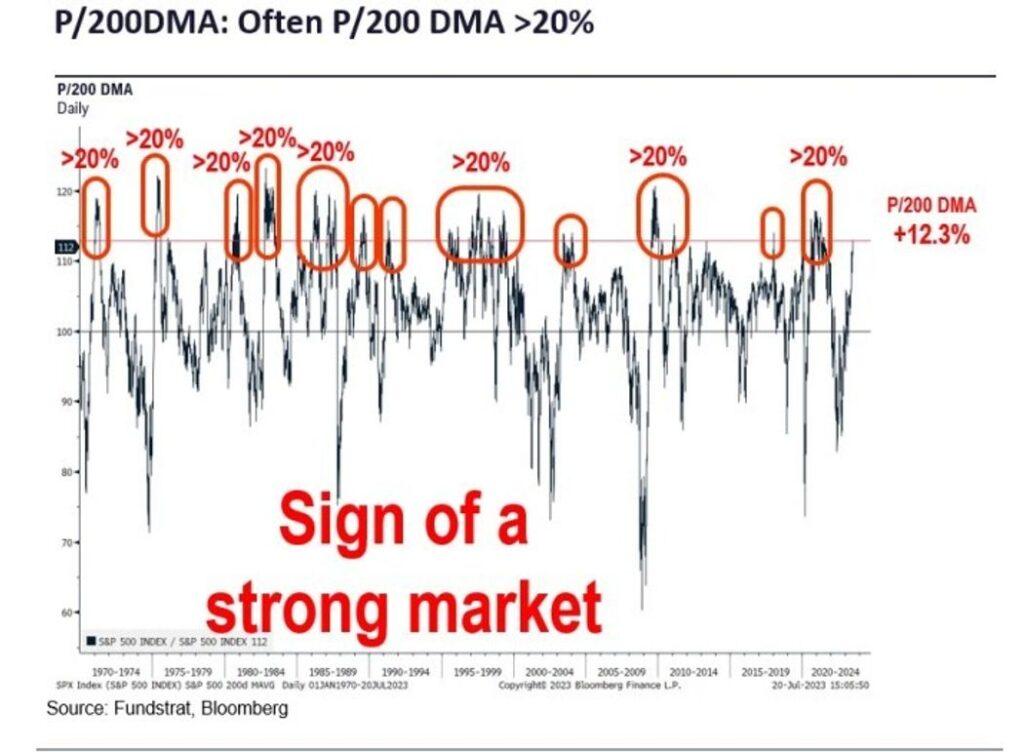

Firstly, fears of the market stretching beyond its limits are exaggerated. Some market players are anxious about the S&P 500 index exceeding its 200-day moving average by over 12%, indicating over-purchase. Yet as illustrated in the following chart, in 8 out of the preceding 12 occasions that the market rose this much above the trend line, it still managed to climb an additional 20% or more. This is merely an indication of a robust market, according to Lee.

Next, institutional investors are already showing signs of doubt. The most recent fund manager survey from Bank of America reveals that these groups have assigned the lowest weight to equities in their asset class.

A recent survey by JPMorgan reveals that merely 17% of institutions are planning to boost their stocks portfolio in the near future, a significant dip from 85% in January 2022. This pessimistic outlook can be utilized as a useful contrarian signal.

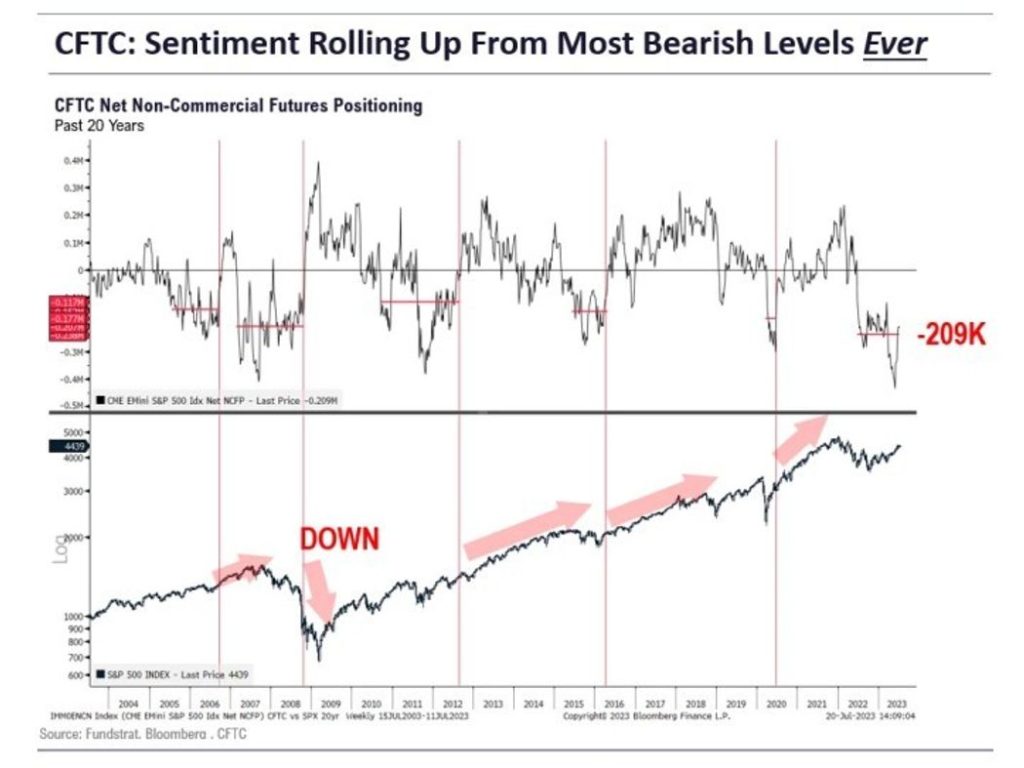

Moreover, the historically pessimistic placement in S&P 500 futures has begun to reverse, a pattern that indicated “significant upward shifts” in equities in four out of the last five instances, according to Lee.

Lee believes that some significant occurrences in the upcoming weeks might result in reduced interest rates, which in turn could bolster the stock market. For instance, the Federal Reserve’s policy verdict on 26th July might indicate the final increase in rates for this cycle. A couple of days later, the data from the June PCE deflator should reflect the harmless June CPI report. Furthermore, the CPI report for July, released on 10th August, could show similar deflationary tendencies.

“So, we believe that the upcoming 2-3 weeks have potential positive driving factors that could result in an unexpected favorable response from the markets. Consequently, the window for the market correction is somewhat restricted. This implies that the current market downturn could possibly turn around by July 26th,” concludes Lee.