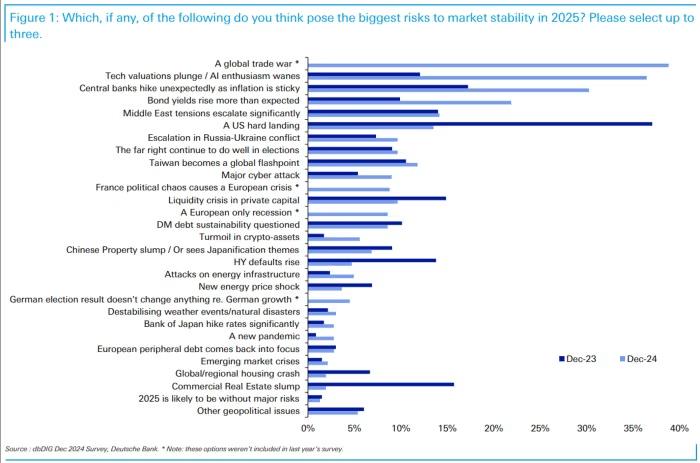

Top Market Risks for 2025

Deutsche Bank Research Highlights Shifting Market Risks for 2025 Investors’ views on the most significant threats to market stability have evolved as 2025 approaches, with concerns over a potential global trade war now topping the list, according to Deutsche Bank Research. This marks a departure from last year when fears of a U.S. economic “hard […]

Stocks Soar 27%: Will the Fed Spark a Correction?

Wall Street sentiment has turned cautious as the stock market rally pauses ahead of the Federal Reserve’s final meeting of 2024. Investors hoping for a December surge led by tech stocks have been met with disappointment, raising concerns about the market’s resilience. The S&P 500 Value Index (SPYV) extended its record losing streak, while the […]

U.S. Stock Break 20-Year Trend: What It Means

S&P 500 Faces Nine Consecutive Days of Weak Market Breadth, Unseen in Over 20 Years The U.S. stock market is grappling with another wave of “bad breadth,” a phenomenon where more stocks decline than rise, even as major indexes show gains. This trend has persisted for nine straight sessions, a rarity not seen since the […]

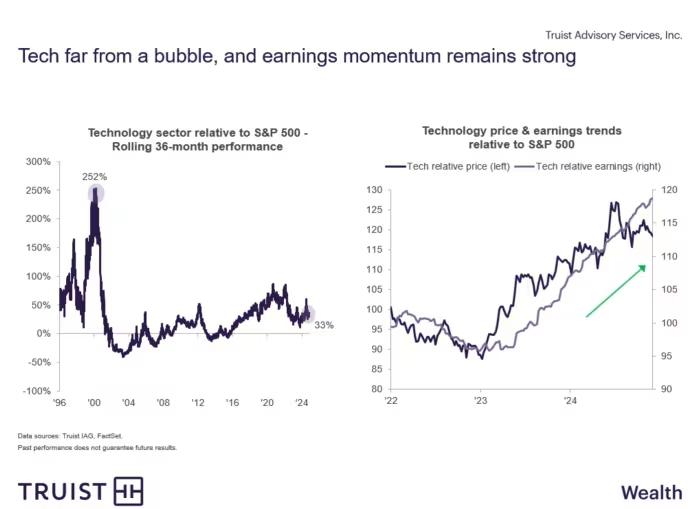

Nasdaq 20,000: Milestone or Warning?

Tech stocks fueled a historic rally on Wednesday, pushing the Nasdaq Composite index above the 20,000 threshold for the first time. The surge was driven by megacap technology names, with Alphabet Inc. (GOOGL, GOOG) and Meta Platforms Inc. (META) hitting record closes. The Nasdaq jumped 1.77%, reflecting the tech sector’s strength this year. Investors Face […]

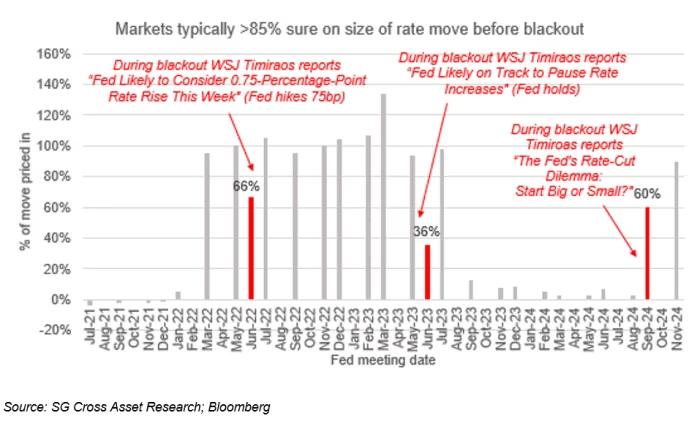

Inflation Surge: A Game-Changer for the Fed?

November CPI Surprise Could Derail December Rate Cut Expectations, Say Fed Watchers Fed-funds futures traders currently assign an 85% probability to the Federal Reserve delivering a 25-basis-point rate cut at its upcoming December policy meeting. This level of certainty aligns with historical patterns during the Fed’s “blackout” period, when officials abstain from discussing monetary policy […]

Bond Vigilantism: Key Investor Tips

Pimco Backs U.S. Equities While Favoring European Debt: Here’s Why Pimco, one of the world’s largest bond managers, is shifting its strategy by cutting exposure to longer-duration U.S. Treasurys in light of an increasingly challenging deficit environment. The global asset manager, with approximately $2 trillion in assets under management, outlined its rationale in a recent […]