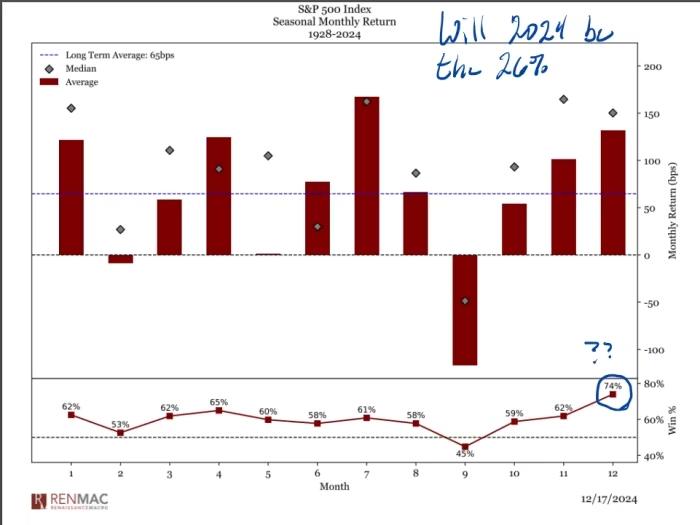

Stocks Eye Gains as Santa Rally Begins

S&P 500 Rebounds, Erasing December Losses in Pre-Holiday Rally The S&P 500 wiped out its December losses on Tuesday in a pre-holiday rally, buoyed by the seasonal optimism of the “Santa Claus rally” period. The index climbed 1.1% in a holiday-shortened session, marking its third consecutive day of gains and reversing losses from last week’s […]

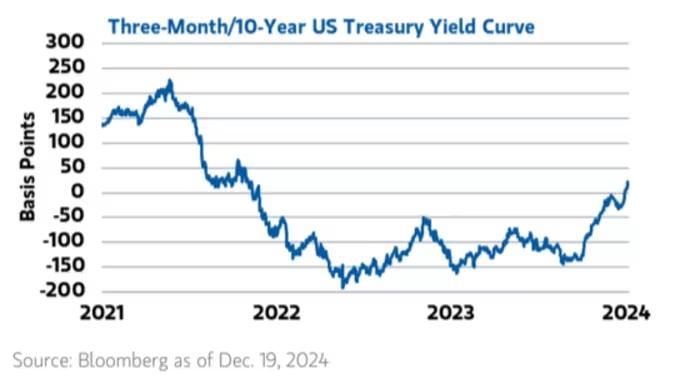

Dollar and Bond Volatility Block Stock Gains

Treasury Yields and Dollar Levels Pose Challenges for Stocks, Analyst Says Stocks kicked off a holiday-shortened week on a positive note Monday, but the ongoing rise in Treasury yields and the U.S. dollar could hinder the stock market‘s upward momentum, according to a well-known market analyst. The bond market and the dollar continued their upward […]

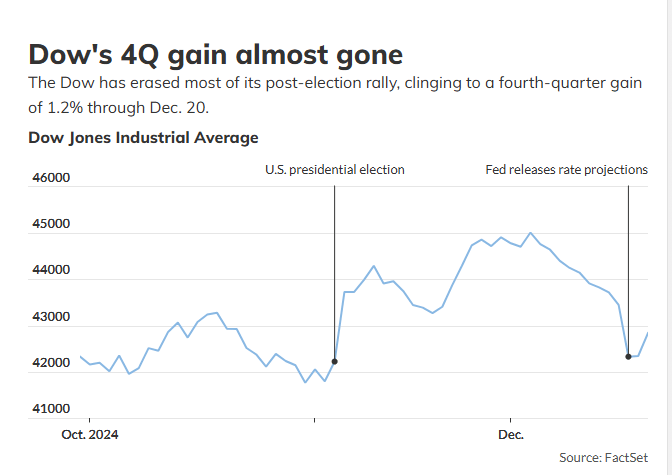

Dow Down in December: Is a Rally Coming?

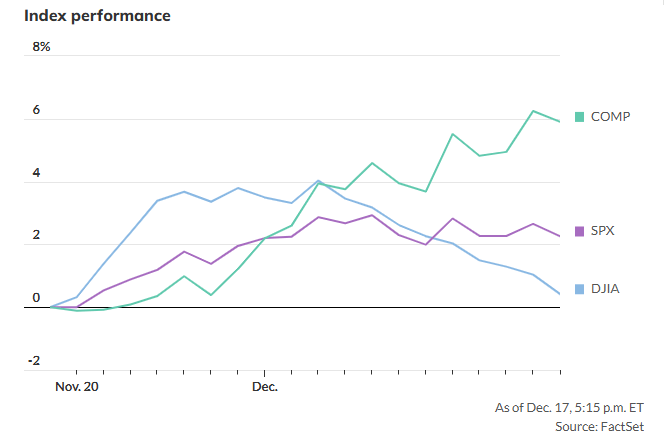

U.S. Stocks End Week in the Red Despite Friday Rally U.S. stocks wrapped up the week with losses, even as a Friday rally provided a temporary boost. The markets have struggled heading into the holiday season, facing headwinds from economic data and policy uncertainties. December Struggles Dampened Rally Momentum An early December shift triggered what […]

Double System Trading: $200 in 5 Minutes

Hello, traders! Today is Thursday, December 19th, and I’m excited to share my trading experience using two powerful systems—the Trade Scalper and the Sonic System. Combining these methods has proven to be an excellent approach for maximizing trading opportunities while maintaining simplicity and effectiveness. Why Combine Methods? Many traders find value in combining systems like […]

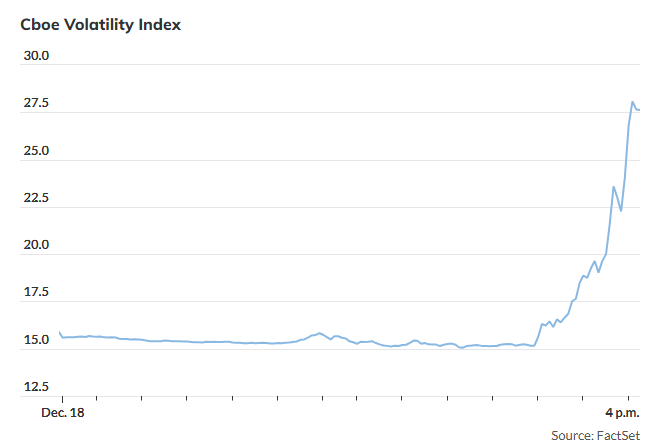

Market Turmoil: Fed Meeting Sparks Volatility

Market Turmoil as Fed Signals Slower Rate Cuts and Sticky Inflation The stock market’s fear gauge, the Cboe Volatility Index (VIX), surged by 74% on Wednesday, reaching 27.6, as stocks and bonds sold off following the Federal Reserve’s latest policy meeting. The meeting concluded with economic projections that suggested a slower pace of interest rate […]

Why the Dow’s Losing Streak Matters

Factors Behind the Dow’s Weakness The Dow Jones Industrial Average experienced its longest losing streak since 1978, falling for nine consecutive trading days. This slump has come as a surprise to many investors, given the strength of the postelection rally that preceded it. Just weeks ago, markets seemed unstoppable, with stocks reaching record highs. However, […]