Should You Leave Stocks? Here’s Why to Hold On

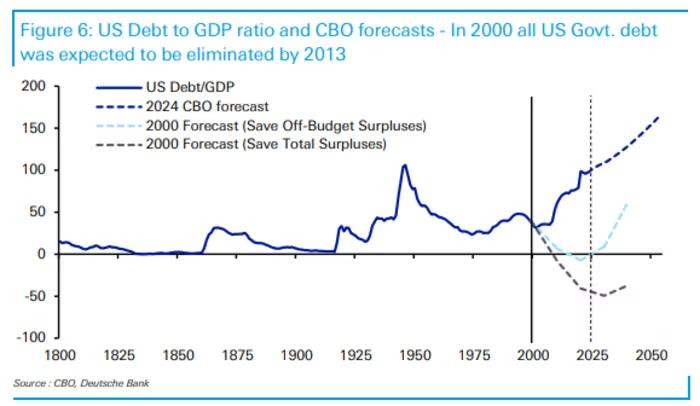

Despite recent strong stock performance, Deutsche Bank strategists reminded investors that the past 25 years haven’t been particularly stellar for stocks. Their report outlines how, since 2000, global markets and economies have been shaped by rising debt levels, slower demographic growth, and stalled globalization. In 2000, for instance, the U.S. Congressional Budget Office anticipated paying […]

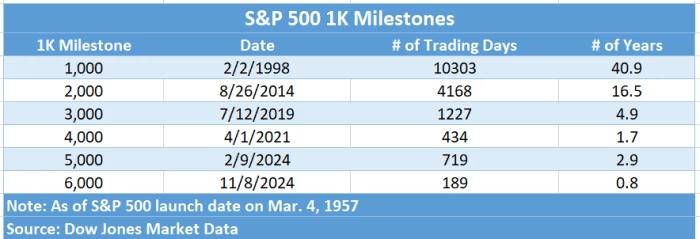

S&P 500 Eyes Mid-6,000s: What’s Fueling the Rally?

Tony Roth, Chief Investment Officer at Wilmington Trust, suggests the S&P 500 could reach the mid-6,000s in the next two months, driven by a recent surge in market confidence. On Monday, the S&P 500 closed above 6,000, and the Dow Jones Industrial Average surpassed 44,000, bolstered by post-election optimism after Donald Trump’s presidential win and […]

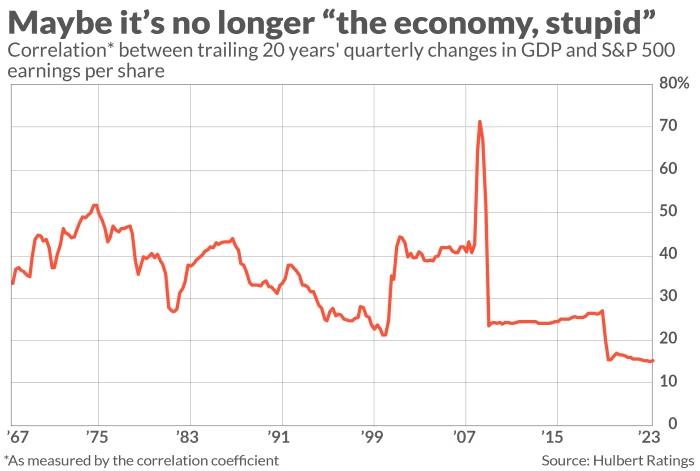

Why Wall Street No Longer Predicts Elections

This year’s surge in the Dow Jones seemed to favor Democrats and Kamala Harris in the presidential election, yet it highlighted the growing disconnection between Wall Street and Main Street. While the stock market has often been viewed as a predictor of election outcomes, it missed the mark this time, prompting a need to investigate […]

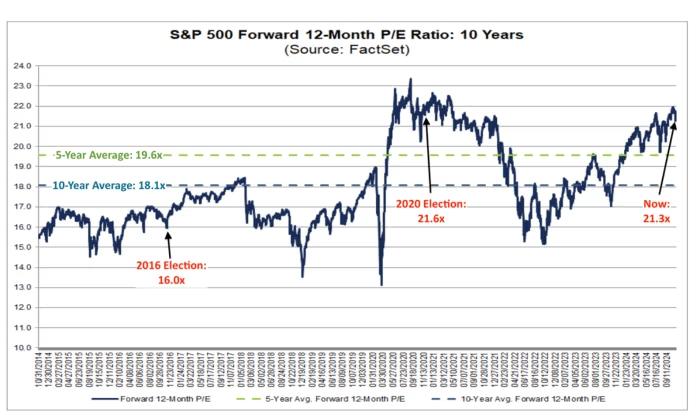

S&P 500 ‘Mania’: Are We in Bubble Territory?

Stifel’s Barry Bannister: “The Train is Approaching Crazy Town” Barry Bannister, one of Wall Street’s few remaining bears, cautioned on Thursday that the S&P 500 is nearing “mania” territory, with stocks increasingly overpriced. This setup, according to Bannister, could lead to a rapid ascent in the short term, but also poses a risk of a […]

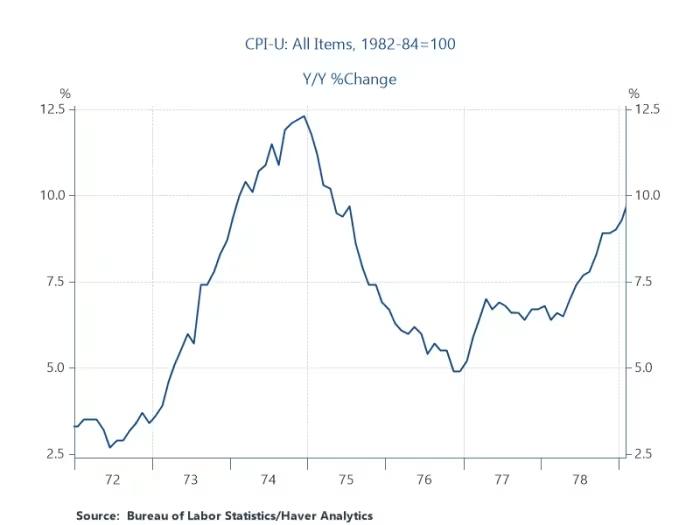

Is the Fed Declaring Victory on Inflation Too Soon?

Legendary investor Stanley Druckenmiller has suggested that if the U.S. faces a serious budget deficit issue, it could arise by late 2025 or early 2026. Following a record post-election stock market rally, all eyes are on the Fed latest interest-rate decision. Druckenmiller, known for his past role alongside George Soros and now managing the Duquesne […]

Big Tech Stocks Impact on S&P 500 Valuations in 2024

According to DataTrek Research co-founder Nicholas Colas, significant shifts within the S&P 500 over the past four to eight years have contributed to its current high valuation compared to 2016. Big Tech stocks, including Nvidia, Meta, and Tesla, surged on Election Day 2024, with the S&P 500 closing 1.2% higher as Americans voted for the […]