Why Automated Trading Systems Fail

Welcome, traders! Today, on this Tuesday, May 7th, let’s delve into the realm of autopilot trading systems. If you’ve ever been curious about how automated trading works or if you’re considering integrating it into your trading strategy, you’re in the right place. Strap in as we navigate through the intricacies of autopilot trading systems and […]

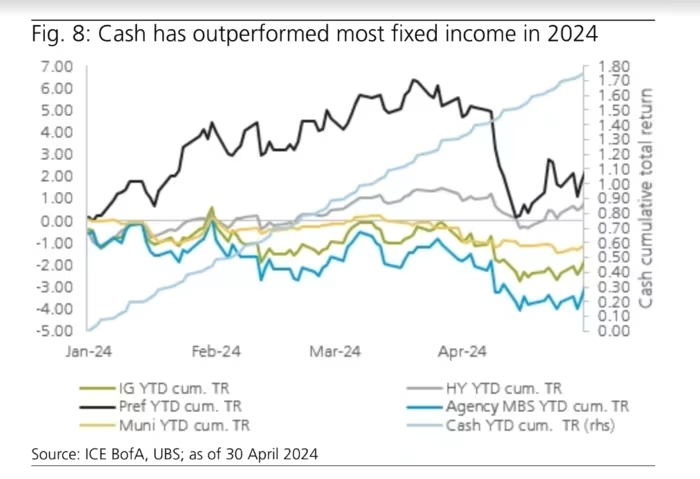

2024: Cash Leads, but Will a Fed Pivot Change?

UBS suggests that in the coming months, the prime catalyst for fixed income performance will be securing steady returns through carry and income compounding. In 2024, cash has emerged as a frontrunner, outshining many segments of the bond market, a trend delighting enthusiasts of a more relaxed investment strategy colloquially referred to as “T-bill and […]

Stock Market Bulls on Alert: Consumer Stress Signals Ahead

Investor caution toward spending is evident as consumer stocks take a hit amidst growing uncertainty over potential interest rate adjustments by the Federal Reserve, currently at a 23-year high. Concerns over consumer strain are surfacing, posing potential risks to the stock market. At the outset of 2024, investors anticipated approximately six quarter-point rate cuts starting […]

Estimating Berkshire’s Apple Dividend Gains

Apple’s announcement of a 4% increase in its cash dividend spells good news for Warren Buffett’s Berkshire Hathaway Inc. Buffett, renowned for his affinity towards dividend-paying stocks, is likely pleased with Apple’s decision to raise its cash dividend to 25 cents a share. Berkshire Hathaway holds over 905 million shares of Apple, approximately 6% of […]

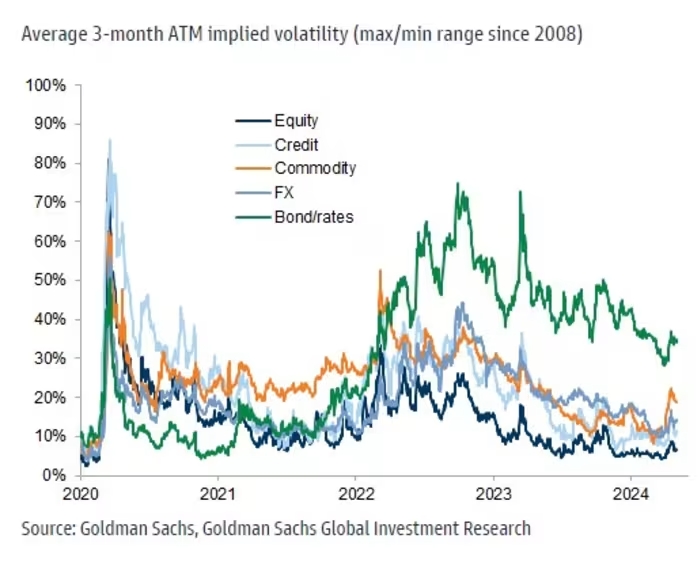

Goldman Sachs’ Guide to Choppy Markets

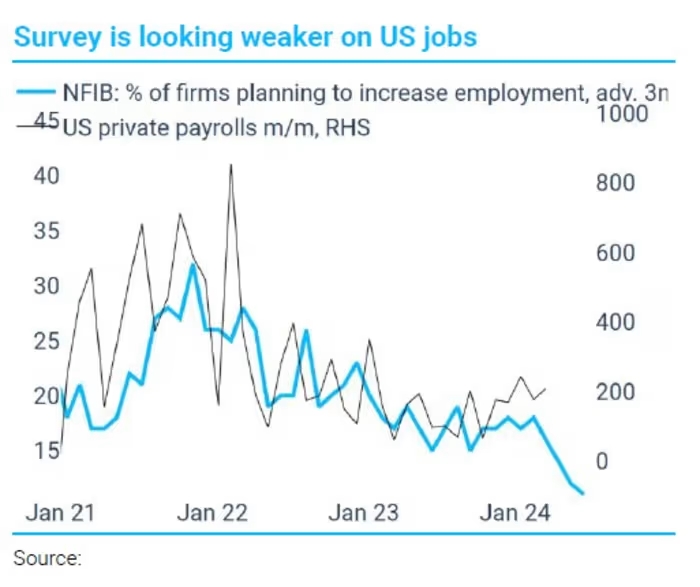

Friday’s early stock-index futures appear optimistic, though the tide could turn pending the nonfarm payrolls report indicating robust labor market conditions leading to increased wage inflation. Fueling this morning’s positivity is a 6% surge in Apple’s shares (AAPL) following their better-than-expected earnings announcement, optimistic outlook, and proposal for an additional $110 billion in share buybacks. […]

S&P 500 Correction or Asian Currency Meltdown in the Cards

The Sell-in-May phenomenon kicked off early this year as Tuesday’s abrupt yield-driven selloff marked the end of April’s trading. Stocks stuttered ahead of a pivotal Fed decision, compounded by disappointment from AI leaders. In a note to clients, Freya Beamish, head of macro research at TS Lombard, sounded a warning bell, predicting an imminent correction […]