Stock Market Rotation from Big Tech: Key Levels to Watch

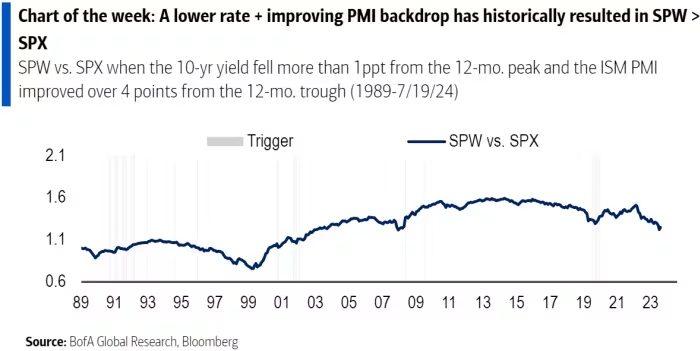

BofA strategists note that a lower Treasury yield combined with an improving manufacturing PMI has historically led to the outperformance of the equal-weighted S&P 500 index. In the past week, there has been a significant shift towards U.S. small-cap stocks, causing investors to consider if this trend marks a rotation away from this year’s Big […]

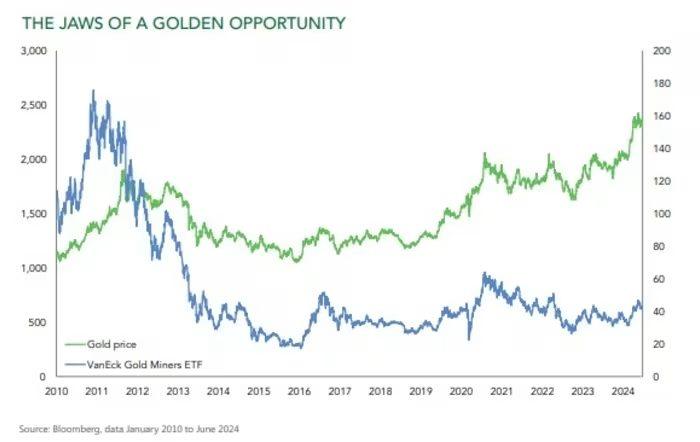

Betting on ‘Ugly Ducklings’ for Big Wins

Not long ago, investors enjoyed a sense of certainty, believing that the big-tech trade would keep leading the market and expecting former President Donald Trump to win the upcoming election. However, things have changed. The market is shifting from tech-based momentum trades to the previously unpopular small caps. Investors who bet on the “Trump-trade” now […]

Market Volatility: Why One Firm Raised Its S&P 500 Target

Good morning, especially if you have successfully managed to boot up your personal computer, because many around the globe have not. More on that later. Thursday’s emailed Need to Know newsletter contained an error: the Nasdaq Composite’s decline on Wednesday was the sharpest since mid-December 2022. While the market may feel turbulent, the S&P 500 […]

Treasury Market Volatility: What It Means for Stock Investors

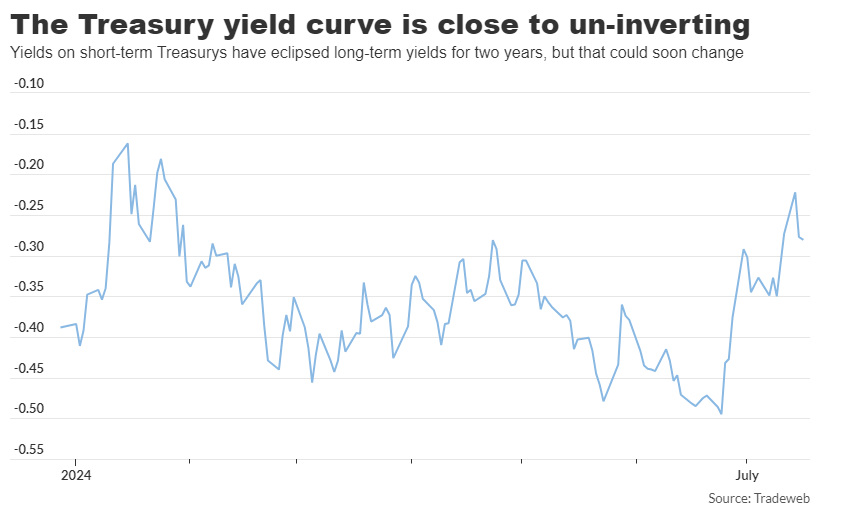

An inverted Treasury yield curve is typically seen as a harbinger of recession, although the U.S. economy has held up so far. An inverted Treasury yield curve is often viewed as a signal of an impending recession. But does the curve’s return to normalcy signal an all-clear for the market? History suggests otherwise. According to […]

Roadmap: Could this be the BEST TradingView Indicator?

If you’re a trader looking to optimize your strategies and maximize your profits, the search for the perfect indicator can be never-ending. However, the “Roadmap” indicator might just be the tool you’ve been looking for. Offered by Day Trade to Win, this indicator provides unique insights that can be pivotal in making informed trading decisions. […]

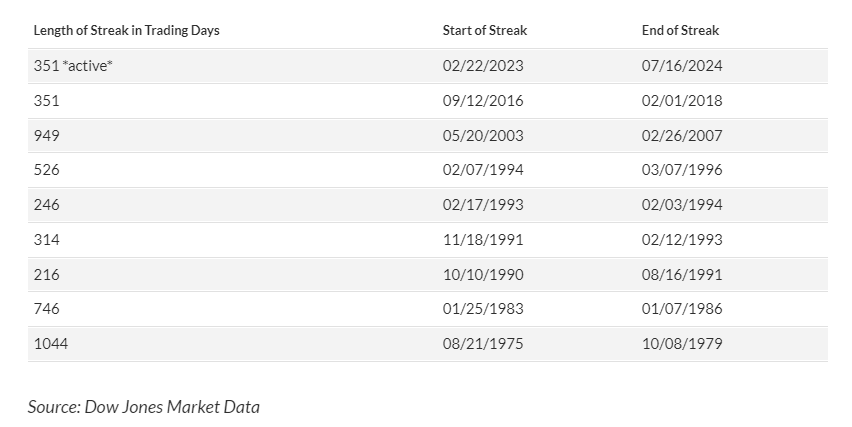

Tranquil Markets: How the Calm in U.S. Stocks Affects Your Investments

An unusually tranquil stretch for U.S. stocks is set for a milestone on Wednesday as the rally broadens beyond a few megacap names. If the S&P 500 avoids a significant selloff, it will mark 352 consecutive sessions without a 2% decline, the longest streak since February 2007. Todd Sohn, ETF and technical strategist at Strategas, […]