Price Action Trading, What is it?

Price Action Trading is a trading technique that uses price information from the past and present to determine future price movements. Traders who use Price Action are looking for patterns in price movements that can be used to identify potential trading opportunities.

Price Action Traders use price, chart patterns, and support/resistance levels to identify potential trades. They often look for trends in the price data that may indicate an entry or exit point. Price Action Trading is popular among forex traders because of its simplicity and low-risk level compared to other forms of trading.

It requires less analysis and fewer indicators, making it easier to implement than some other strategies.

Price Action Traders focus on understanding what the market tells them rather than relying on technical indicators or economic data, making it a great tool for traders looking for a simpler approach to trading.

3 Steps for Traders – Think direction + signals + RISK = Winners

Why sell the market? As traders, we can buy (long) or sell (short) the markets to achieve a profit objective, but only if we are right in the direction. Typically, markets fall faster than they rise. This is important to note when the volatility is strong, and the market is in free fall. Traders need […]

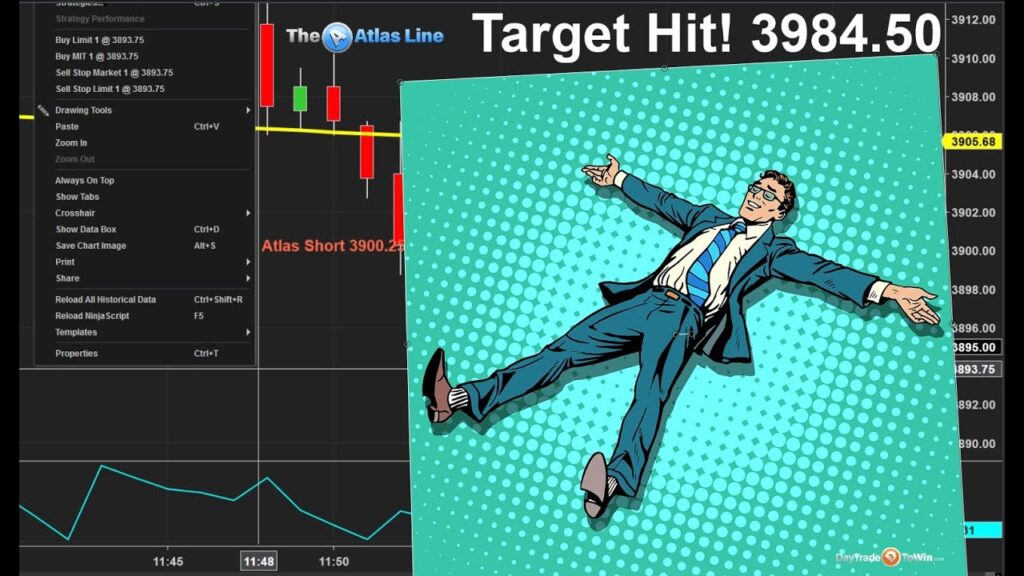

Atlas Line Charts – Crude Oil (CL), Euro (6E) & E-Mini (ES)

The Atlas Line continues to identify trade setups for big market moves and scalping opportunities in advance, unlike common day trading indicators. Look at the charts below to see the differences in Atlas Line trading between the E-Mini S&P, Crude Oil and Euro markets. Crude Oil – February 22, 2011 Euro – February 22, 2011 […]

What to do when trading the Emini SP news

This day trading video explains the ATR (Average True Range) and how to use it to your advantage when trading. The Atlas Line is used to correctly know when to buy or sell the market instead of counting on the news to tell you what to do. Where do you enter? Where do you exit? […]

Atlas Line Trading Tool

This video, revived to HD format, is one of the best we’ve done in terms of explaining how effective the Atlas Line™ is. Where do you enter? Where do you exit? Which indicator to follow? Where do you reverse? All of these questions come to mind when dealing with day trading indicators. In this video, […]

E-Mini S&P December Contract

As predicted in an earlier post, this week has shaped up to be highly profitable for Atlas Line™ users. E-Mini S&P Futures Contract Trading October 15, 2010 Three Bounce Short order signals were given in quick succession, combined with the Atlas Line™ intersecting price. Since the Atlas Line is an excellent filtering tool, this double […]