U.S. Stock-Market Soars: An Insight into Enduring Bearish Perspectives

The positive momentum in the U.S. stock market, which started in the first half of 2023, is still ongoing in the second half. This has kept optimistic investors hopeful, especially as the technology-focused Nasdaq 100 index has already increased by 42% this year. Conversely, pessimistic investors monitor the situation closely, anticipating when the current momentum […]

Exploring The Market: S&P 500 Futures Ascend While Carvana, SoFi Technologies Struggle in Premarket Trading

Two hours before the U.S. stock markets opened, Coherent Corp. (COHR) experienced a 5.0% increase in pre-market trading, while Delta Air Lines Inc. (DAL) saw a 4.5% increase. Shares of Trade Desk Inc. Cl A (TTD), American Airlines Group Inc. (AAL), and CAVA Group Inc. (CAVA) were all experiencing increases of at least 3%. At […]

Meme Stocks Return: Strategist Sounds Alarm for Potential Stock Market Impact

Many have voiced their criticism towards the stock market rally of 2023, claiming that it is mainly focused on a handful of large technology companies. However, according to Jonathan Krinsky, managing director, and chief market technician at BTIG, the recent addition of a few more stragglers is now worrying investors. He points out that a […]

Potential S&P 500 Surge: Fundstrat’s Lee Predicts a 100-Point Bump Following Inflation Data

As doubts about the 2023 market rally begin to emerge, Tom Lee from Fundstrat has returned with an optimistic prediction. The ex-analyst from JPMorgan Chase provided clients with a suggestion to take advantage of a “strategic buying opportunity”. In a research note, the analyst argued that the recent decrease in prices presents a good opportunity […]

Inflation Data Influences Stock Market Stability: Insights from Today’s Trading News

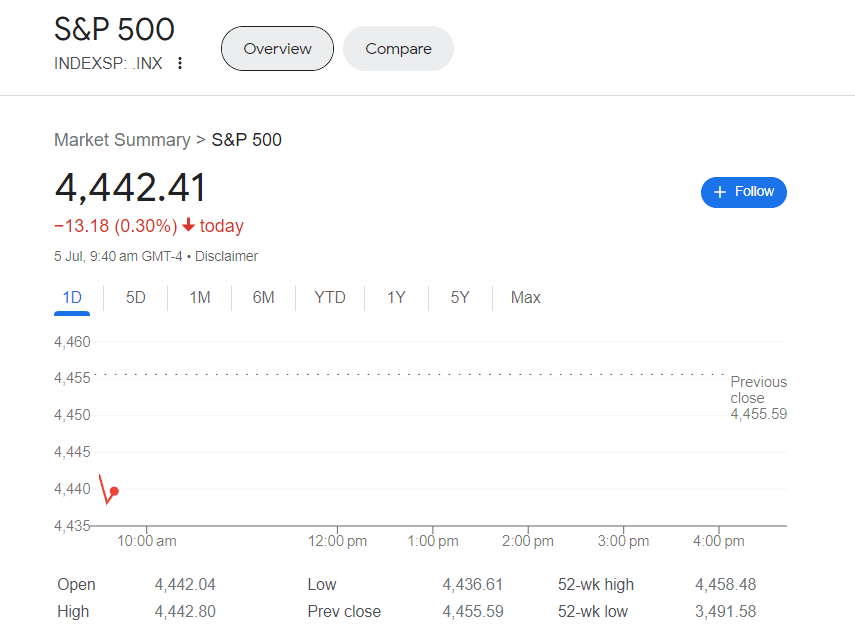

On Monday, the stock market started with a slight decrease, marking the beginning of a week that will primarily focus on inflation, interest rates, and the commencement of the second-quarter earnings season. The S&P 500, the Dow Jones Industrial Average, and the Nasdaq Composite all experienced a decline and dropped below the neutral point. S&P […]

The Great Debate: Is the Stock Market Riding High or Set to Crash?

Following a disastrous year in 2022, the US stock market experienced a significant surge in 2023. The S&P 500 has witnessed a 15.36% increase thus far, and the tech-oriented Nasdaq Composite has reported an astounding gain of 31.69% since the beginning of January. Various factors have contributed to the sudden increase, with one being the […]

S&P 500 Futures in Decline: A Rough Start to Premarket Trading

With only two hours before the U.S. stock market opening, Wolfspeed Inc. (WOLF) has experienced a 16.5% rise during the pre-market trading session, while Rivian Automotive Inc. Cl A (RIVN) has seen a 7.2% increase. Simultaneously, RBC Bearings Inc. (RBC), Transocean Ltd. (RIG), and R1 RCM Inc. (RCM) have all witnessed at least a 3% […]

Legendary Investor Jeremy Grantham Predicts a 70% Stock Market Crash: What’s Next?

The likelihood of a stock market crash in the coming years is 70%, warns renowned investor Jeremy Grantham. Grantham, the co-founder of GMO, compares the present market state and historical crashes, increasing concerns about market vulnerability. Previously, Grantham estimated an 85% likelihood of a looming bubble in the market ready to burst. This has been […]

U.S. Stock Market Fights Back Recession Scare: S&P 500 Hits Young Year’s Half-year High

Liz Ann Sonders, Chief Investment Strategist at Charles Schwab, suggests that the increasingly ‘frothy’ atmosphere in the stock market may leave equities susceptible to a downturn. The S&P 500 index recently completed its best first half of a year since 2019. Despite worries of an upcoming U.S. recession, it seems that this concern is becoming […]

Disrupting Traditional Market Theory: The Transformative Role of Big Tech

Discussing an unpredictable market—high-volatility and high-quality stocks have seen an upward trajectory this year. This isn’t ordinarily the case, but there’s a rationale behind it. Typically, when investors opt for high-volatility stocks, pushing their value higher, they often divest from quality stocks. The intention here is to capitalize on increased profits as the economy recovers—a […]