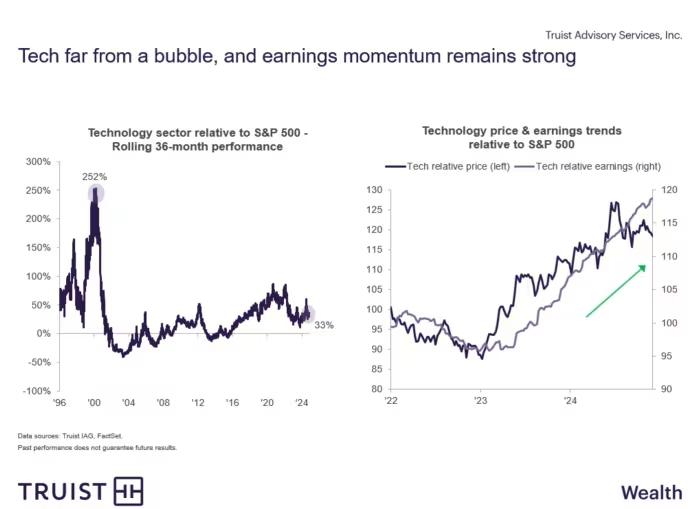

Nasdaq 20,000: Milestone or Warning?

Tech stocks fueled a historic rally on Wednesday, pushing the Nasdaq Composite index above the 20,000 threshold for the first time. The surge was driven by megacap technology names, with Alphabet Inc. (GOOGL, GOOG) and Meta Platforms Inc. (META) hitting record closes. The Nasdaq jumped 1.77%, reflecting the tech sector’s strength this year. Investors Face […]

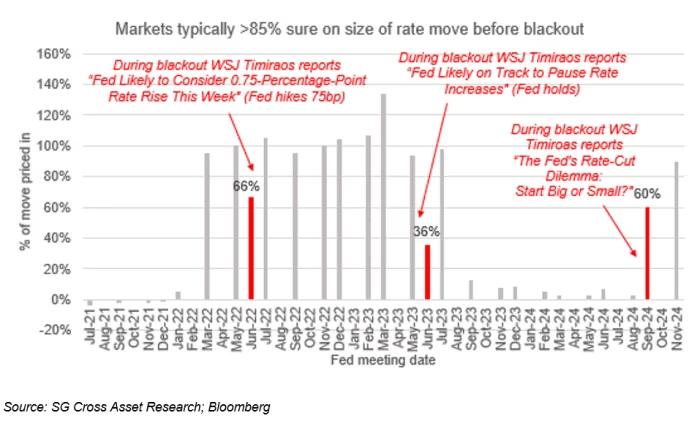

Inflation Surge: A Game-Changer for the Fed?

November CPI Surprise Could Derail December Rate Cut Expectations, Say Fed Watchers Fed-funds futures traders currently assign an 85% probability to the Federal Reserve delivering a 25-basis-point rate cut at its upcoming December policy meeting. This level of certainty aligns with historical patterns during the Fed’s “blackout” period, when officials abstain from discussing monetary policy […]

Bond Vigilantism: Key Investor Tips

Pimco Backs U.S. Equities While Favoring European Debt: Here’s Why Pimco, one of the world’s largest bond managers, is shifting its strategy by cutting exposure to longer-duration U.S. Treasurys in light of an increasingly challenging deficit environment. The global asset manager, with approximately $2 trillion in assets under management, outlined its rationale in a recent […]

Market Impact of Declining Earnings Projections

The stock market is trading at record highs, but declining profit projections for S&P 500 companies suggest a pullback may be on the horizon. Wall Street analysts have revised their 2025 earnings per share (EPS) forecasts downward by 0.5% over the past six months, from $276 in June to $273, according to FactSet. Sales estimates […]

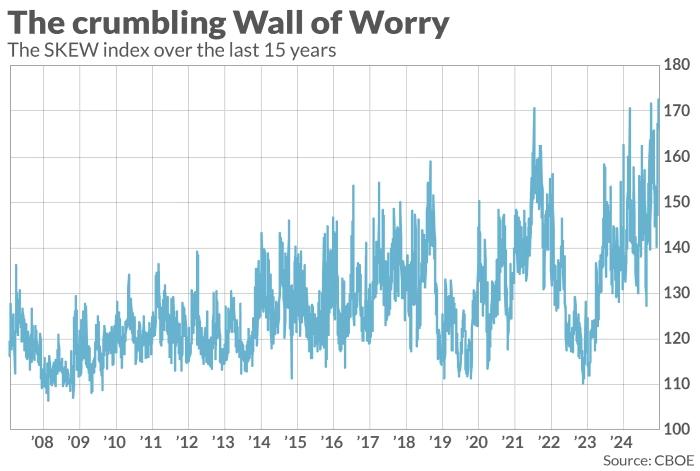

Why Wall Street Isn’t Worried – But You Should Be

Stock traders have grown increasingly bullish and complacent—and that’s a bearish signal. A fresh concern on the stock market’s horizon is the new all-time high of the CBOE’s SKEW Index. While many analysts interpret this rise as a sign that traders believe a Black Swan event, such as a crash, is now more likely, this […]

Bond Vigilantes and France’s Unique Challenge

French 10-Year Bond Yields Match Greek Counterparts Amid Political Turmoil Yields on 10-year French bonds are now trading at levels comparable to Greek bonds, highlighting concerns over France’s political instability and fiscal health. On Tuesday, French bond yields stood at 2.90%, nearly identical to the 2.92% yield on Greek bonds with the same maturity, according […]