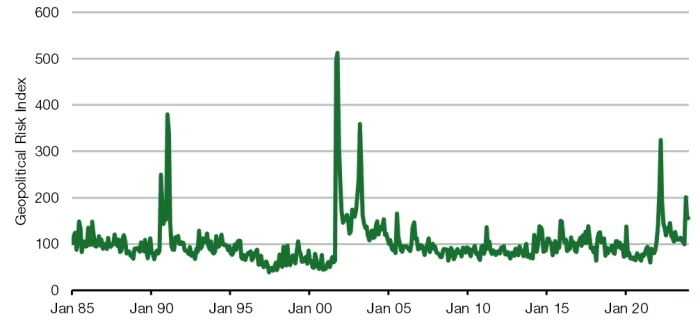

Opinion: The Essential Step-by-Step Investor Guide for Maneuvering Through Armed Conflicts

Next time you’re faced with armed conflict, here’s the savvy approach: In our world, where conflicts and tensions wield significant influence over markets, there’s no shortage of experts offering advice to investors. But heed this: most of them thrive on sensationalism, which may captivate headlines but often spells trouble for investment portfolios. In my book […]

Stocks Take a Hit: Iran-Israel Escalation Drives Flight to Safety

On Friday, Treasurys, gold, and the U.S. dollar all experienced increases in value, while there was a surge in demand for investments that protect against stock market losses. News that Israel is preparing for a possible attack from Iran caused investors to seek safer investments on Friday, leading them to sell off stocks and instead […]

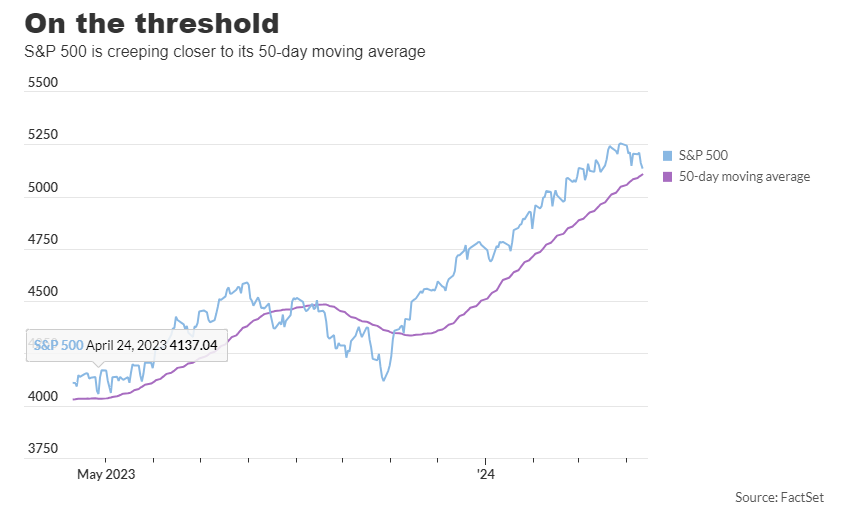

On the Verge: The S&P 500’s Rally Reaches a Make-or-Break Moment

The S&P 500 came within 33 points of its 50-day moving average on Thursday, marking the closest approach to this key trendline since November 13th. This proximity hints at a pivotal moment for the stock market rally, as recent turbulence has brought the index within striking distance of an important technical threshold for the first […]

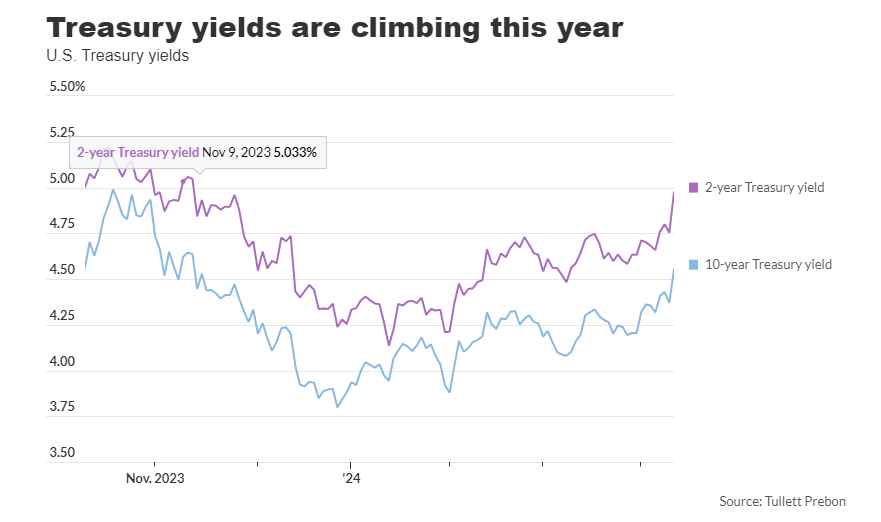

Fed Rate-Cut Expectations Pushed to September: Stocks and Bonds Feel the Pinch

Will we actually see the anticipated cuts in 2024?” George Catrambone, head of fixed income for the Americas at DWS Group, questioned during a phone interview as markets reacted to a stronger-than-expected inflation report on Wednesday. Concerns arose among investors about whether this data might dissuade the Federal Reserve from implementing any interest rate cuts […]

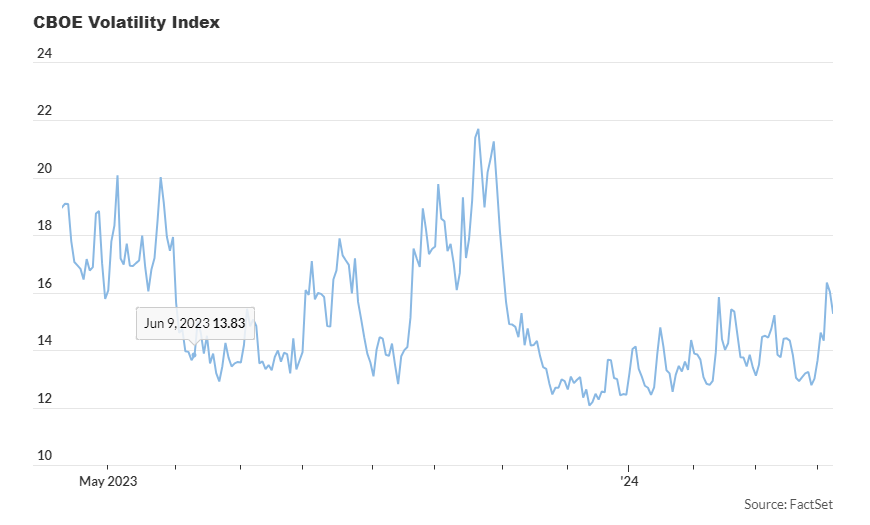

Is the Stock-Market Rally on Edge? Experts Warn of a ‘Tipping Point

Analysts caution that the recent uptick in the Vix alongside increased interest in bearish options suggests potential weakness ahead for stocks. After enjoying five months of stability, the stock market‘s upward trajectory faced a hiccup last week as the Vix, dubbed the “fear gauge,” surged, prompting concerns among some experts about a more significant downturn. […]

Factors Behind Wall Street’s Record S&P 500 Forecast

Wells Fargo has upgraded its outlook for the S&P 500 stock index, citing several factors driving bullish sentiment in the market. They have raised their year-end target for the index to 5,535 points, up from 4,625, indicating a potential additional increase of over 6% from current levels. Analysts at Wells Fargo Securities point to the […]