Bond Market Signals for Trump’s Second Term

Stick with Shorter-Term Bonds, but Growth Concerns Linger President Trump’s trade-war tactics continue to challenge investors, as stock market fluctuations highlight uncertainty, alongside mixed signals from the bond market. On Tuesday, yields on 2-year Treasurys hovered near 4.21%, just below their 200-day moving average, according to FactSet data. Meanwhile, 10-year yields were closer to 4.51%, […]

Winners & Losers in Trump’s Trade War

The new tariffs will be more extensive than those imposed during Trump’s first term. Starting Tuesday, the U.S. will enforce a 25% tariff on imports from Canada and Mexico, along with an additional 10% levy on Chinese goods. This escalation broadens the trade war, affecting both allies and rivals. Energy imports from Canada, including oil, […]

IBM Stock Skyrockets! Breaking Down Its Biggest Rally in Decades

IBM’s Growth Outlook Strengthens as AI Boosts Consulting Business. IBM is making a strong comeback. That’s the sentiment from Evercore ISI analyst Amit Daryanani, following International Business Machines Corp.’s (IBM) latest earnings report. The company’s optimistic outlook has Wall Street excited, sending IBM’s stock soaring—leading gainers in both the S&P 500 and Dow Jones Industrial […]

Meta AI Push: Bigger Than DeepSeek

Meta CEO Calls Consumer AI ‘One of the Most Transformative Products We’ve Made’ For those expecting Meta Platforms Inc. to scale back its aggressive spending after the DeepSeek news, think again. Not only did Meta (META +0.32%) reaffirm its capital expenditure forecast of $60 billion to $65 billion for the year—first shared by CEO Mark […]

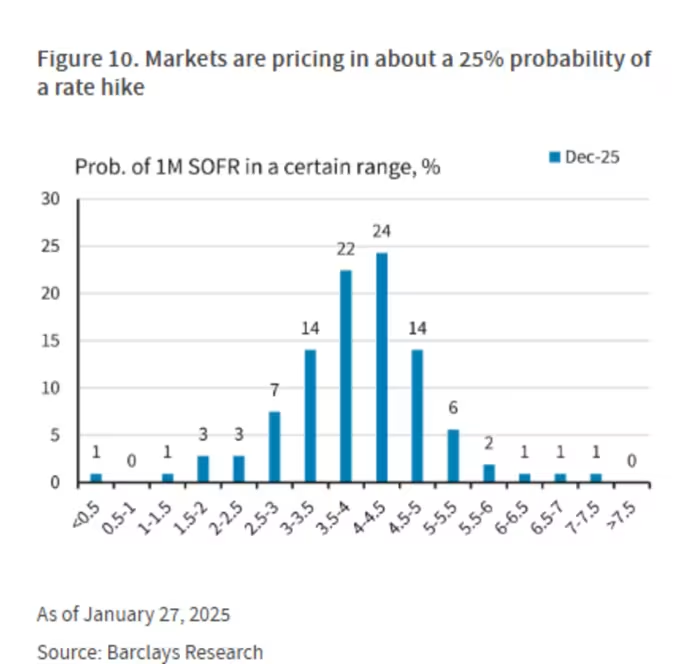

Barclays: Rate Hikes Unlikely, But Key Indicators Bear Watching

While the Federal Reserve is widely expected to hold interest rates steady on Wednesday, discussions around potential hikes have gained traction. Analysts at Barclays reaffirmed their expectation for slightly lower rates through 2025 but cautioned that rate hikes aren’t entirely off the table. Options markets have begun pricing in a roughly 25% probability of an […]

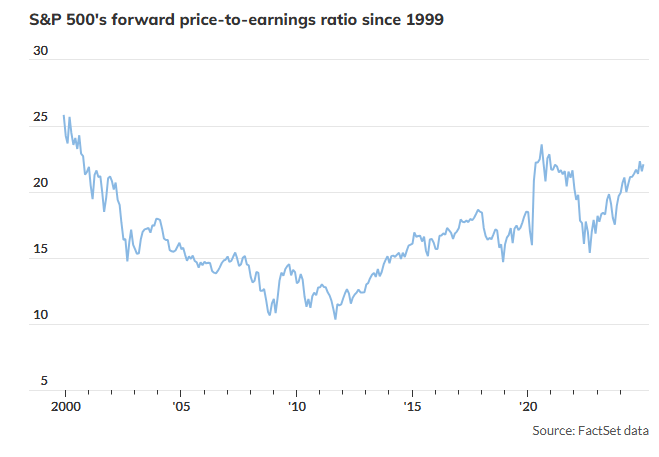

Pricy Stocks? Focus on These Sectors

The start of President Donald Trump’s second term has fueled a vigorous rally, propelling the S&P 500 to new record highs and pushing market valuations to notable extremes. This surge has prompted investors to consider whether there are more affordable alternatives to the prominent megacap technology stocks, which may still benefit from the president’s initial […]