S&P 500 Nears Correction on Tariff Fears

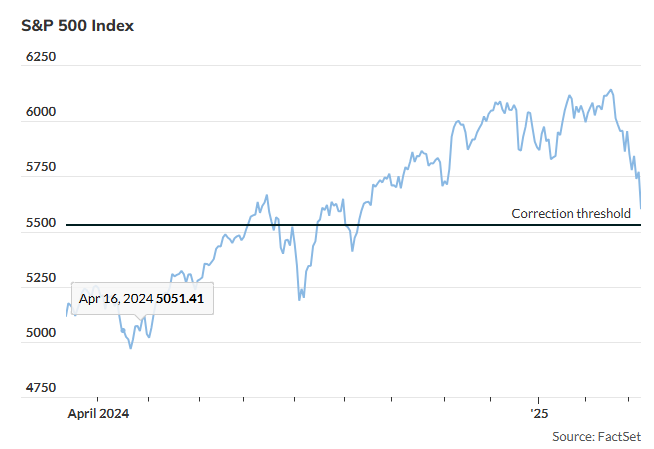

On Tuesday, the S&P 500 (SPX) fell 0.8% to close at 5,572.07, following a volatile trading session, according to FactSet data. A correction, defined as a 10% drop from a recent peak, would place the index at 5,529.74, per Dow Jones Market Data. Morgan Stanley’s Andrew Slimmon does not believe the Trump administration’s intent is […]

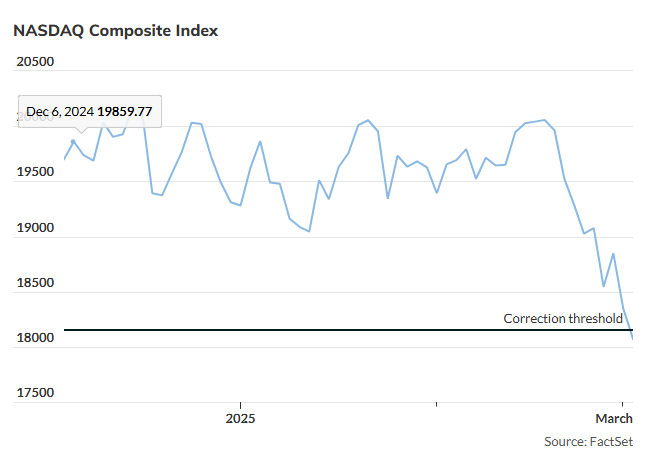

Nasdaq Plunge Sparks Bear Market Fears

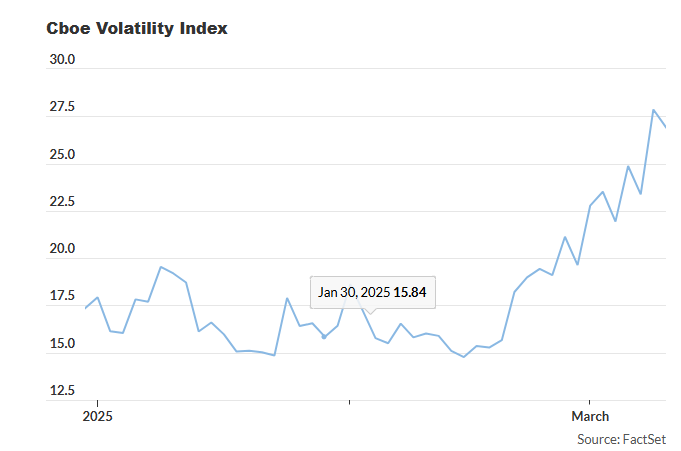

Dow Plummets Nearly 900 Points as S&P 500 Edges Closer to Correction U.S. stock markets suffered a significant blow on Monday, marking their worst trading day of 2025. Investor concerns over a potential U.S. recession intensified after the Trump administration failed to ease fears, raising the likelihood of continued selloffs and even a bear market […]

JPMorgan: Stock Market May Miss Year-End Target Timeline

The bulls are starting to feel the pressure. JPMorgan, which has always been a cautious optimist, is showing signs of wavering. The bank recently parted ways with Marko Kolanovic after his bearish outlook failed to materialize. Its new team, led by Dubravko Lakos-Bujas, isn’t exactly bullish by Wall Street standards, projecting the S&P 500 to […]

Investor Optimism in a Down Market

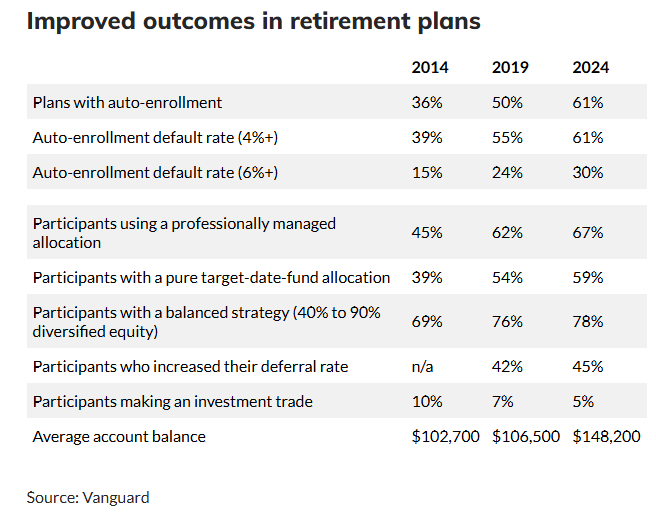

It might seem like the wrong time to talk about retirement optimism, especially when the stock market is experiencing significant turbulence. Forget Your 401(k) Statement—Focus on These Promising Retirement Trends Instead On a recent day of market declines, David Stinnett, Vanguard’s head of strategic retirement consulting, remained upbeat about retirement savings trends. Despite ongoing concerns […]

S&P 500 Erases Postelection Gains, Nasdaq Nears Correction

The benchmark S&P 500 stock index closed Tuesday at its lowest level since November 4, erasing all gains made since President Donald Trump’s November 5 election victory. The sharp decline was driven by mounting concerns that the administration’s sweeping tariff measures could stifle economic growth. The Nasdaq Composite, known for its heavy weighting in technology […]

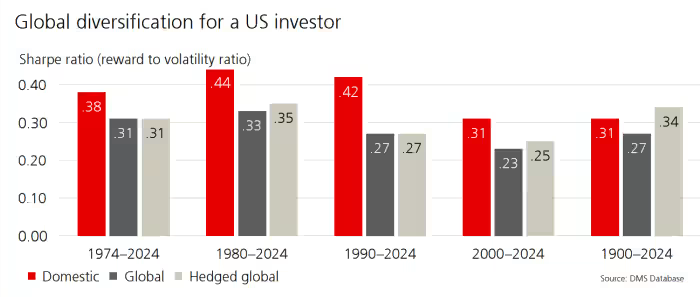

Investing at Highs? History Says Diversify

Global Investment Returns Yearbook Highlights Stock-Market Profitability and Volatility A nostalgic clip from Ferris Bueller’s Day Off, featuring economist Ben Stein’s dry explanation of the Smoot-Hawley Act, has been circulating on social media. The Act, which raised tariffs to boost revenue but ultimately worsened the Great Depression, sparks curiosity about its potential modern-day parallels. Against […]