Nvidia Stock Drops After GTC: Hype vs. Reality for Investors

Investors Looking for New Surprises Got a Familiar Story Instead Jensen Huang delivered his trademark enthusiasm during Tuesday’s two-hour keynote — reportedly without a teleprompter — laying out Nvidia Corp.’s ambitious vision for the future. But for Wall Street, the energy wasn’t enough to make up for a lack of fresh surprises. Shares of Nvidia […]

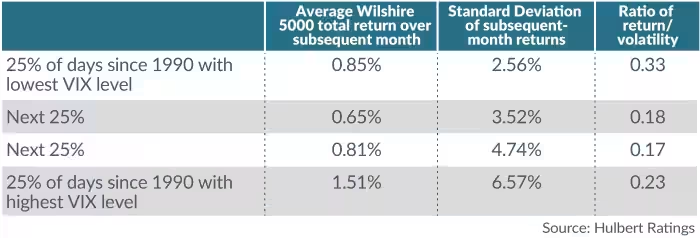

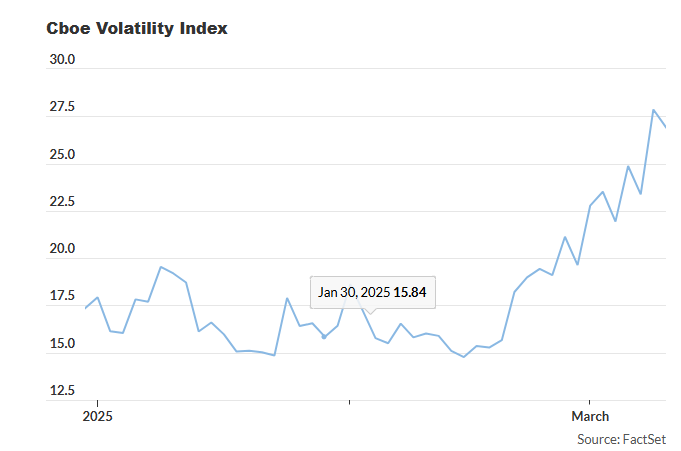

VIX Whiplash: Your Next Move

A VIX Spike Can Signal Opportunity — But Expect a Wild Ride A sudden surge in the VIX can be a bullish sign for stocks, but it also brings the kind of volatility that can shake investors out of their positions. If the VIX at the end of March holds near current levels, a cautious […]

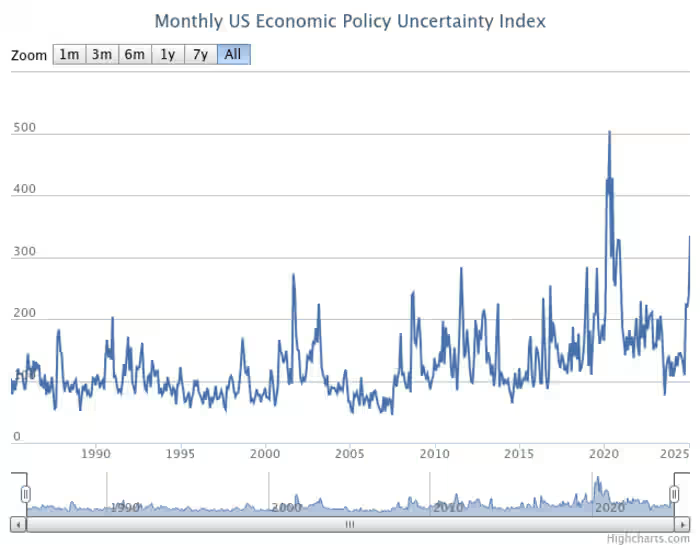

Fed Stays Out: Market Bulls on Their Own

No ‘Powell Put’ Likely as Fed Maintains Caution, Says Economist Investors hoping for a Federal Reserve safety net may be disappointed this week, as Fed Chair Jerome Powell is unlikely to signal any market-friendly interventions when policymakers meet. “The upside risks to inflation suggest that, despite recent stock market weakness, there is little chance of […]

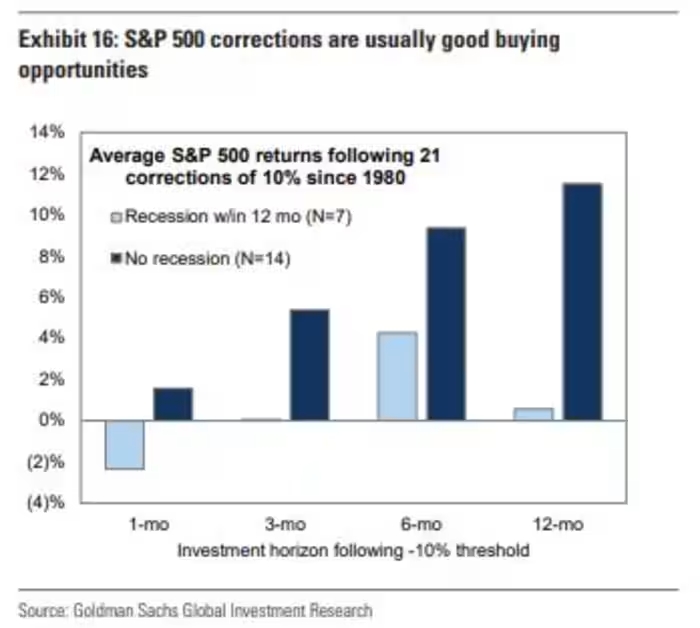

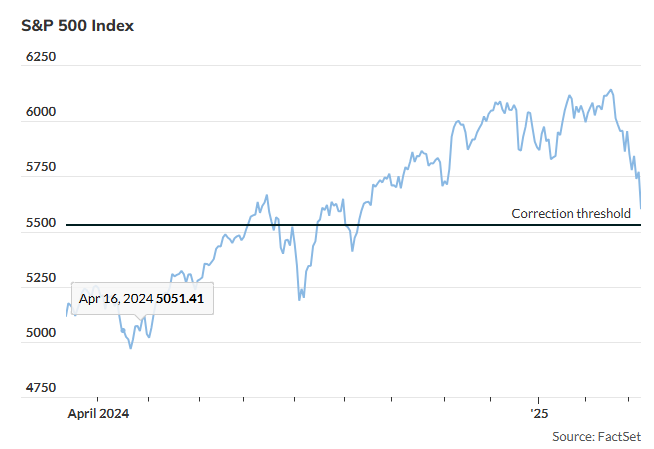

S&P 500 Rapid Correction: A Buying Opportunity?

Fundstrat’s Tom Lee highlighted that the S&P 500 recent dip into correction territory occurred at the fifth-fastest pace since 1950. Historically, similar declines have been followed by market rebounds within three months. The speed of the downturn has caught many investors off guard. Just months ago, markets were celebrating strong consecutive annual gains. However, growing […]

S&P 500 Nears Correction on Tariff Fears

On Tuesday, the S&P 500 (SPX) fell 0.8% to close at 5,572.07, following a volatile trading session, according to FactSet data. A correction, defined as a 10% drop from a recent peak, would place the index at 5,529.74, per Dow Jones Market Data. Morgan Stanley’s Andrew Slimmon does not believe the Trump administration’s intent is […]

Nasdaq Plunge Sparks Bear Market Fears

Dow Plummets Nearly 900 Points as S&P 500 Edges Closer to Correction U.S. stock markets suffered a significant blow on Monday, marking their worst trading day of 2025. Investor concerns over a potential U.S. recession intensified after the Trump administration failed to ease fears, raising the likelihood of continued selloffs and even a bear market […]