Boost Your Trading with ATR and News Events

When navigating the fast-paced world of trading, understanding key market indicators is essential to making informed decisions. Today, we’ll delve into how experienced traders approach the market using tools like news events, the Average True Range (ATR), and systems such as Sonic. These methods help traders determine when to enter or exit trades, manage risk, […]

Backup Plan When the E-Mini Won’t Work

The E-Mini S&P is a great market to trade – unless it’s slow. Well, it’s been slow. There are numerous videos that I’ve created detailing when to just say NO to trading the E-Mini under undesirable conditions. What is considered slow? I use a 5-Min chart in conjunction with the ATR (Average True Range) set […]

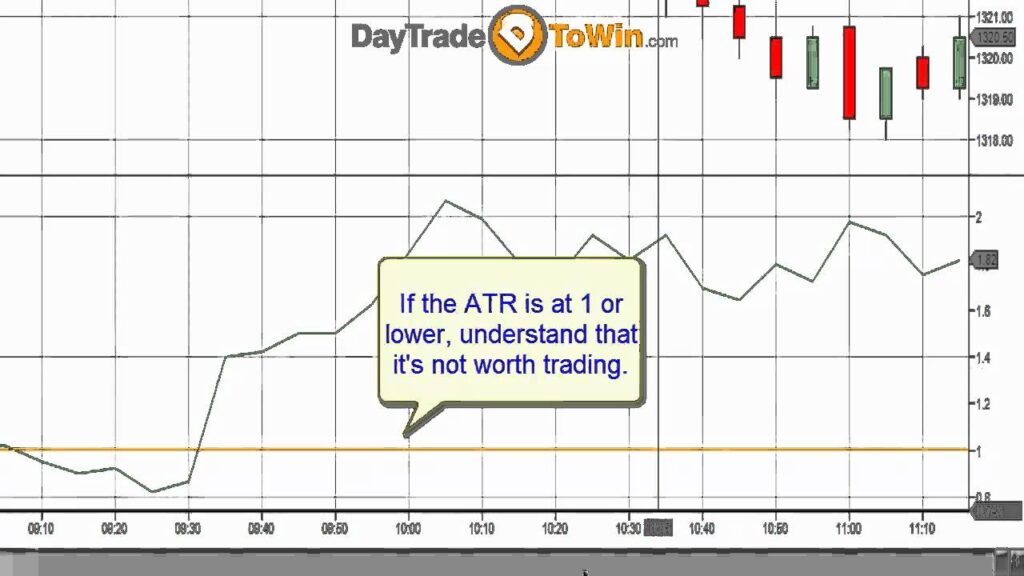

Identify Slow Market Conditions Using the ATR

This video will show you how to objectively determine whether a market’s activity is too slow to trade. In less than seven minutes, John Paul will set you straight on when to “stay out” based on ATR (Average True Range). Using the correct ATR parameters along with value ranges, you can quickly assess an instrument’s […]

$1275 First Trade of the Day

Purchase the Atlas Line Wouldn’t it be great if you had an automated solution to tell you when to go long or short and at what price? That’s exactly what the Atlas Line can tell you. In this video, the first Atlas Line signal of the day on the ES (E-Mini) appeared around 10:00 a.m. […]

Easy Futures Trading – Atlas Line Bar Timer, ATR and ATO

Above, check out a new video where John Paul shows how effective the (At the Open) method is when used in conjunction with the Atlas Line. Traders have been using the ATO trade for about five years, and it’s still an effective strategy. In the video, John goes for 6 ticks, equivalent to 1.5 points, […]

Atlas Line, Bar Timer & ATR Trading

Yesterday, October 28, John Paul recorded a video in which price came up to the Atlas Line and bounced off it. Long orders were produced right when price was being “supported” by the Atlas Line. Remember to watch in HD! John is trading the December contract using a 5-minute time frame. Take a look at […]