S&P 500 Investors Rejoice: Wall Street’s Top Bullish Bank Sets Target at 5,500

Societe Generale asserts that the trajectory of the S&P 500 will be steered by ‘U.S. exceptionalism,‘ according to reports. This sentiment underlies their bullish outlook, with a year-end target of 5,500, reflecting a modest increase of just over 5% from current levels. Among major financial institutions tracked by MarketWatch, Societe Generale’s projection appears to be […]

S&P 500 Futures Hold Ground After Notching 17th Record Close

Early Wednesday, U.S. stock futures hinted at the potential for another S&P 500 record high, despite a slightly higher-than-expected inflation report being shrugged off by investors. Here’s how the stock-index futures are trading: On Tuesday, the Dow Jones Industrial Average rose 235.83 points, or 0.61%, to close at 39,005.49, the S&P 500 added 57.33 points, […]

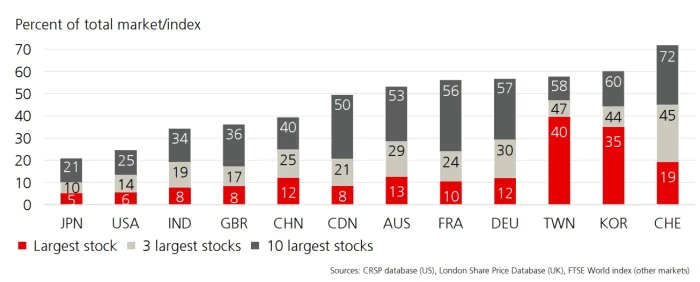

The Untold Story: How the U.S. Stock Market Bucks Concentration Trends

Despite the widespread discussion of the dominance of a select few companies like the Magnificent Seven driving stock-market gains, the reality is quite different: the U.S. market is among the least concentrated globally. According to the latest insights from the global investment returns yearbook, authored by Paul Marsh and Mike Staunton of London Business School […]

Navigating Today’s Market: Insights from the Top Trades of the Past Five Decades

Early Friday futures trading indicates a positive start for stock indices. The continuation of this optimism into Wall Street’s opening may hinge on labor market data. For equity bulls, a U.S. nonfarm payrolls report showcasing steady job growth and modest wage inflation is the preferred outcome, as it is unlikely to dissuade the Federal Reserve […]

2024 Trading Blueprint: 9 Tips to Master the Market!

Hello Traders! Welcome to an exciting journey of rebooting your trading strategies for 2024. Whether you’re a seasoned pro looking for an edge or a newcomer navigating the markets, these nine tips will be your compass in the dynamic trading landscape. Remember, trading involves risks, so only invest funds you can afford to lose. Let’s […]

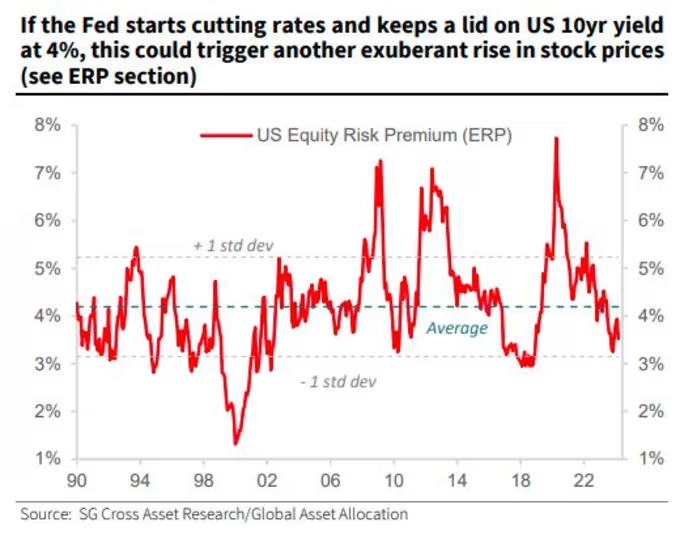

Navigating the ‘Pain Trade’ in 2024: Potential Reversal of Stock and Bond Market Fortunes

Incorrectly timing rate cuts poses a significant risk, warn strategists at TS Lombard As the market embarked on a robust “everything rally” fueled by high expectations of imminent interest rate reductions by the Federal Reserve to avert a recession, the risks of miscalculating the timing of these cuts are emphasized by Skylar Montgomery Koning and […]