On Monday, the S&P 500 and the Nasdaq reached their peak closing marks since April of 2022.

Investors are anticipating the release of the inflation report and the decision on interest rates by the Federal Reserve. Traders are currently predicting that there is a 72% likelihood that the Federal Reserve will keep the interest rates the same during their meeting on June 13-14. The details for the consumer price index will be uncovered today.

The shares of Nasdaq, Inc. (NASDAQ: NDAQ) fell by approximately 12% on Monday after the announcement of acquiring Adenza for a price of $10.5 billion through a combination of cash and stock.

On Monday, there were reports that Broadcom Inc. (a company listed on the NASDAQ exchange under the symbol AVGO) may be approved by EU antitrust regulators to buy VMware (a company listed on the NYSE exchange under the symbol VMW) for $61 billion. This news led to an increase of more than 6% in the share price of Broadcom Inc.

Most industries listed on the S&P 500 ended the day with a positive outcome, with the consumer discretionary and information technology sectors seeing the largest increases on Monday. Despite this, the energy sector went against the general trend and finished the session in a weaker position.

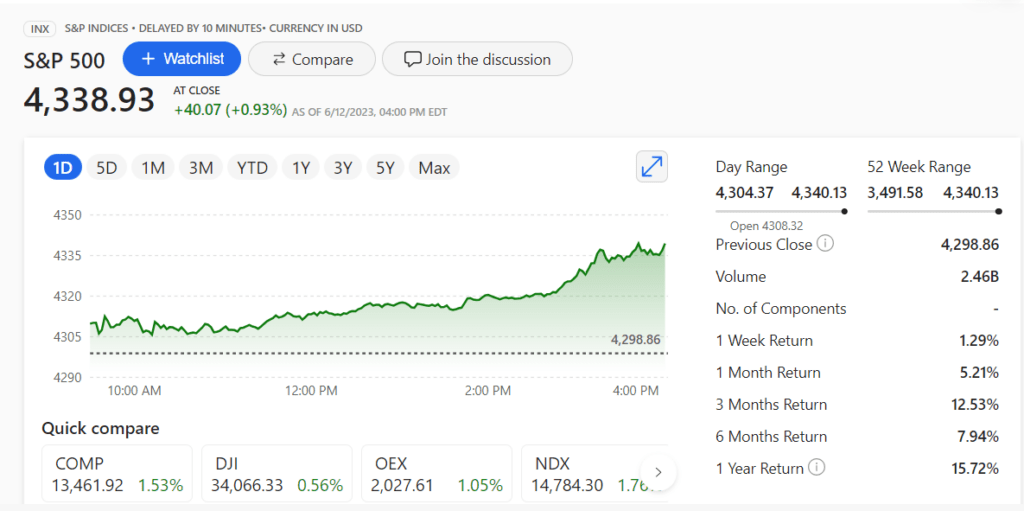

On Monday, the Nasdaq 100 had an increase of 1.76% and ended at a closing value of 14,784.30 due to the rise in shares of Amazon.com, Inc. (NASDAQ: AMZN) and Tesla Inc (NASDAQ: TSLA).

In the prior trading session, the S&P 500 increased by 0.93% and the Dow Jones climbed by 0.56% to reach a value of 34,066.33.

On Monday, the CBOE Volatility Index (VIX) of the Chicago Board Options Exchange increased by 8.5% and ended at a value of 15.01.

What is CBOE Volatility Index?

The VIX, which stands for the CBOE Volatility Index, is a popular indicator of the stock market’s anticipated volatility. It is calculated using call and put options from the S&P 500 index.