In 2023, despite initial concerns about a recession, the S&P 500 (SNPINDEX: ^GSPC) demonstrated resilience by surging 24%. The first seven months saw a robust 20% increase, driven by strong economic growth, subdued inflation, and growing enthusiasm for artificial intelligence.

However, the latter half of the year brought challenges. August, September, and October witnessed a three-month decline as bond yields surged, inflation picked up, and the Federal Reserve indicated a prolonged period of elevated interest rates. The headwinds subsided during the holiday season, concluding the year on a high note.

A noteworthy achievement for the S&P 500 was its nine consecutive weekly gains at the end of 2023, marking its longest winning streak since 2004. Historical patterns suggest that such streaks often precede further gains in the subsequent year.

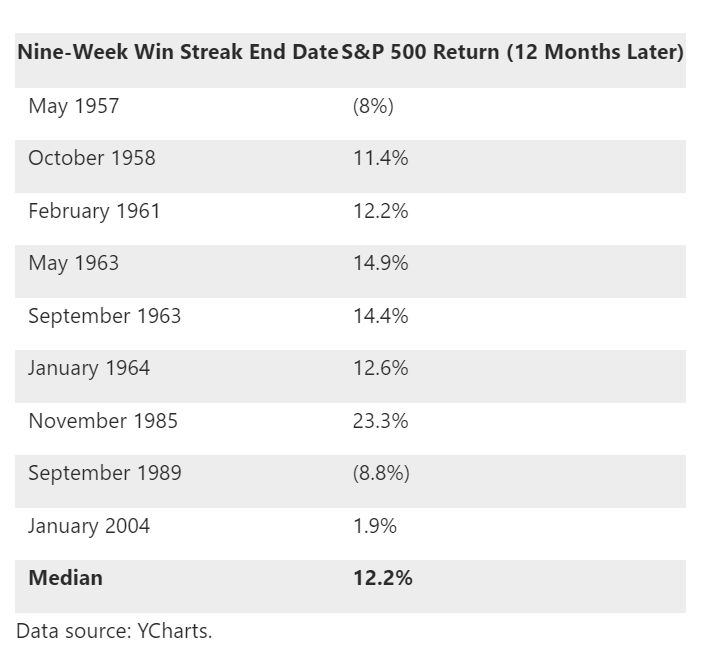

The S&P 500, introduced in March 1957, has experienced a total of 10 nine-week winning streaks, with the most recent concluding in December 2023. Looking at the historical data, the median return for the S&P 500 over the 12 months following such streaks is 12.2%.

This historical insight hints at a potential 12.2% increase by the end of 2024, suggesting substantial upside in the U.S. stock market.

However, it is crucial to approach this with caution, acknowledging that historical data does not guarantee future outcomes. The recent winning streak, driven by economic predictions regarding future monetary policy, introduces unique circumstances that may influence the market differently this year.

Despite this, another factor supporting optimism for the stock market in 2024 is the expectation of strong earnings. S&P 500 companies, after three consecutive quarterly profit declines starting in Q4 2022, concluded an “earnings recession” in Q3 2023. Projections for 2023 anticipate revenue growth of 2.3% and earnings growth of 0.8%.

Wall Street consensus, however, foresees an acceleration in 2024, with revenue growth at 5.5% and earnings growth at 11.8%. This positive momentum suggests potential upward movement in the market, with a 9% upside from its current level, according to FactSet Research.

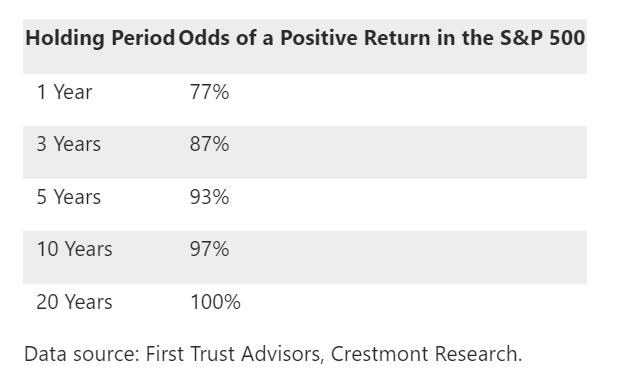

Investors are reminded to consider the inherent uncertainty in forecasts, and while the odds of a positive return increase with a longer holding period, there are no guarantees in the stock market.

The chart emphasizing the relationship between holding period and the probability of a positive return reinforces the idea that patience is a key element in achieving success in the stock market.

Over the past three decades, the S&P 500 has exhibited consistent growth, compounding at an annual rate of 10.11%, emphasizing the enduring principle that patience is indeed the secret to making money in the stock market.