On Monday, U.S. stock futures flirted with their highest levels of the year, supported by benchmark borrowing costs hovering near their summer lows.

Here’s a snapshot of stock-index futures trading:

- S&P 500 futures (ES00, +0.15%) increased by 10 points or 0.2% to 4778.

- Dow Jones Industrial Average futures (YM00, +0.15%) gained 49 points, or 0.1%, reaching 37710.

- Nasdaq-100 futures (NQ00, +0.01%) added 25 points, or 0.1%, reaching 16845.

In the previous session, the Dow Jones Industrial Average rose by 57 points or 0.15% to 37305, the S&P 500 remained unchanged at 4719, and the Nasdaq Composite gained 52 points or 0.35% to 14814.

Market drivers:

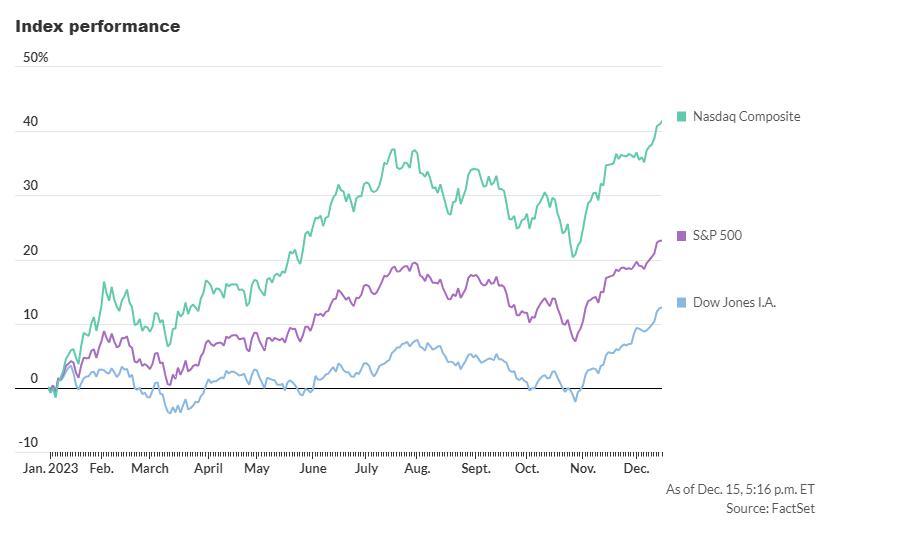

Stock-index futures show marginal strength as the final full trading week of the year kicks off, with the S&P 500 near its highest level in nearly two years and within 2% of its record high.

The equity benchmark has enjoyed a seven-week winning streak, marking its best run in six years, with a 14.6% gain amid optimism that the Federal Reserve will commence interest rate cuts next year.

The 10-year Treasury yield (BX:TMUBMUSD10Y), which surpassed 5% in October, is now around 3.9%, marking a recent decline after the Fed signaled a more dovish monetary policy last week.

However, early Monday trading in stock futures and bonds showed less enthusiasm following recent statements from Fed officials, including New York Federal Reserve Bank President John Williams and Chicago Fed President Austan Goolsbee, tempering expectations of imminent rate cuts.

Stephen Innes, managing partner at SPI Asset Management, noted, “The surge in risk appetite, fueled by the U.S. Federal Reserve’s recent stance, has paused as [S&P 500] bulls are likely catching their breath at the open.”

Innes added, “Despite some pushback from Fed officials, interest rate futures markets are still currently pricing 150 basis points of rate cuts from the Federal Reserve next year. So, the recent decline in bond yields and the dollar is expected to underpin risk assets throughout the week.”

Tom Lee, head of research at Fundstrat, remains bullish, anticipating support for stocks from fund managers who, until recently, had been defensively positioned due to macroeconomic concerns. Lee predicts performance chasing into year-end, coupled with retail investors withdrawing $240 billion from ETF and mutual funds, contributing to the underlying bid for equities.

Economic updates expected on Monday include the release of the homebuilder confidence index for December at 10 a.m. Eastern.