Live Leap Year Trade – E-Mini S&P

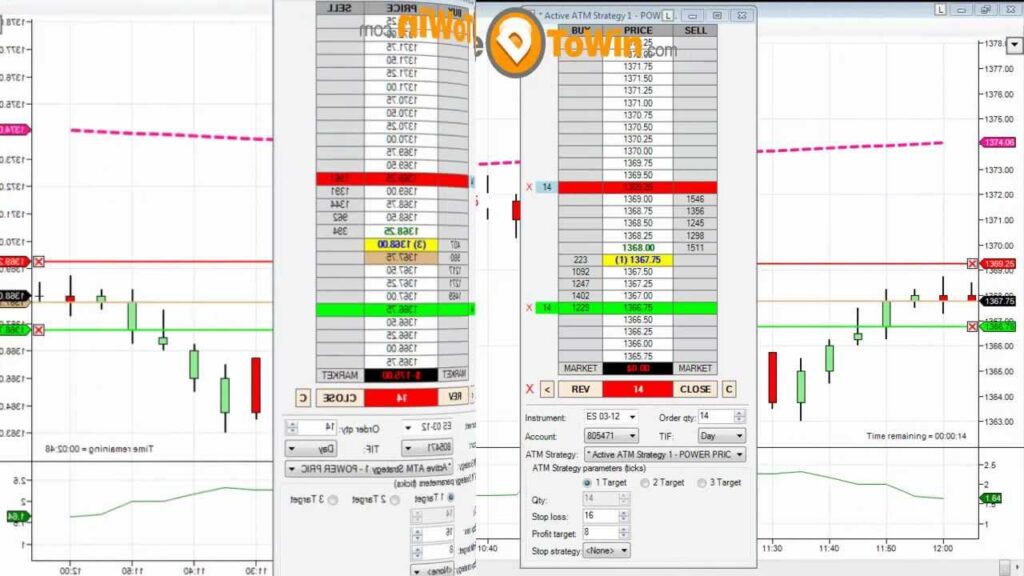

Here’s a video of a live trade John took yesterday on the E-Mini using the Atlas Line. Note that the trade setup in use is called a Pullback, the rules of which are taught in the live training that’s included with purchase. John uses the ATR (Average True Range) to indicate the profit target and […]

NinjaTrader Time Sync and Windows Time

In a live webinar or recording, you’ve probably heard John Paul discuss the importance of synchronizing your Windows clock with official time servers. Why is this important? Your data feed may use native time stamping, and if your Windows clock is off by only a small amount, NinjaTrader will display information differently. This applies to […]

Backup Plan When the E-Mini Won’t Work

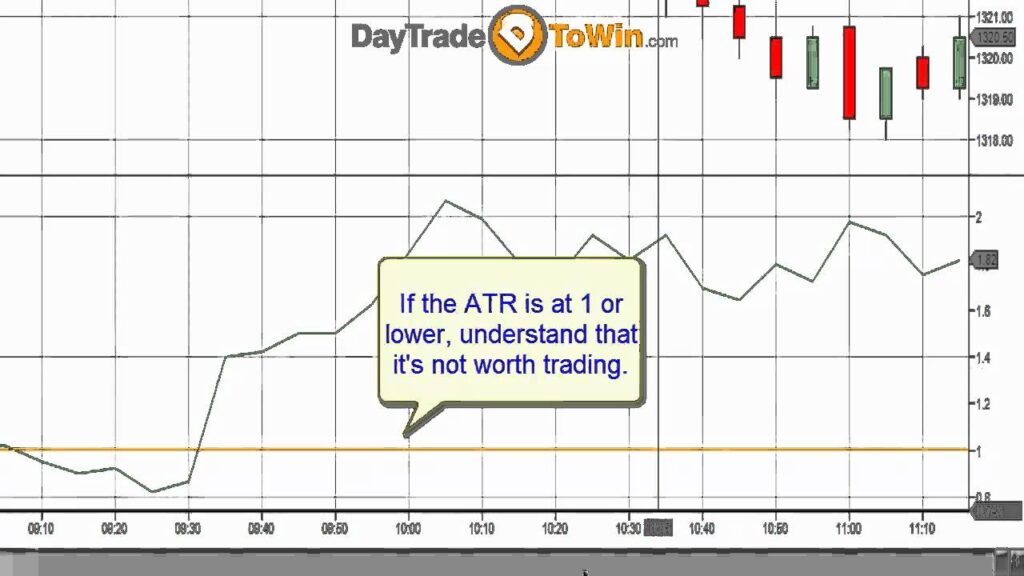

The E-Mini S&P is a great market to trade – unless it’s slow. Well, it’s been slow. There are numerous videos that I’ve created detailing when to just say NO to trading the E-Mini under undesirable conditions. What is considered slow? I use a 5-Min chart in conjunction with the ATR (Average True Range) set […]

Insider Trading Bill Passes House

Today, the U.S. House of Representatives passed a bill, the STOCK (Stop Trading on Congressional Knowledge) Act, to curb Congressional insider trading. Vote results indicate 417 Congress members in favor of the bill and two in opposition. This House version differs from that of the Senate, which includes provisions for financial data collectors to disclose […]

Live Price Action Webinar from February 3, 2012

John Paul once again proves that successful day trading can be easy. The video starts with showing you how to take advantage of the large bullish news event candle at around 8:30 a.m. US/Eastern. A common mistake is made when trying to interpret the news as either positive or negative, then entering based on your […]

How Many Contracts Should You Be Trading?

As a day trading coach, I am frequently asked, “How many contracts should I trade?” It may surprise you that there is no simple answer (one, two, ten, etc.). There are several factors to consider when answering this question. Brokers usually advise clients on how many lots they are able to trade based on account […]

Today’s Atlas Line Trade on the ES

Here’s today’s ES trade using the Atlas Line. A rather choppy period gave way to our Long order signal, produced automatically by the Atlas Line at 1327.25. With a direction and entry price, we immediately entered. Based on real-time market conditions, we knew exactly what our profit target and stop loss should be. John refers […]

Identify Slow Market Conditions Using the ATR

This video will show you how to objectively determine whether a market’s activity is too slow to trade. In less than seven minutes, John Paul will set you straight on when to “stay out” based on ATR (Average True Range). Using the correct ATR parameters along with value ranges, you can quickly assess an instrument’s […]

Data Feed Spotlight – Kinetick – Fast Market Data, Unfiltered

As you’re probably aware, we at Day Trade to Win always use NinjaTrader when trading, in our videos or otherwise, as our preferred trading platform. Kinetick is NinjaTrader’s solution for fast, unfiltered, real-time market data for Stocks, Futures and Forex. Kinetick is optimized for NinjaTrader 7 and designed to exceed the expectations of the most […]

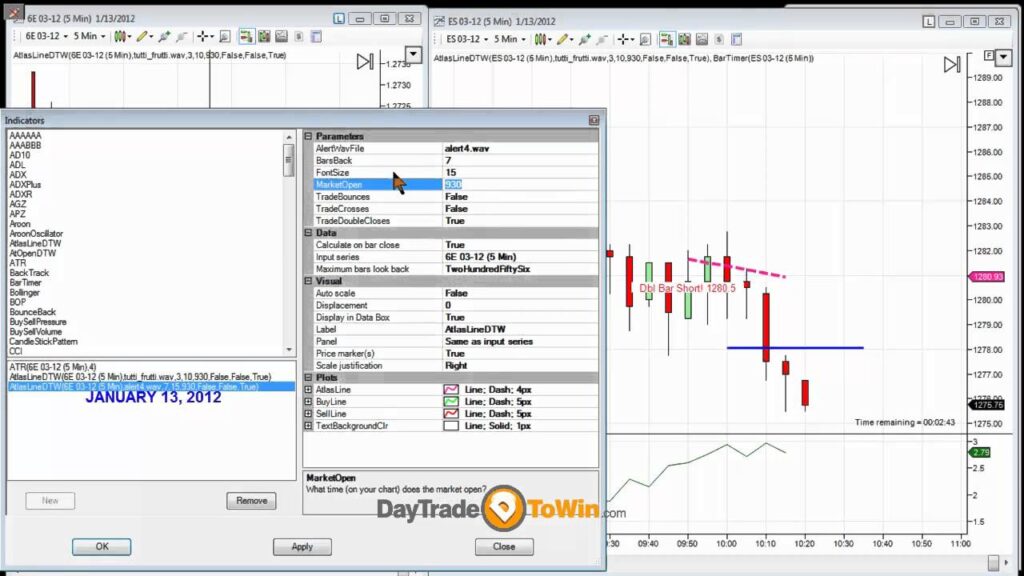

Atlas Line ES and 6E Trading (Webinar from Last Week)

By popular demand, here’s the webinar recording from last Friday (January, 13, 2012). As you’ll see, it was a profitable day as the Atlas Line provided Short signals right before the big moves in the ES (E-Mini) and 6E (Euro). John leaves his live charts running, so you can see how price moves in relation […]