What’s Driving Tesla’s Surge Despite Yet Another Downgrade?

Tesla’s stock had an uncertain trajectory on Monday, initially dipping following another downgrade before rebounding into positive territory. By midmorning, its shares had stabilized. This downgrade, the fourth from a major brokerage firm this year, reflects a broader skepticism on Wall Street towards Tesla amid a slowdown in demand for electric vehicles. Mizuho analyst Vijay […]

Market on Brink of Steep Correction, Hussman Warns of 1929-style Valuation Extremes

Investor John Hussman has issued a stark warning about the current state of the stock market, comparing it to historic bubbles such as those preceding the 1929 crash and the market peak in 2021. According to Hussman, stock valuations are as extreme as they were before previous market downturns, signaling the potential for a significant […]

S&P 500 Investors Rejoice: Wall Street’s Top Bullish Bank Sets Target at 5,500

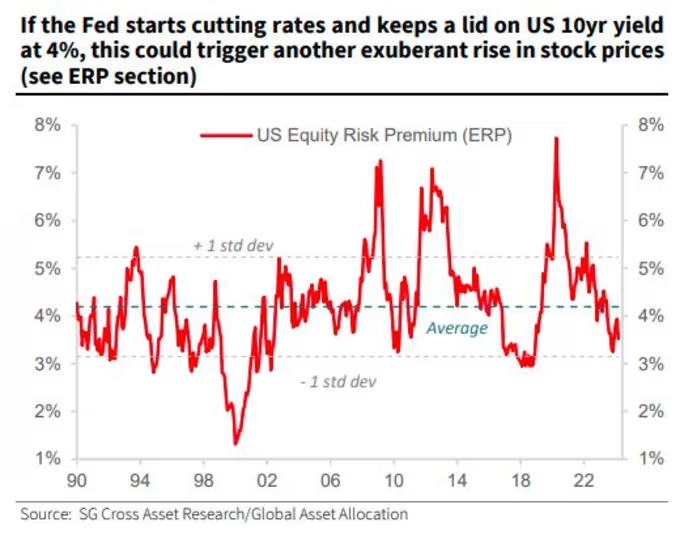

Societe Generale asserts that the trajectory of the S&P 500 will be steered by ‘U.S. exceptionalism,‘ according to reports. This sentiment underlies their bullish outlook, with a year-end target of 5,500, reflecting a modest increase of just over 5% from current levels. Among major financial institutions tracked by MarketWatch, Societe Generale’s projection appears to be […]

Fed’s Rate Stance Sparks Stock Market Rally to Historic Peaks

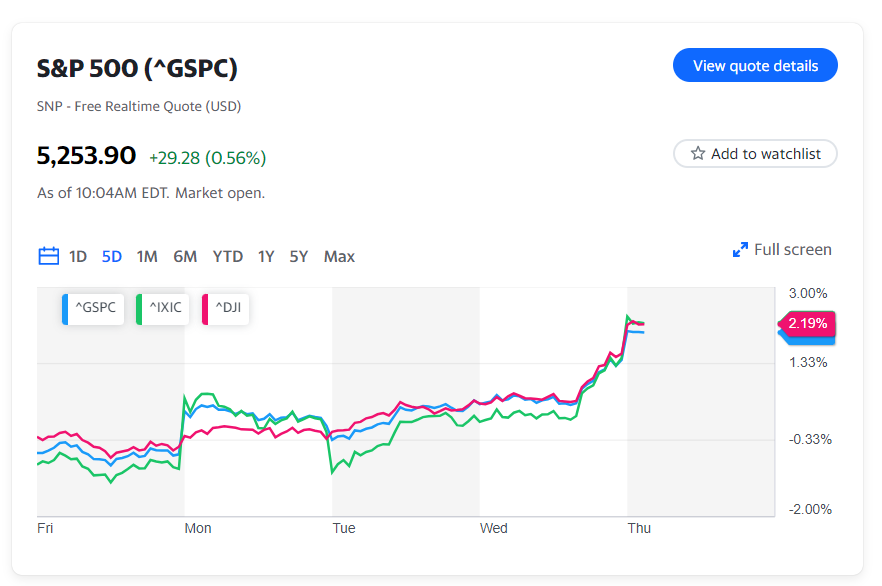

US stock indexes surged to new heights on Wednesday following the Federal Reserve’s decision to maintain interest rates and uphold its projection of three rate cuts this year. The S&P 500 (^GSPC) climbed by 0.8%, reaching a historic close above 5,200 at 5,224.62. Simultaneously, the Dow Jones Industrial Average (^DJI) surged approximately 1%, achieving a […]

Understanding the Fed’s Position: Insights from BlackRock’s Rick Rieder

Wednesday will see the Federal Reserve unveiling its policy verdict alongside interest rate projections. BlackRock’s Rick Rieder notes a reassessment among investors regarding the timing of potential interest rate cuts, as tackling inflation’s final hurdles proves challenging. Amidst the ongoing two-day policy conclave, Rieder, BlackRock’s Chief Investment Officer of Global Fixed Income, underscores Fed officials’ […]

Regulatory Roadblocks: Can an Apple-Google AI Partnership Prevail?

The previous collaboration between tech giants Apple Inc. and Alphabet Inc.’s Google has already sparked federal regulatory scrutiny, stemming from a multi-billion dollar search agreement that led to an antitrust lawsuit by the Justice Department. Now, with talks of another partnership, this time concerning Google’s Gemini artificial intelligence engine, concerns arise about a potential repetition […]