The S&P 500 index is currently experiencing a bullish market trend, and the level of volatility in the market is at its minimum. Additionally, a higher number of stocks are exhibiting an upward trend, as compared to the previous months. Does this mean that investors have nothing to be concerned about?

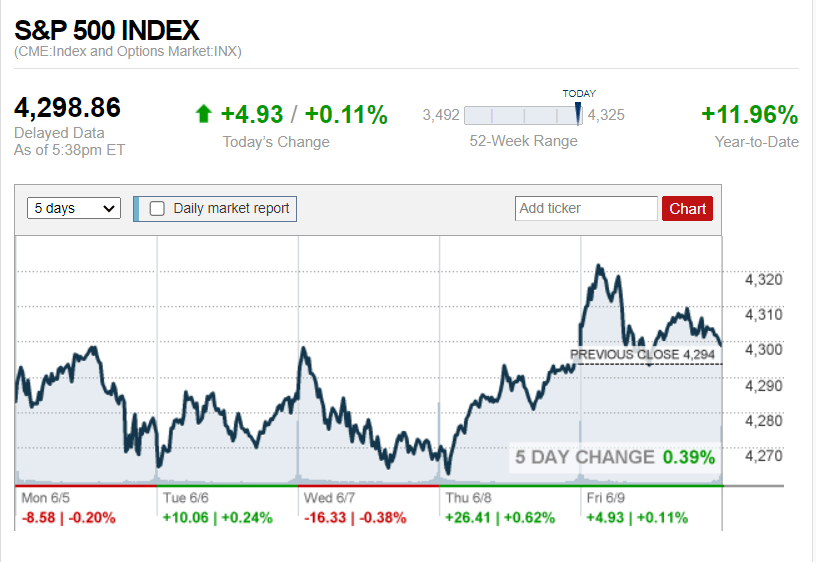

There doesn’t seem to be anything to worry about in the stock market this week. The S&P 500 went up by 0.4%, the Dow Jones Industrial Average went up by 0.3%, and the Nasdaq Composite went up by 0.1%. The Cboe Volatility Index, also known as VIX, fell below 14 points, a level that hasn’t been seen since before the pandemic. This means that there is no indication of fear in the market, as shown by the fear index.

Why should we be concerned? Both Republicans and Democrats agreed to raise the debt ceiling until the next presidential election, and the concerns regarding banking turmoil have diminished. Additionally, economic data indicates that there isn’t much to worry about in terms of a possible economic slowdown.

Marko Kolanovic, the chief global markets strategist at J.P. Morgan, states that both the U.S. and global economies are stable and strong and that concerns about a recession happening soon are exaggerated.

The positive developments in the market have sparked a renewed interest in stocks and industries beyond the limited influence of a few major technology companies that propelled the stock market in May. Despite the fact that the companies within the S&P SmallCap 600 index are less geared towards long-term trends like artificial intelligence and more towards traditional economic growth, it has still managed to achieve an increase of 7% this month. The rise of sectors such as finance and industry is promising for the S&P 500, which would have remained stagnant this year if not for a handful of large-cap stocks that boosted its performance. However, this reliance on a few major players cannot continue indefinitely.

As other stocks are also starting to rise, it is appropriate that the S&P 500 has come out of the longest bear market since 1948 after 248 trading days. Although there is still a 10% increase required to reach the index’s highest record from early 2022, it is possible that it may reach it.

Before we can move forward, there are some obstacles we must overcome. On Tuesday, the inflation data for May will be released. It is predicted that the core consumer price index will increase by 0.4% from last month, which is the same rate as seen in April. Moreover, there will be a 5.2% rise compared to last year, which is a decrease from the 5.5% seen last month.

The committee in charge of Federal Reserve policy will make an announcement one day later. The prediction from futures markets is that there will be a break in the raising of interest rates, which have gone up by five percentage points since March 2022. If there is an unexpected result in either measurement of the Consumer Price Index, it could lead to a loss of confidence in the market.

Kolanovic argues that the US is likely to experience a recession, despite a possible delay, due to reasons such as reduced profit margins and stricter credit requirements. He explains that such factors indicate that the economy is reaching its limits and the end of its growth phase may be in sight.

However, at the moment, the concerns and fears that the market has overcome are gradually fading away. It is advised to embrace this positive trend while it continues.